Updated SJC gold price

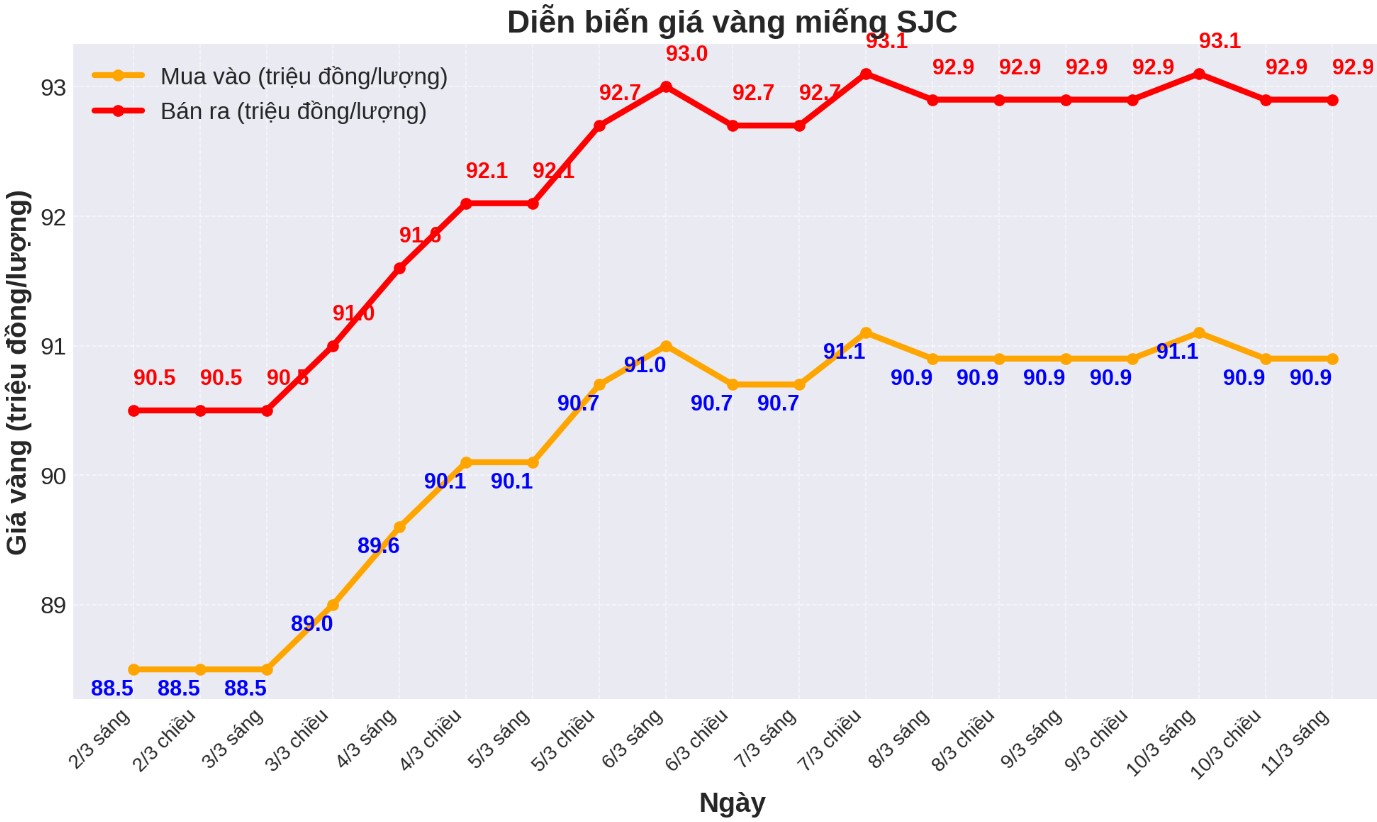

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.9-92.9 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold is listed at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 90.9-92.9 million VND/tael (buy - sell), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold is listed at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND91.1-93.1 million/tael (buy - sell), an increase of VND200,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold is listed at 2 million VND/tael.

9999 round gold ring price

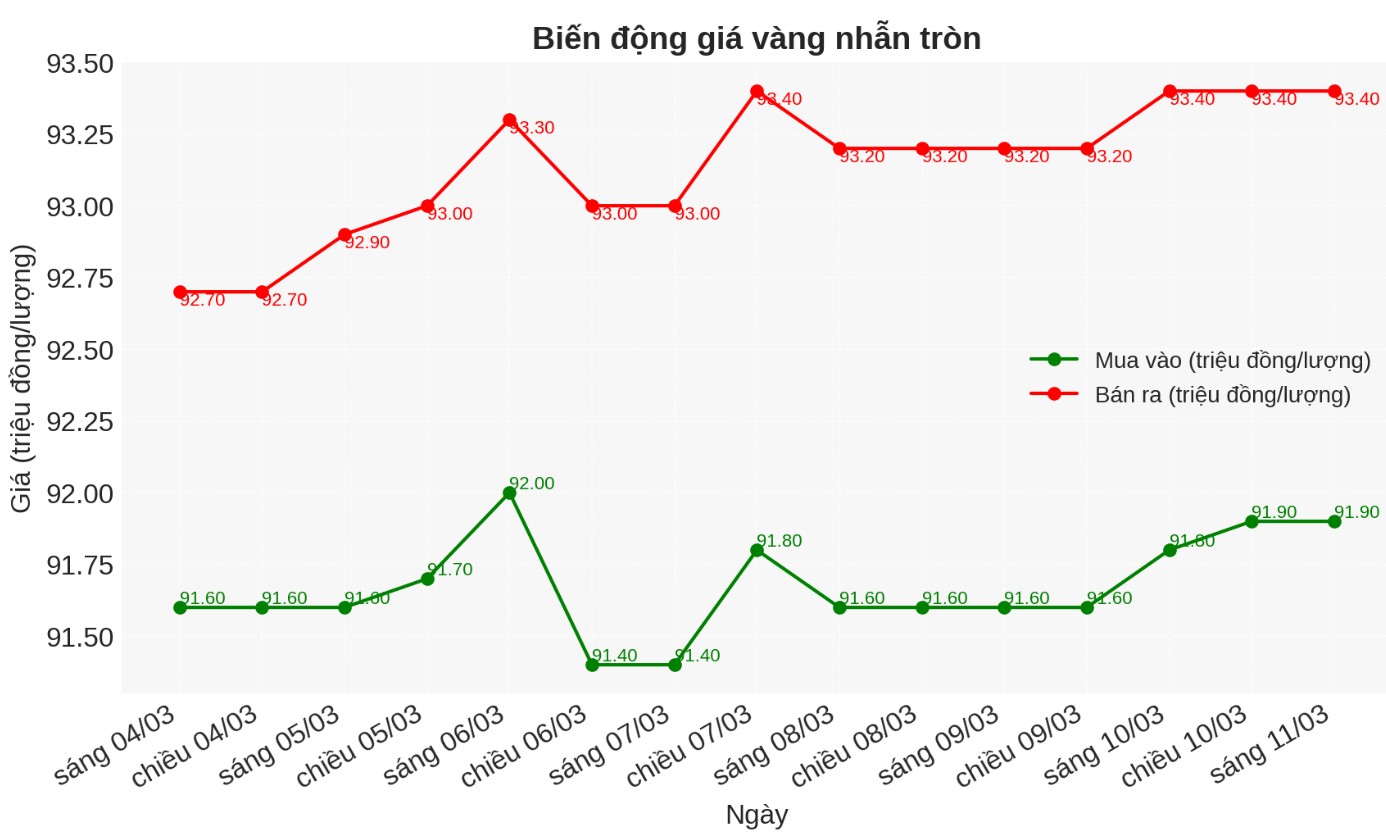

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.9-93.4 million/tael (buy - sell); increased by VND300,000/tael for buying and increased by VND200,000/tael for selling.

The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.9-93.5 million VND/tael (buy - sell); increased by 200,000 VND/tael for both buying and selling.

The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 0:15 a.m., the world gold price listed on Kitco was at 2,893.9 USD/ounce, down 15.6 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices fell sharply, falling below the important psychological threshold of 2,900 USD/ounce in the context of the USD increasing. Recorded at 0:15 on March 11, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.867 points (up 0.06%).

Gold prices fell last night, however, strong fluctuations and selling pressure in the US stock market have helped the precious metal maintain stable prices.

Gold contracts for delivery in April fell $2.2 to $2,911.9/ounce. The price of silver delivered in May also decreased by 0.179 USD, trading at 32.63 USD/ounce. Part of the reason comes from the fact that short-term traders took profits after a series of price increases.

The US stock market continues to decline as concerns about tariff policies could push the economy into further recession. In a television interview, US President Donald Trump did not rule out this possibility, saying that the economy is in a "transition period" and needs time to adapt. He emphasized: "We are bringing prosperity back to America... That is very important and always takes time."

Investors are awaiting important economic data for the week, including the February consumer price index (CPI) report on Wednesday and the February producer price index (PPI) report on Thursday.

Technically, gold futures for April are still holding a short-term advantage. The buyers' goal is to get the price above $2,974.00/ounce - the highest level in the history of this contract.

In contrast, sellers are targeting an important support level of 2,844.10 USD/ounce, the lowest level last week.

For now, gold's most recent resistance levels are $2,926.4 an ounce and $2,941.3 an ounce, respectively, while key support levels are $2,900 an ounce and $2,892.5 an ounce.

In other markets, WTI crude oil prices decreased, trading around 66.50 USD/barrel. The yield on the 10-year US Treasury note was at 4.22%.

Important economic data for the week

Tuesday: Number of US job positions (JOLTS).

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...