According to the US Department of Labor, the country's overall producer price index (PPI) in June did not increase, after increasing by 0.1% in May. This latest inflation data was lower than expected, as the market expected a 0.2% increase.

Over the past 12 months, overall wholesale inflation increased by 2.3%. This figure is also lower than economists' forecast of 2.5%. Last month's whole-year inflation was revised up from 2.6% to 2.7%.

The core PPI excluding volatile food and energy prices - also unchanged in June, after rising 0.1% in May. Analysts predict core PPI will increase by 0.2%.

Some experts believe that cooling inflation data could support gold prices, as this shows that inflationary pressures are under control and could create conditions for the US Federal Reserve (FED) to cut interest rates this year.

However, there are also opinions that economic instability and inflation concerns are still present due to import tariffs imposed by US President Donald Trump and the ongoing global trade war. PPI is considered an early inflation forecast, as manufacturers often shift higher input costs to consumers.

In terms of production costs, although overall and core inflation were low, the final price of goods increased by 0.3%, while service prices decreased by 0.1%. In the group of goods, telecommunications equipment - goods sensitive to tariffs - increased by 0.8%.

According to the PPI report, energy prices increased by 0.6% last month, while food prices increased by 0.2%.

Jamie Cox - CEO of Harris Financial Group - commented that the "cold" wholesale inflation data may not have much impact on interest rate expectations. The market is still expecting the Fed to start cutting interest rates in September.

The downward pressure is still there, but the Fed will not rush to adjust interest rates until September. As long as the labor market remains strong and stable, interest rates are unlikely to fall sharply. That is a positive thing. Inflation has harmed millions of Americans, and focusing on controlling it is necessary, Putin said.

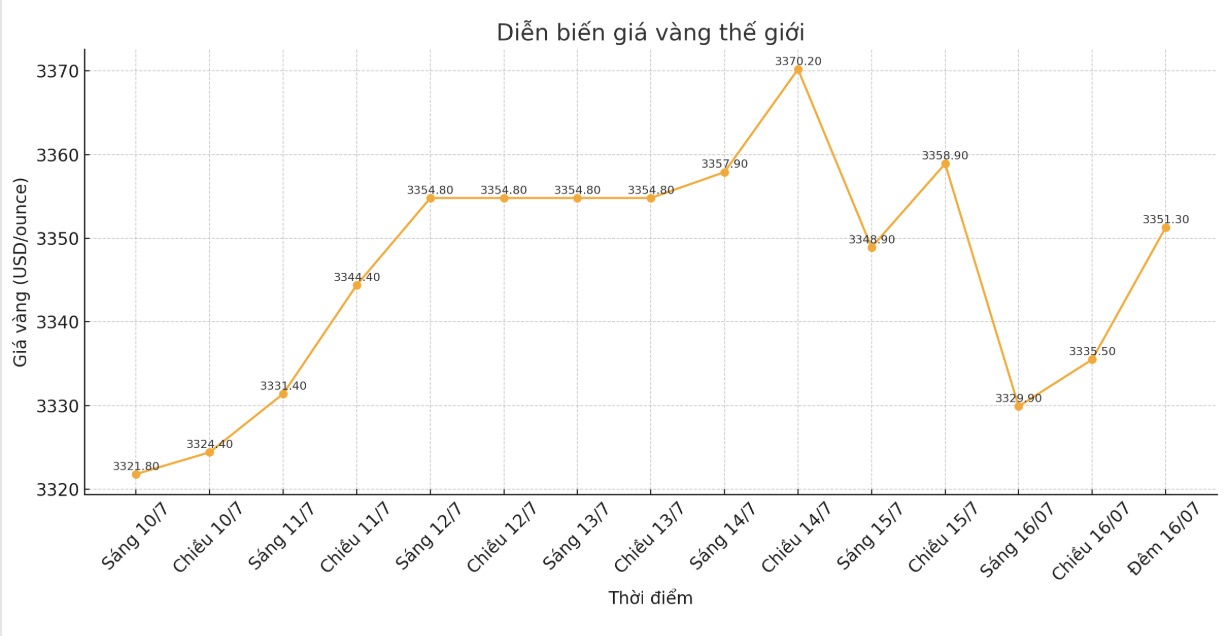

Technically, bulls for August gold are still holding a short-term advantage. The next upside target for buyers is to close the session above the strong resistance level at 3,400 USD/ounce. In contrast, the next bearish target for the bears is to push prices below the key technical support level at the bottom of June at $3,250.5 an ounce.

The most recent resistance was at $3,375/ounce, followed by a peak this week at $3,389.3/ounce. The most recent support is the weekly low at $3,327.30/ounce, followed by $3,300/ounce.

See more news related to gold prices HERE...