A report released by the New York branch of the US Federal Reserve (FED) shows that Empire State's manufacturing index in July skyrocketed from -16 to 5.5 points - the first positive level since February. This is a signal that the manufacturing sector in this region is gradually recovering after many gloomy months, far exceeding the expectations of analysts who were only at -9.

The report stated: Making in New York has rebounded after months of weakness. New orders and delivery quantity increased slightly, delivery time was longer and inventory increased significantly". In addition, the employment index and average working hours also increased for the first time since 2022, showing both the number of employees and working hours improved.

However, the worrying point in the report is the increased pressure on input prices. The input material price index increased by 9 points to 56, while the selling price index remained at 25.7, reflecting that inflationary pressures have not cooled down.

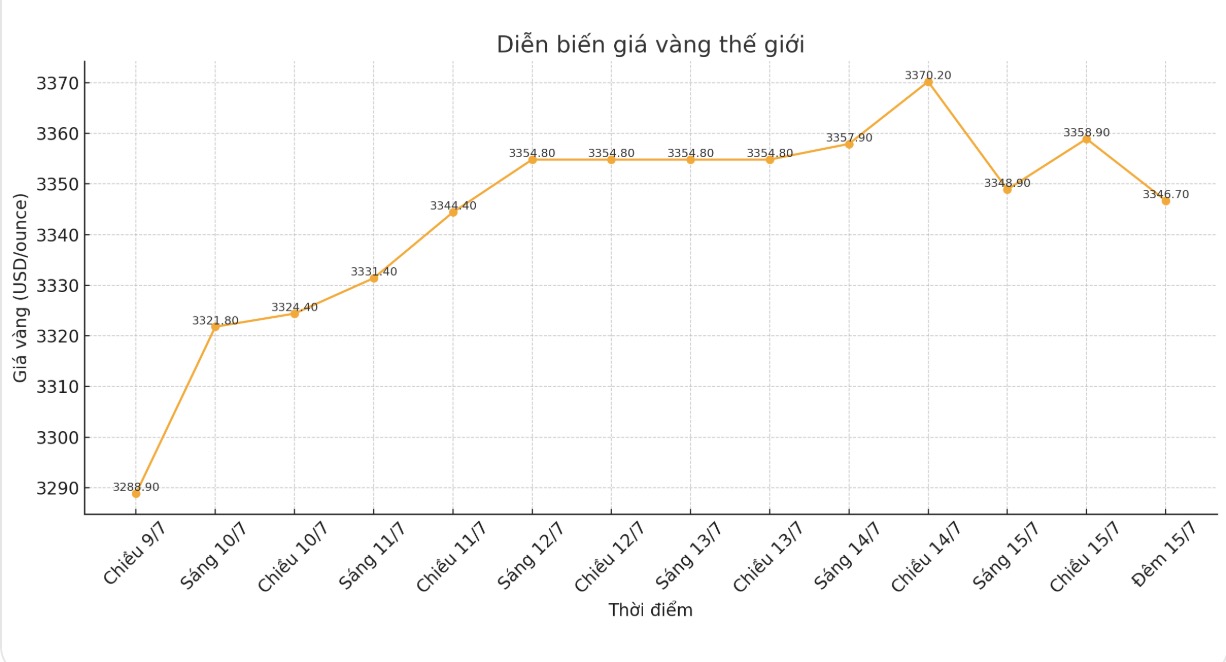

Immediately after this report was published at 8:30 p.m. on July 15 (Vietnam time) at the same time as the June inflation data, spot gold prices fell, retreating to $3,348/ounce. This is a natural reaction as positive signals from the US economy undermine gold's safe-haven role.

At the same time, the US Bureau of Labor Statistics announced that the consumer price index (CPI) in June increased by 0.3% compared to the previous month, higher than the 0.1% in May and as forecast. Full-time inflation in the first 12 months increased to 2.7%, compared to 2.4% in May, exceeding the forecast of 2.6%. Notably, core inflation (excluding energy and food prices) also rose to 2.9%, up from last month (2.8%) despite still below expectations of 3.0%.

Gold prices initially reacted positively to the signal of core inflation increasing more slowly than expected, but the increase did not last long as factors from the labor market and manufacturing all showed that the US economy was not weak enough for the FED to rush to lower interest rates.

Expert Aaron Hill - head of analytics at FP Market - commented: "This is an unpredictable CPI report. Inflation is rising, but at a slower pace. This is unlikely to change the Fed's policy at the upcoming meeting. He said the market has now ruled out the possibility of a Fed rate cut in July, but is still leaning towards a policy easing in September.

Chris Zaccarelli - Investment Director of Northlight Asset Management - also said that the FED is in a dilemma: "If inflation is truly stable, the FED can cut interest rates as early as September. But if the following reports show the opposite, keeping interest rates unchanged will take longer.

In fact, factors driving US consumer prices in June included housing and energy costs, with the gasoline price index increasing by 1%. In addition, prices of medical services, furniture, entertainment, fashion and personal care also increased simultaneously.

In the context of persistent inflation and unclear economic prospects, gold prices are under pressure from both sides: weakening demand for shelter but there is not a strong enough catalyst to break the important resistance level of 3,400 USD/ounce. Experts say that only when the FED officially signals a rate cut, will gold have the opportunity to re-establish the historical peak set in April.