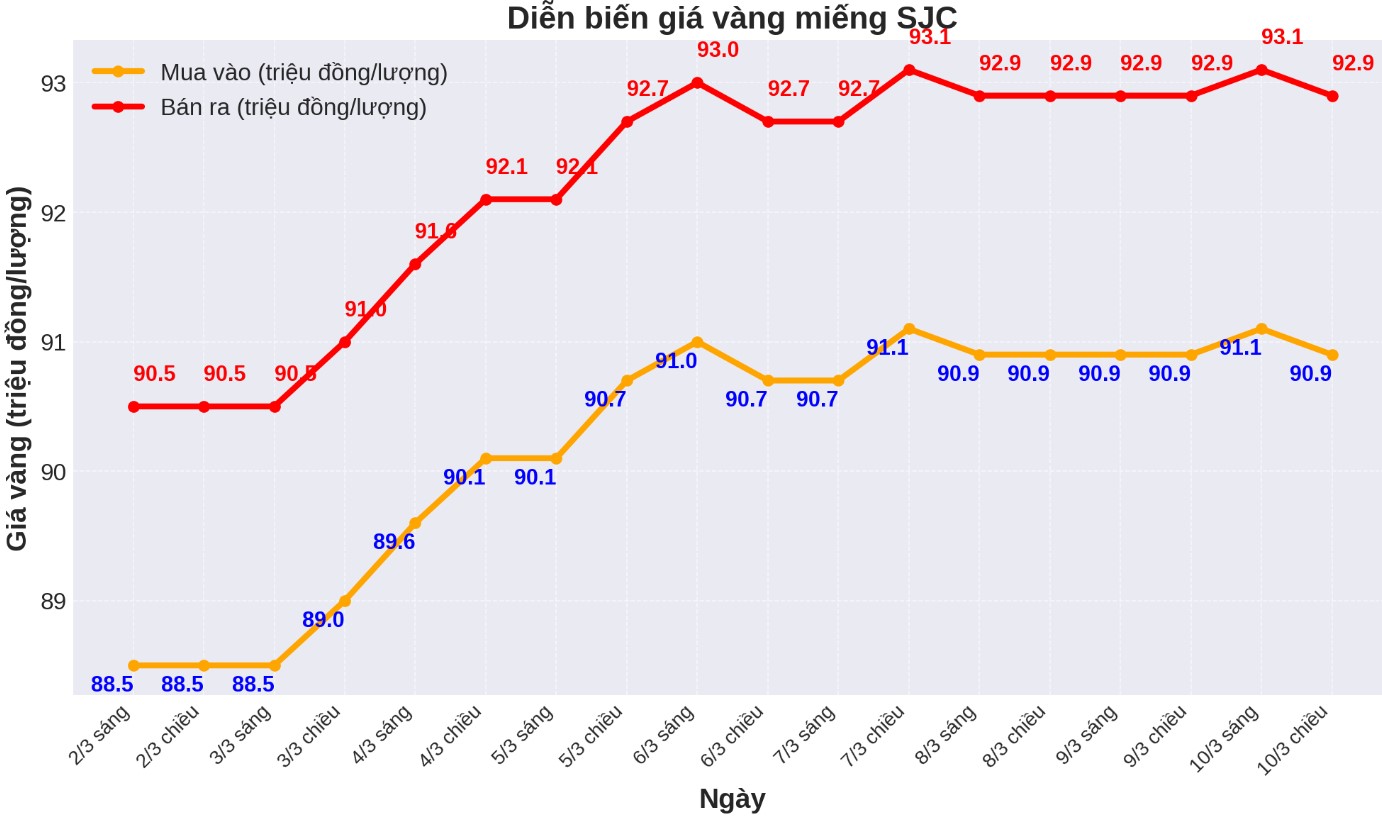

Updated SJC gold price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.9-92.9 million VND/tael (buy in - sell out), unchanged in both buying and selling directions.

The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 90.9-92.9 million VND/tael (buy - sell), unchanged in both buying and selling directions.

The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND91.1-93.1 million/tael (buy - sell), an increase of VND200,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

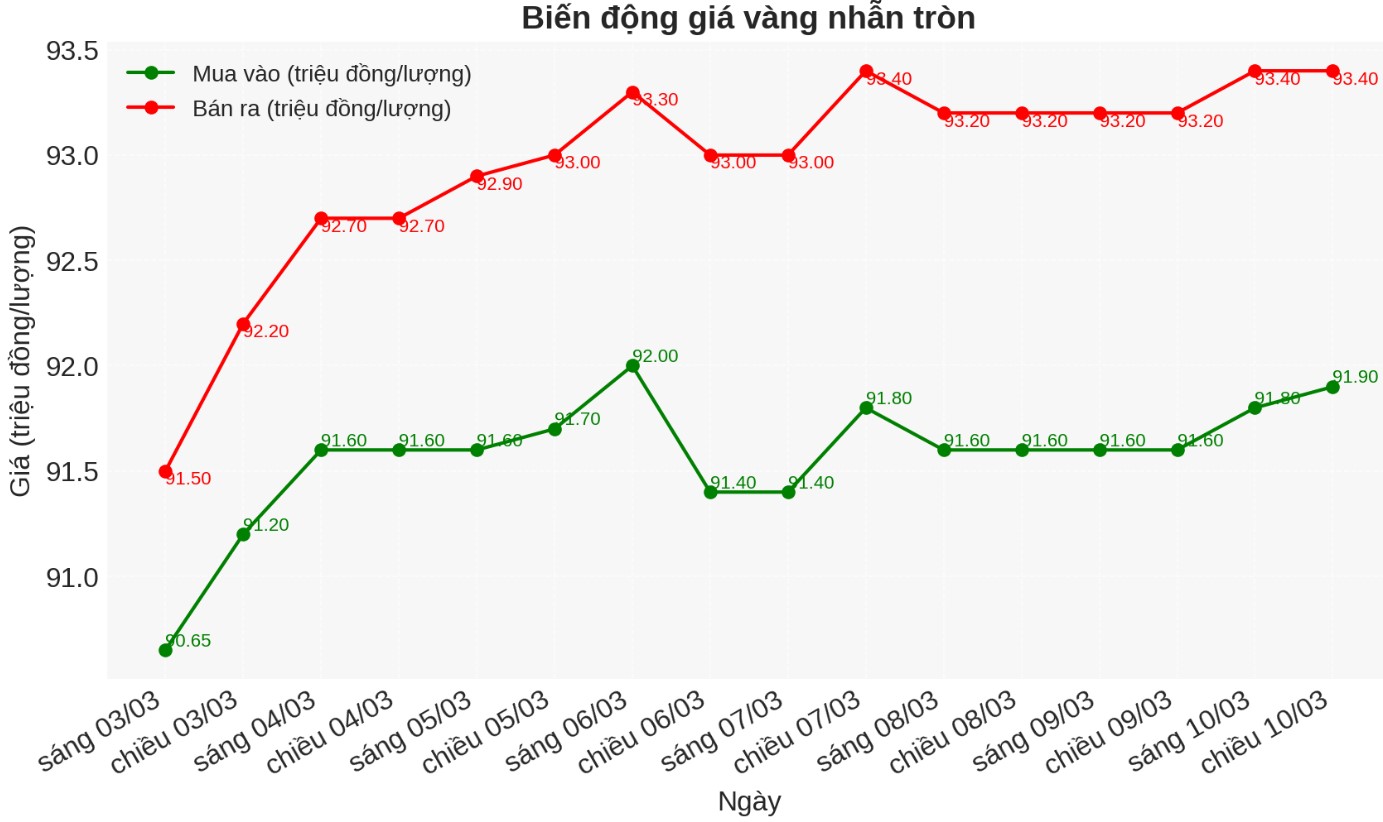

9999 round gold ring price

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.9-93.4 million/tael (buy - sell); increased by VND300,000/tael for buying and increased by VND200,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.9-93.5 million VND/tael (buy - sell); increased by 200,000 VND/tael for both buying and selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 5:30 p.m., the world gold price listed on Kitco was at 2,902.6 USD/ounce, down 6.9 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices cooled down despite the decline of the USD. Recorded at 5:30 p.m. on March 10, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.565 points (down 0.24%).

According to Reuters, gold prices moved sideways on Monday as the US dollar strengthened, offsetting safe-haven demand amid concerns about a trade war.

Investors are watching inflation data this week for clues on the next interest rate decision by the US Federal Reserve (FED).

Peter Fertig, an analyst at quantitative Commodity Research, said the rising USD is putting pressure on gold and predicted that the precious metal will continue to correct below $2,900/ounce.

Meanwhile, the market is still focused on trade tensions. In the latest statement sent to Canada, US President Donald Trump warned on Friday that counterpart tariffs on the dairy and timber industries could soon be imposed.

Frank Watson, market analyst at Kinesis Money, said golds remaining above $2,900 an ounce reflects concerns about the macroeconomic picture and the increasing geopolitical risk environment.

Traders are waiting for data from the US Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday to find a signal about the Fed's interest rate policy.

The Fed has kept interest rates unchanged since the beginning of this year after cutting rates three times in 2024. Market valuations currently reflect expectations for another interest rate cut in June.

Gold is seen as a hedge against inflation and geopolitical instability, but higher interest rates could reduce the attractiveness of non-yielding assets.

Data shows that the consumer price index of China - the world's leading metal consumer - did not meet expectations in February and decreased the most in 13 months, while the situation of decreasing production prices continued.

Spot silver prices rose 0.2% to 32.59 USD/ounce, platinum prices rose 1% to 973 USD, while palladium prices rose 0.5% to 952.68 USD.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...