Updated SJC gold price

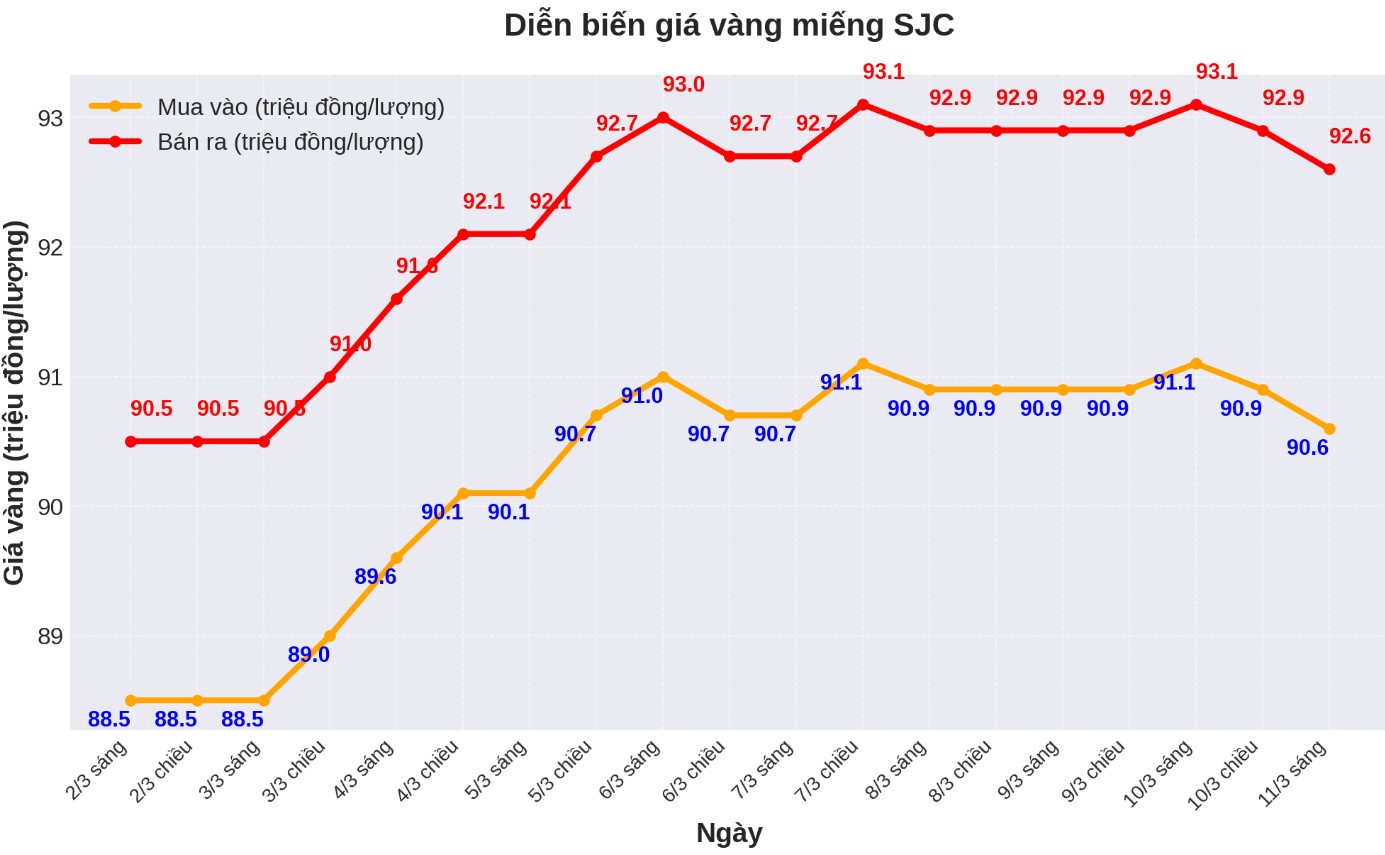

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 90.6-92.6 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 90.6-92.6 million VND/tael (buy in - sell out), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.6-92.6 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

9999 round gold ring price

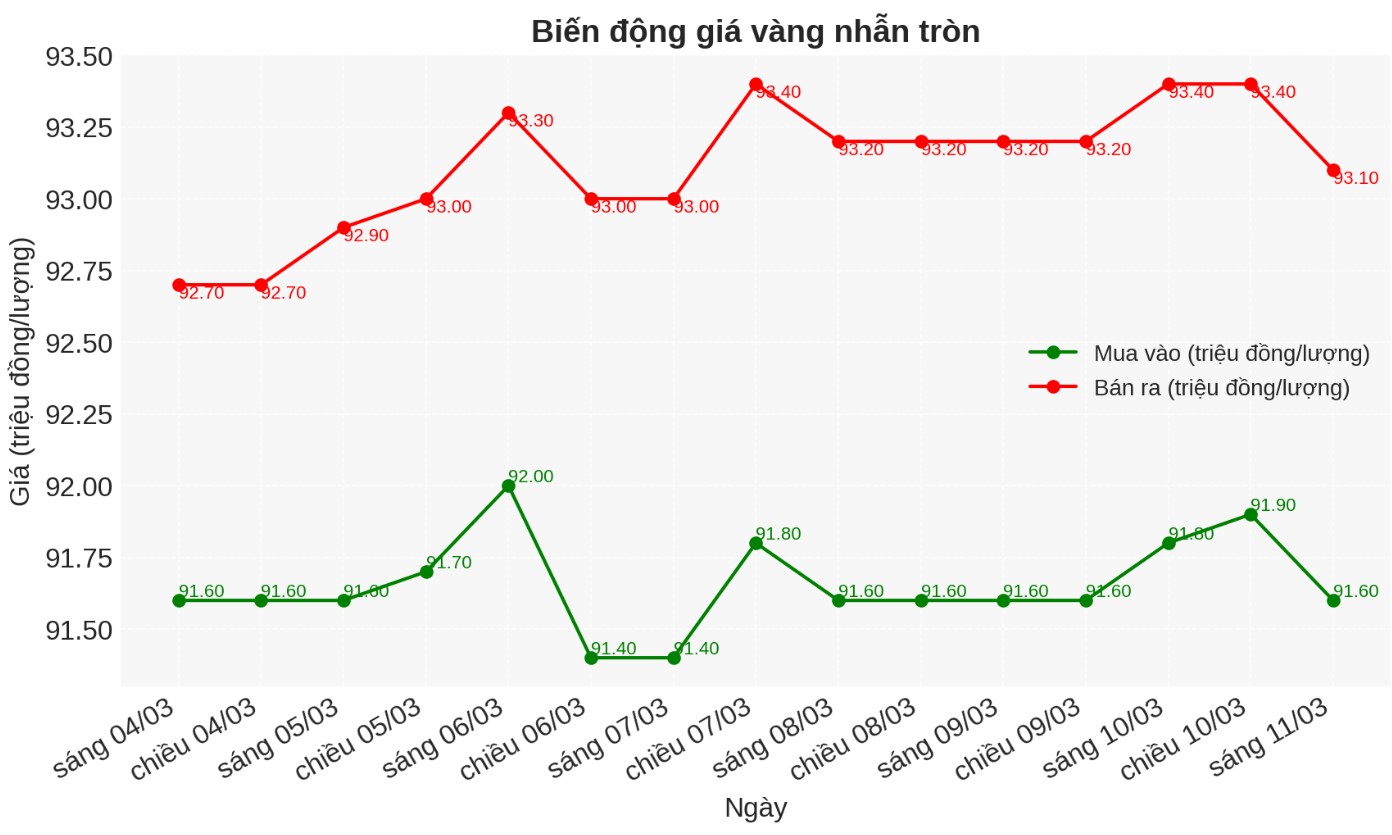

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.6-93.1 million/tael (buy - sell); down VND200,000/tael for buying and down VND300,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.7-93.2 million VND/tael (buy - sell); kept the same for buying and decreased by 100,000 VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

Recent trading sessions of plain gold rings have often fluctuated in the same direction as the world. In the context of the world market recording a strong increase, the domestic gold ring price this morning may increase.

World gold price

As of 9:23 a.m. on March 11, the world gold price listed on Kitco was at 2,897.2 USD/ounce, down 18.3 USD/ounce compared to the same time in the previous session.

Gold price forecast

World gold prices fell despite the decline of the USD. Recorded at 9:00 a.m. on March 11, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.717 points (down 0.23%).

According to a market strategist, although gold prices have decreased, there is still room for increase as demand from investors is increasingly strong.

In an interview with Kitco News, George Milling-Stanley - chief gold strategist at State Street Global Advisors (SSGA) - said that although gold exchange-traded funds (ETFs) have not attracted much cash flow in this price increase, market sentiment is changing rapidly as investors see new potential for gold.

February was the time of a boom in the gold ETF market, when North American investors rushed to buy.

According to the World Gold Council, last month, North American ETFs attracted 72.2 tonnes of gold, worth $6.8 billion, marking the month with the largest cash flow since July 2020 and the February with the strongest capital flow ever.

Milling-Stanley said that in the context of economic uncertainty and complex geopolitical situations, investors are looking to gold as a safe haven and anti-inflation channel.

Notably, most of this capital flows into SPDR Gold Shares (NYSE: GLD) - the world's largest gold ETF, managed by State Street.

Data from the GLD shows that more than 20 tonnes of gold were purchased in the fund on February 21 - the largest increase in a single day in more than three years. In total, the GLD has increased nearly 22 tons of gold since the beginning of the year, with an estimated capital flow value of about 1.9 billion USD.

Although the GLD's gold holdings have increased sharply, Milling-Stanley believes that there is still room for investment demand to continue to expand. Currently, the GLD holds 894 tonnes of gold, down 33% from its all-time high in December 2012 and 30% below the peak of the previous rally in October 2020.

Milling-Stanley predicts that gold investment demand will continue to increase, supported by three main drivers.

Sharing the same view, Rich Checkan - chairman and CEO of Asset Strategies International said that concerns about the stock market and inflation will continue to increase gold prices.

Alex Kuptsikevich, senior market analyst at FxPro, said that since the beginning of March, gold prices have reversed and increased, often exceeding the $2,900/ounce mark. US President Donald Trump's tariff policies and the risk of a trade war are still key factors driving the market and supporting gold prices.

Important economic data next week

Tuesday: Number of US job positions (JOLTS).

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

See more news related to gold prices HERE...