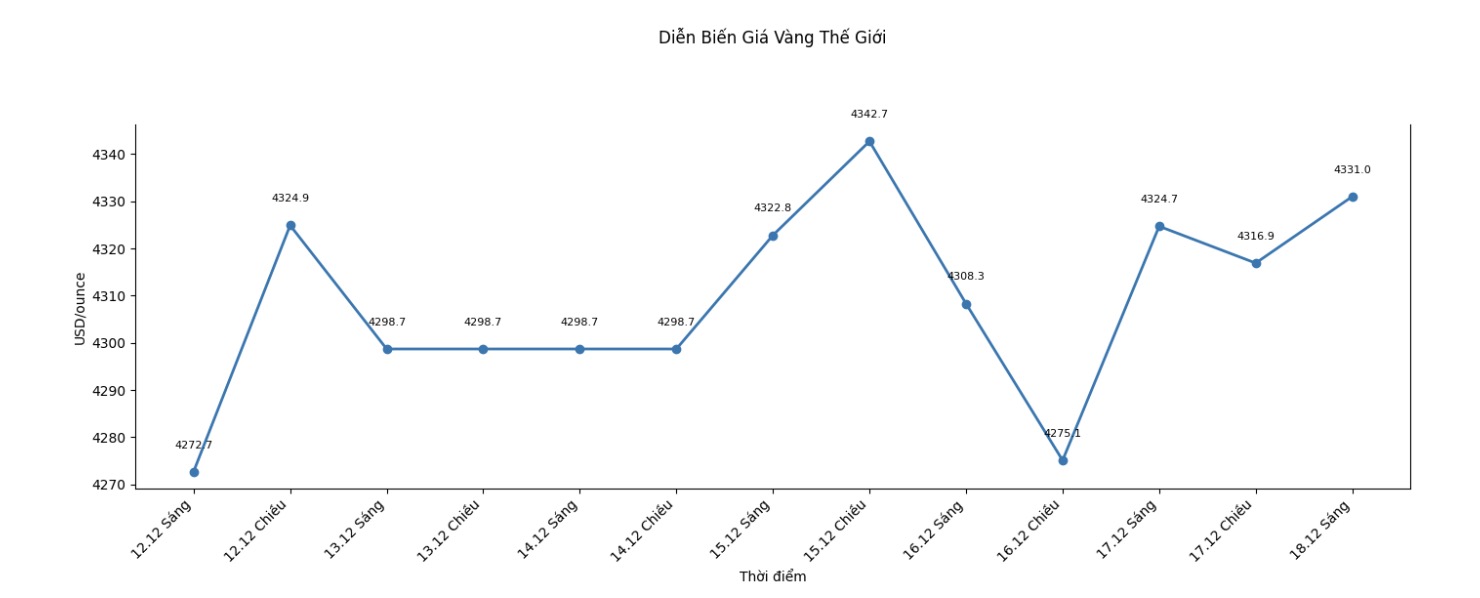

In their official 2026 outlook report, commodity analysts at BMO Capital Markets said they expect gold prices to peak in the first half of the year, with an average price of $4,600/ounce, up 5% from the previous forecast. For the whole year, BMO forecasts gold prices to average around $4,550 an ounce, up 3% from the old estimate.

Although optimistic about the entire precious metals group, BMO analysts believe that gold will be the outstanding asset in 2026.

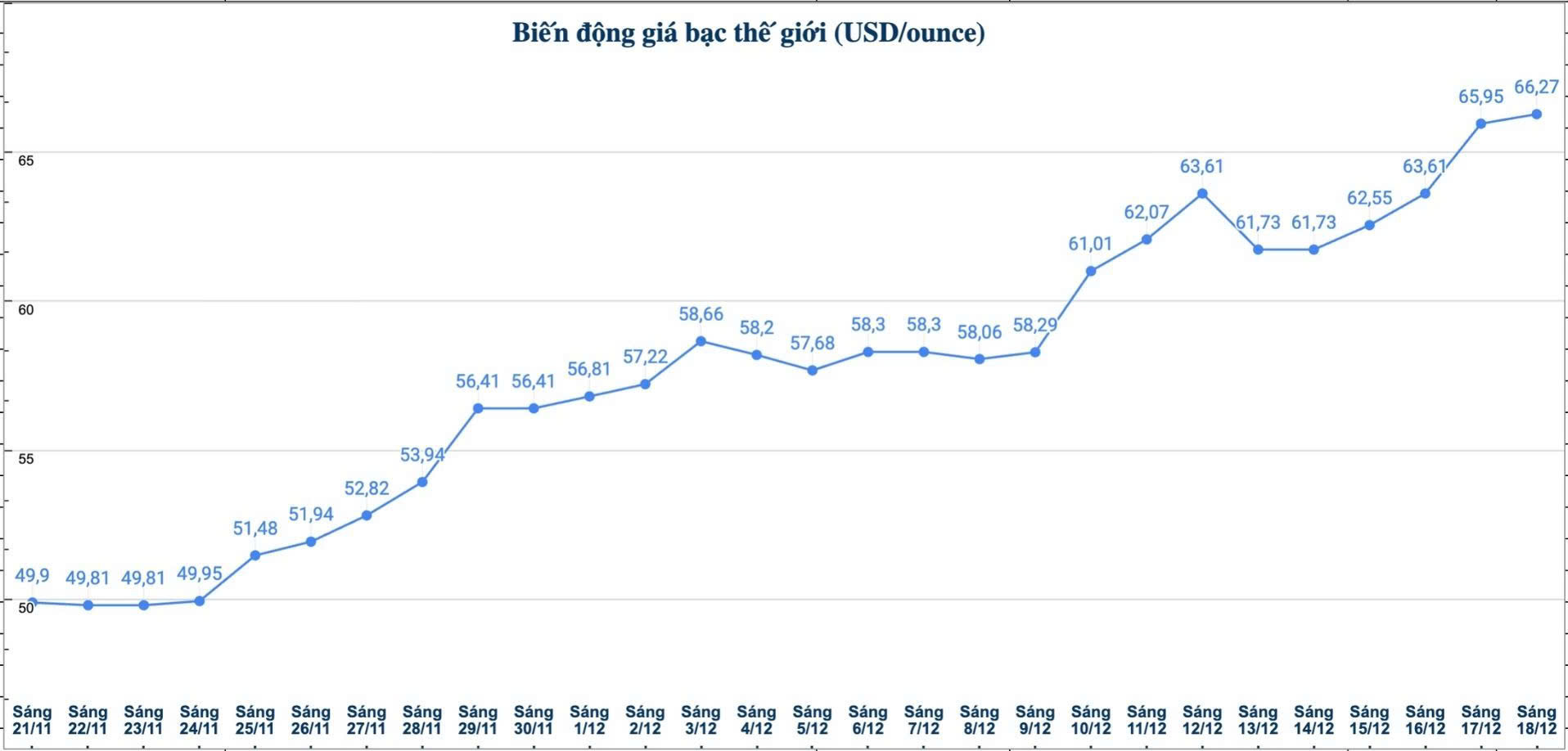

For silver, BMO forecasts an average price of around $60/ounce in the fourth quarter, which is also the highest of the year. The average price of silver for the whole year is estimated at 56.3 USD/ounce. This new forecast is made in the context of silver prices currently trading above $65/ounce.

One of the biggest adjustments this quarter has been the silver price forecast, as we raised 14% to 56.3 USD/ounce for 2026. Investors have shown greater interest than expected in silver, likely due to being caught up in a protective trend against currency depreciation, and being affected by the US increasing reserves after silver was recently classified as a strategic mineral group," said experts.

We still believe that golds multi-year rally is far from over, as the precious metal continues to benefit from a combination of short-term support factors (inflation concerns) and long-term (currencies expected to thin). We still predict that gold prices will have room to increase in 2026, supported by further interest rate cuts.

However, we have become more cautious about other precious metals such as silver and platinum, as they show signs of overbought in recent weeks.

These metals could trade similarly to gold as the market falls into a supply shortage (even more volatile during price increases, as seen this year); however, our latest updated models show that the shortage is gradually narrowing."

BMO also emphasized that gold prices continue to be strongly supported by macro factors, as falling interest rates next year put pressure on the USD - which is still vulnerable to the global "currencies" trend of "denominating the value of currencies" due to increased public debt.

Golds ability to hold on after the October sell-off shows that the metals diversification and safe haven role remains intact. We are entering a new era of gold, where a new gathering of demand momentum is emerging, associated with the major theme of de-dollarization," said analysts.

Geopolitical de-dollarization comes from the fact that many entities want to reduce their exposure to the USD due to the risk of sanctions (like Russia) or to reduce their dependence on the USD trading system (like China), in which buying gold is often an important step.

Meanwhile, de-dollarization is protective, stemming from growing concerns about the weakening of currency value, due to increasing public debt of countries.