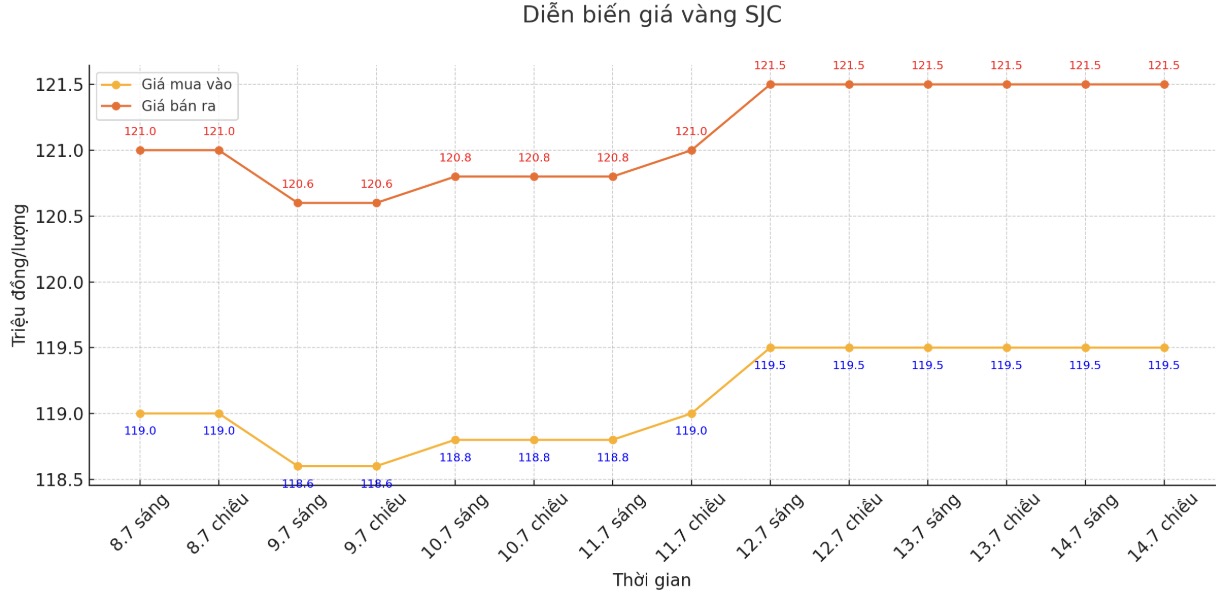

SJC gold bar price

As of 5:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.5-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.5-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

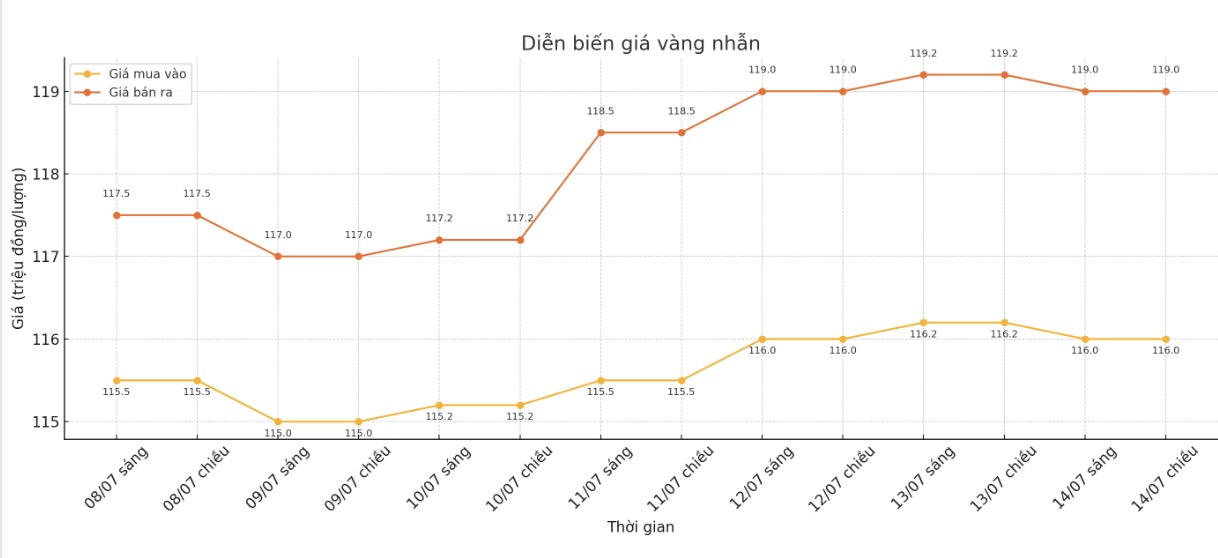

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.3-118.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

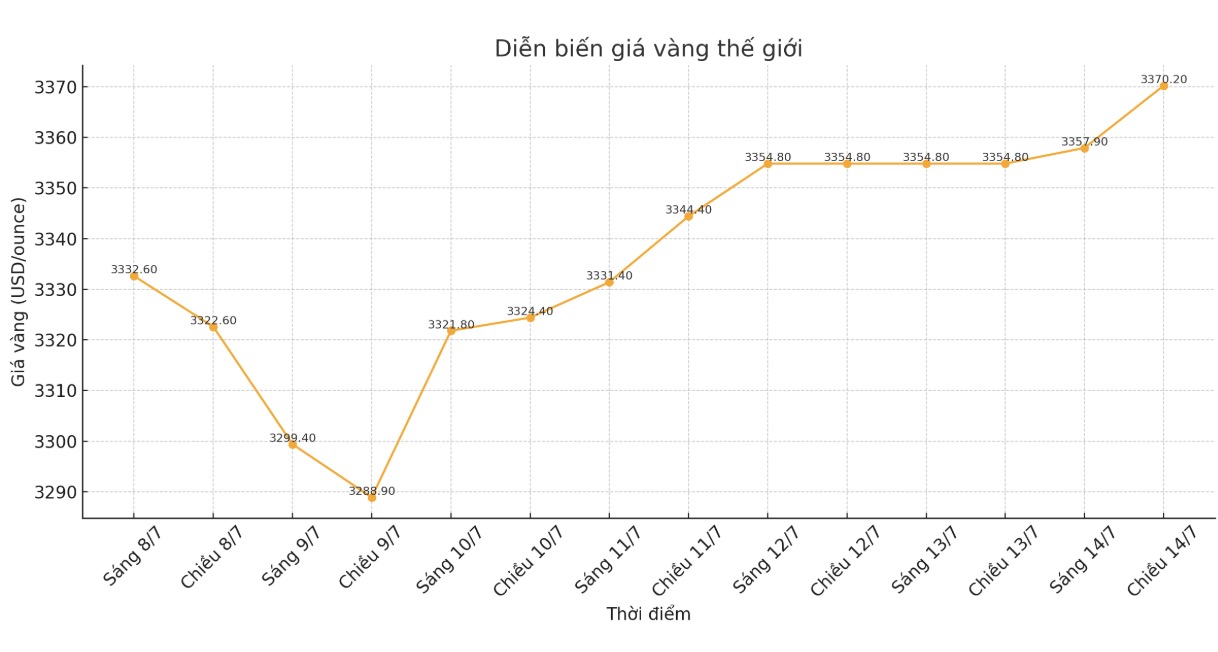

World gold price

The world gold price was listed at 5:50 p.m. at 3,370.2 USD/ounce, up 15.4 USD/ounce compared to 1 day ago.

Gold price forecast

Gold prices rose to a three-week high, fueled by safe-haven demand after US President Donald Trump threatened to impose tariffs on the European Union and Mexico, while silver prices hit a nearly 14-year peak.

Trump said on Saturday he would impose a 30% tariff on most imports from the EU and Mexico from August 1, and issued a similar warning to other countries.

Both the EU and Mexico have described the tariffs as unfair and disruptive, while the EU has said it will extend the suspension of US tax retaliatory measures until early August, while continuing to promote a negotiated solution.

Trumps tax declarations are supporting demand for safe-haven assets, and gold is the main beneficiary of that, said Giovanni Staunovo, commodity analyst from UBS.

Regarding economic data, traders are waiting for the US consumer price index (CPI) and producer price index (PPI) this week to have more signals about the interest rate roadmap of the US Federal Reserve (FED).

Investors now expect the Fed to cut a total of 50 basis points in interest rates from now until the end of the year, starting in October. Gold often tends to increase in a low interest rate environment.

Meanwhile, Indian investors - who have a tradition of hoarding gold - are increasingly turning to silver, as silver's yield this year has surpassed gold.

Spot silver rose 1.7%, to 39.02 USD/ounce, after hitting its highest level since September 2011 in the trading session.

The increase in silver "is driven by speculative cash flow, as the metal overcomes technical resistance levels" - Staunovo commented.

ANZ Bank in a note said that if silver breaks above the $3537 mark, it could activate technical buying power and push prices closer to $40.

platinum prices fell 1.2%, down to $1,382.72/ounce. Meanwhile, palladium rose 1.3%, to $1,230.87/ounce, the highest level since late October 2024.

US gold futures increased by 0.5%, to $3,379.3/ounce.

Economic data to watch next week

Tuesday: US Consumer Price Index (CPI), Empire State manufacturing survey.

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...