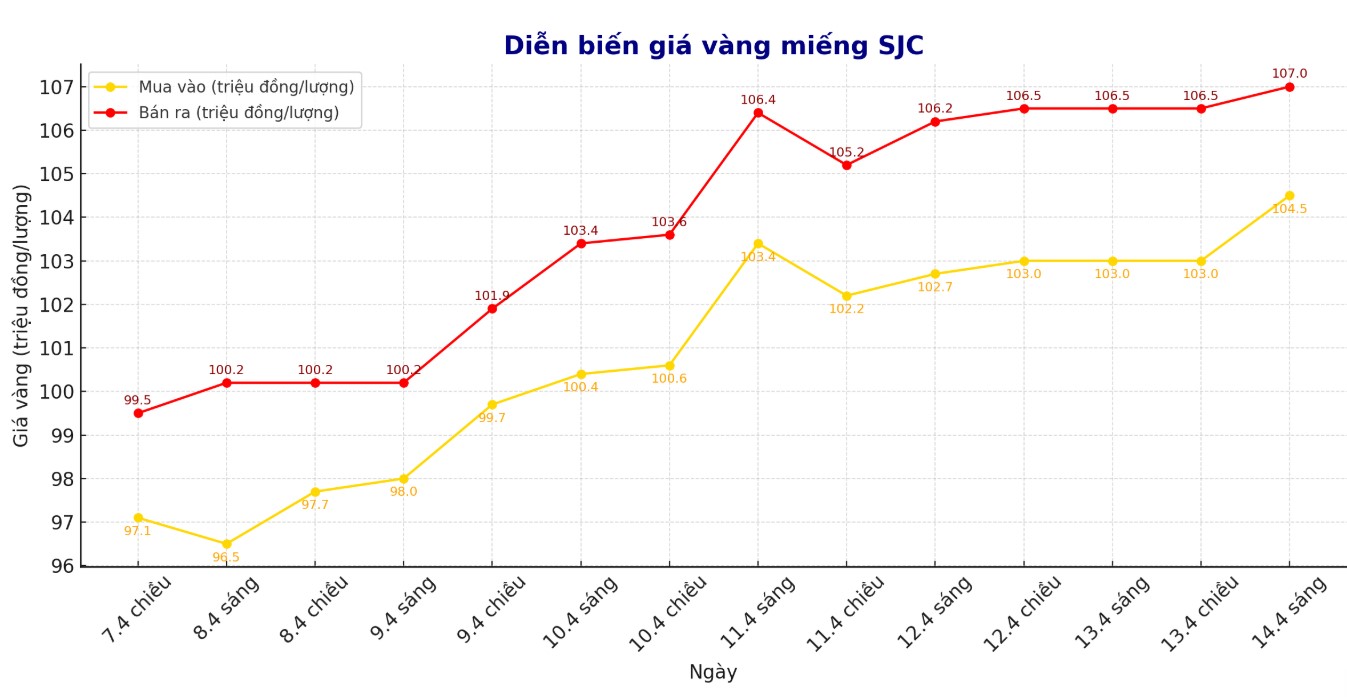

Update SJC gold price

As of 9:00 am, SJC gold price was listed by Saigon SJC VBQ Company at the threshold of 104.5-107 million VND/tael (buying - selling), an increase of 1.8 million VND/tael purchased and an increase of 800,000 VND/tael sell. Buying price difference - sold at the threshold of 2.5 million VND/tael.

At the same time, SJC gold price was listed by DOJI Group at the threshold of 104.5-107 million VND/tael (purchased - sold), an increase of 1.8 million VND/tael purchased and increased by 800,000 VND/tael. Buying price difference - sold at the threshold of 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed SJC gold price at 104.5-107 million dong/tael (buying - selling), an increase of 1.8 million dong/tael to buy and an increase of 800,000 dong/tael sell. Buying price difference - sold at the threshold of 2.5 million VND/tael.

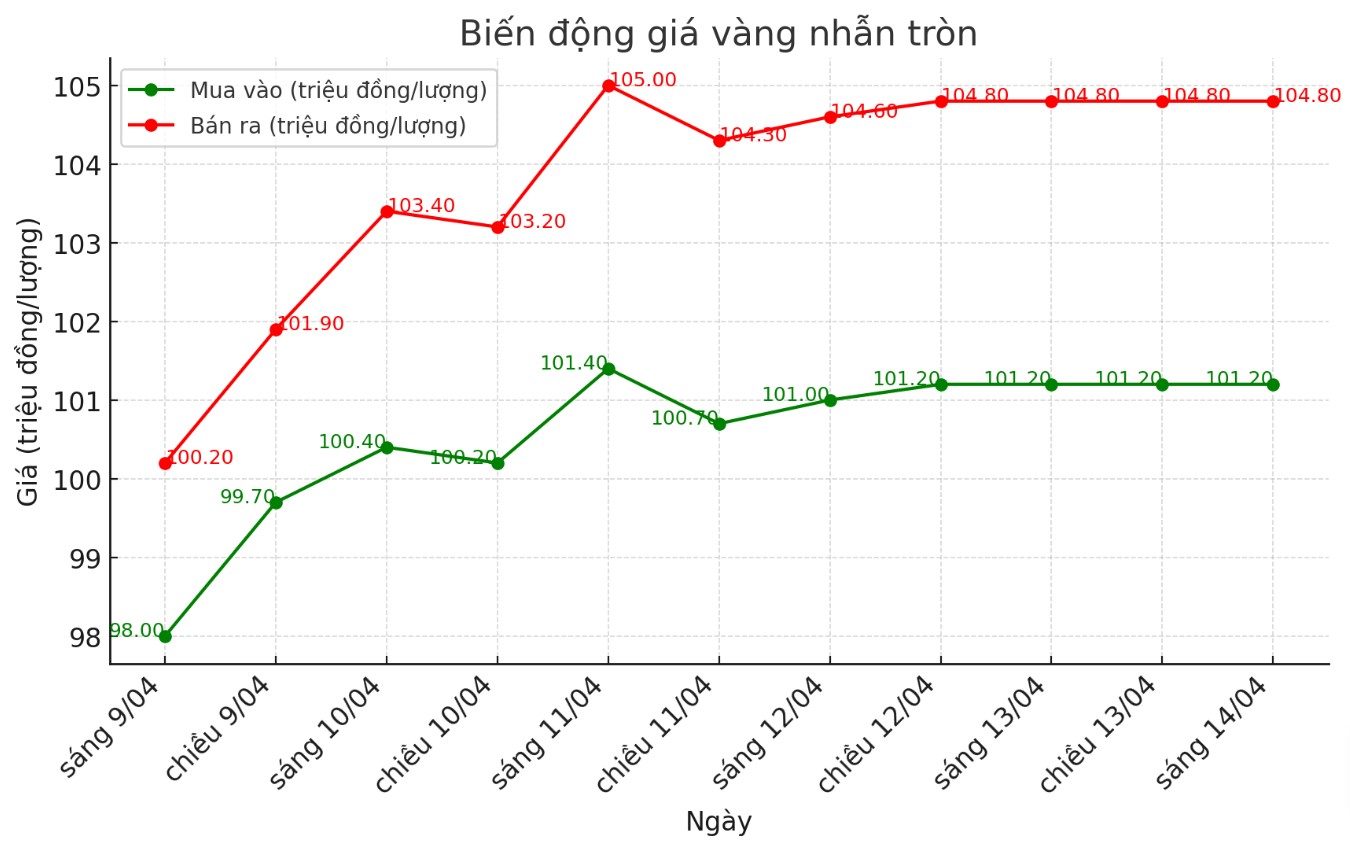

Gold price round 9999

As of 9:00 am today, the price of gold ring 9999 prosperity at Doji listed at the threshold of 101.2-104.8 million VND/tael (bought - sold), an increase of 200,000 VND/tael both in the two buying and selling. Buying price difference - sold at the threshold of 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 102.1-105.6 million dong/tael (bought - sold), an increase of 600,000 dong/tael of both directions to buy and sell. Buying difference - sold at 3.5 million VND/tael.

In the context that the domestic gold price fluctuated strongly, the bought and selling distance was pushed up too high, causing risks for individual investors to rise.

In the context that the world gold market has many fluctuations, the difference in purchasing - large sale of the domestic market is a clear warning sign. If the price of gold turns down, the buyer will face a huge loss. Individual investors, especially those who have the psychology of "surfing", should consider carefully before falling money.

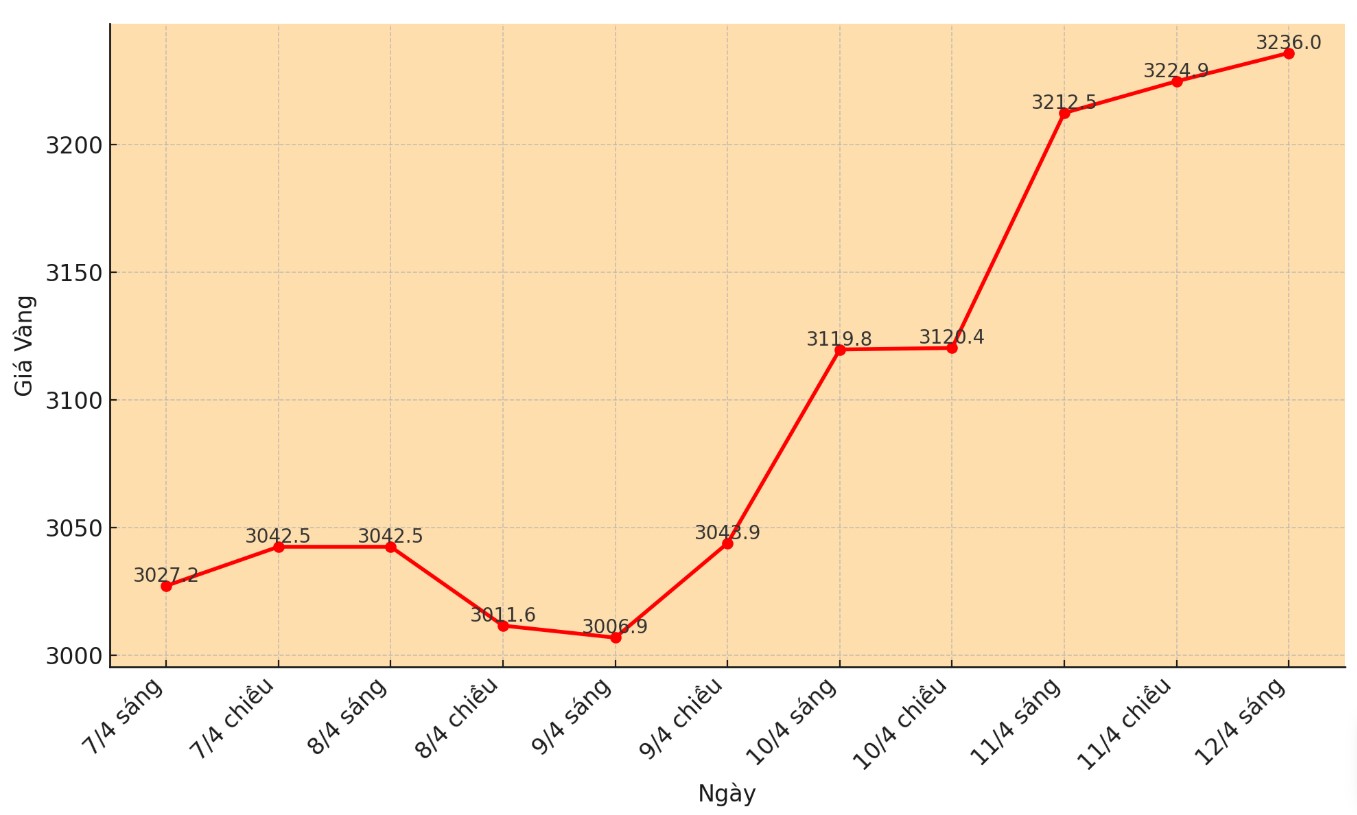

World gold price

At 8:40 pm, the world gold price listed on Kitco around the threshold of US $ 3,236.7/ounce, up 0.7 USD compared to the beginning of the trading session last morning.

Gold price forecast

The latest weekly gold survey of Kitco News shows that most of the experts in the industry are optimistic with gold. While small investors also expect more positive.

This week, 16 analysts participated in Kitco News's survey. Wall Street almost absolutely agreed that gold price will continue to increase in the short term.

15 people (accounting for 94%) predicted that gold prices would increase next week, no one thought that gold would decrease. Only one person (6%) thinks that gold will hold at the current high level without increasing.

Meanwhile, 275 investors participated in Kitco's online survey. Psychology of small investors is also more positive when other types of assets are discounted.

189 people (69%) think that gold price will increase this week. There are 50 people (18%) expected gold will decrease, the remaining 36 people (13%) think that the price will go sideways.

Adrian Day - Adrian Day Asset Management - said the current gain momentum was very clear. He said recent adjustments only lasted in a short time and was quickly bought back.

"Gold is attracting great attention from investors, and the motivation for price increase is still very strong," he said.

Sharing the same opinion, James Stanley - a high -level market strategist at Forex.com also maintained an optimistic view of gold. "I have kept a positive stance in gold for a long time and has no reason to change," he said. According to Stanley, the current development shows that it should not be contrary to the increase in gold.

Colin Cieszynski - Patriarchal strategist at Sia Wealth Management - said he was also optimistic about gold next week, when the dollar tends to weaken and the instability factors have not shown signs of ending.

Adam Button - Head of Monetary Strategy at Forexlive.com - warns that the US economy is in a difficult situation. According to him, investors are looking for safe shelter and gold is meeting that demand.

"The market is reflecting concerns about one or more risks at the same time, inflation increases, growth growth or labor productivity decreases. All can occur simultaneously" - he said.

Another noteworthy factor, according to the button, is the recent decision of the US Supreme Court - allowing the president to dismiss independent agencies. This can pave the way for direct intervention to the central bank. "If Mr. Trump fired Fed President Jerome Powell, gold price could be up to 5,000 USD/ounce," he predicted.

See more news related to gold price here ...