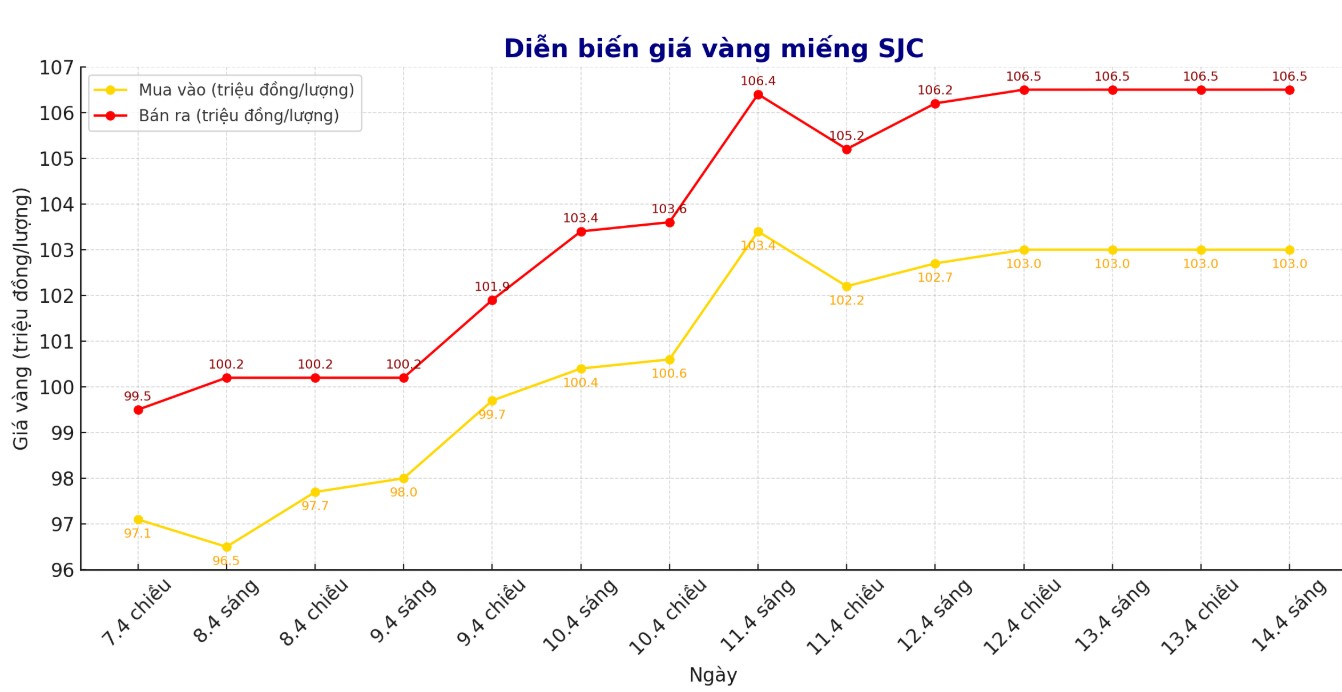

Update SJC gold price

As of 6:00 am, SJC gold price was listed by SJC SJC VBD Company at the threshold of 103-106.5 million VND/tael (bought - sold). Buying price difference - sold at the threshold of 3.5 million VND/tael.

At the same time, SJC gold price was listed by Doji Group at the threshold of 103-106.5 million VND/tael (purchased - sold). Buying price difference - sold at the threshold of 3.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed SJC gold price at 103-106.5 million dong/tael (bought - sold). Buying price difference - sold at the threshold of 3.5 million VND/tael.

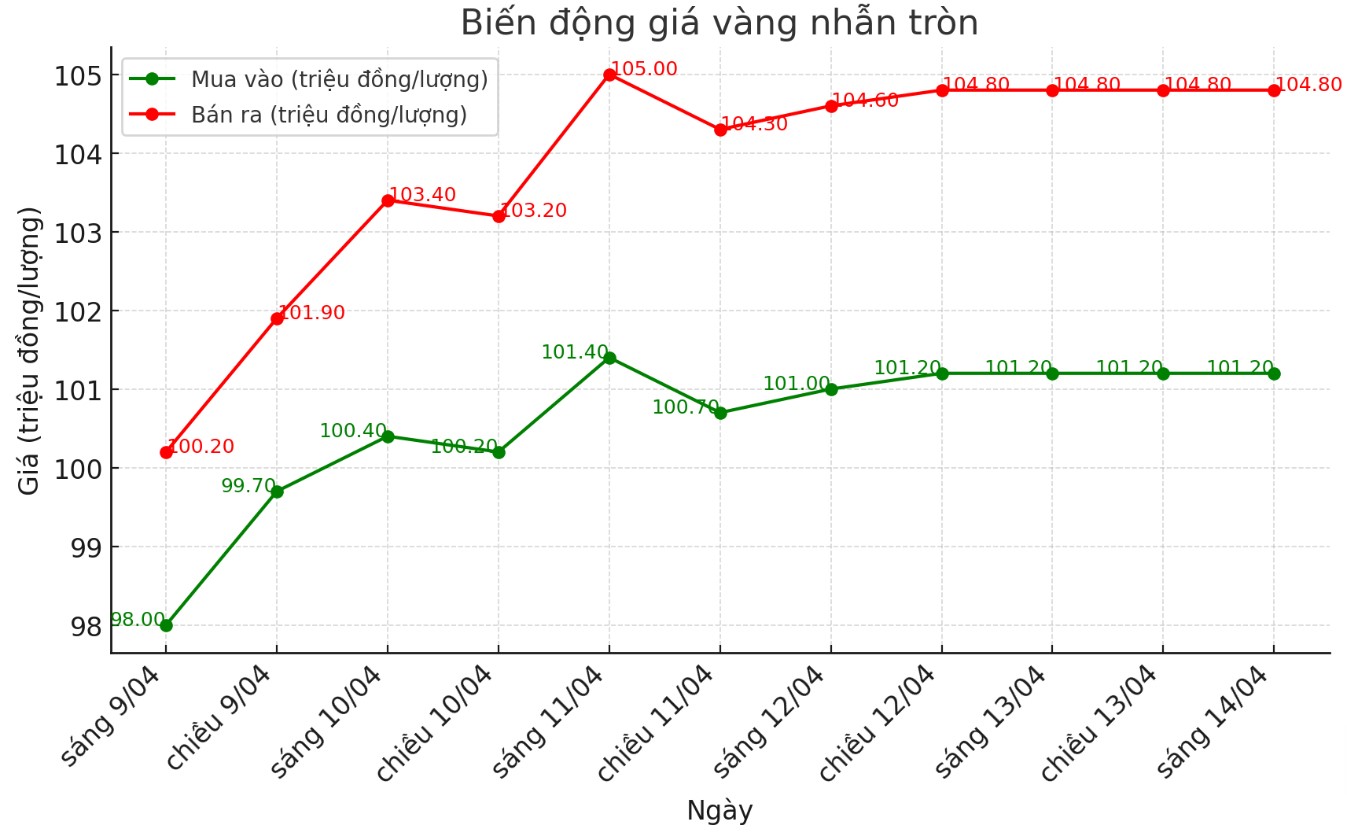

Gold price round 9999

As of 6:00 am today, the price of gold ring 9999 prosperity at Doji listed at the threshold of 101.2-104.8 million VND/tael (purchased - sold). Buying price difference - sold at the threshold of 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 101.6-105.1 million dong/tael (bought - sold). Buying price difference - sold at the threshold of 3.5 million VND/tael.

When the world gold price fluctuates strongly, the gap between the purchase price and the domestic selling price is expanded, showing very clear risks. If the price of gold turns down, the buyer will face a huge loss. Individual investors, especially those who have the psychology of "surfing", should consider carefully before falling money.

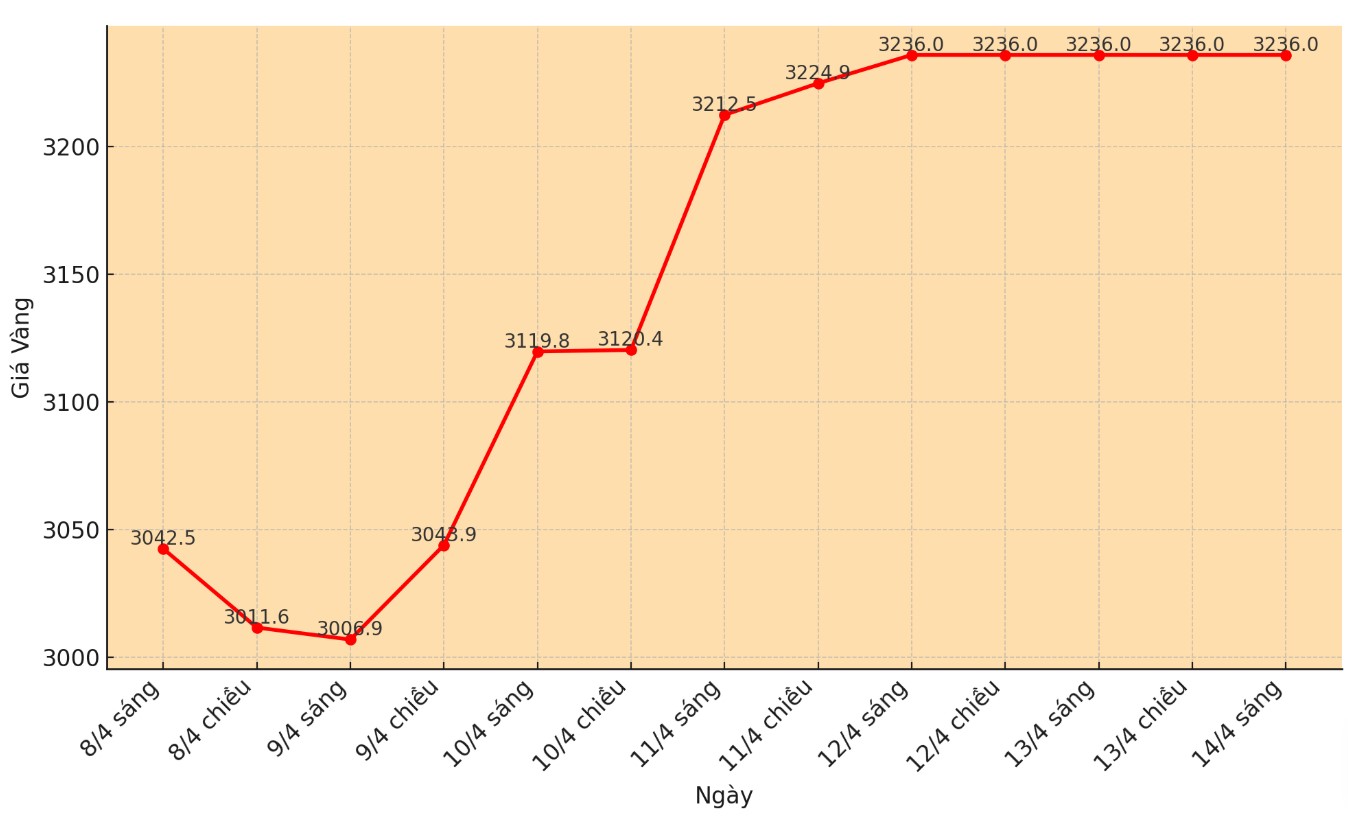

World gold price

As of 6:00 am on April 14, the world gold price listed at 3,236 USD/ounce.

Gold price forecast

This week, 16 analysts participated in Kitco News's survey. Wall Street almost absolutely agreed that gold price will continue to increase in the short term.

15 people (accounting for 94%) predicted that gold prices would increase next week, no one thought that gold would decrease. Only one person (6%) thinks that gold will hold at the current high level without increasing.

Meanwhile, 275 investors participated in Kitco's online survey. Psychology of small investors is also more positive when other types of assets are discounted.

189 people (69%) think that gold price will increase next week. There are 50 people (18%) expected gold will decrease, the remaining 36 people (13%) think that the price will go sideways.

From last year until now, gold price has maintained a sharp increase, setting a record peak and an increase of nearly 21% this year, thanks to the demand for shelter and purchase of central banks and cash flow into gold ETFs.

"We believe that gold can also increase in the positive scenario, the goal is 3,400 - 3,500 USD/ounce in the next few months," - expert Giovanni Staunovo of UBS forecast.

Jerry Prior - CEO Mount Lucas Management - said: "With the current instability, gold price is reflecting the situation. But just an hour later, the market viewpoint can change completely. That shows that the situation is so stable that no one can rely on a script or instruction to cope."

Jesse Colombo - an independent analyst - said that gold still increased sharply because the USD has been highly valued for many years. "The increase in bond yields is now beneficial for gold because it reflects the bond is no longer considered a safe asset. That forces the Fed to stop the currency soon and return to the money pump - this is like 'missile fuel' for gold and goods prices."

Rich Checkan - President and CEO at Asset Strategies International is expected to have short -term profit after a sharp increase, but that does not change the general trend. "Gold is motivating to increase prices clearly and still have room to continue to go up in the near future" - he said.

Economic data to be monitored during the week

Tuesday (15.4): Announcing the Empire State production survey.

Fourth (16.4): The Central Bank of Canada announced a decision on monetary policy. On the same day, President of the US Federal Reserve (Fed) Jerome Powell will have a speech at the Chicago Economic Club.

Thursday (April 17): European Central Bank (ECB) meeting to discuss policies. The United States announced the number of weekly unemployment benefits, new construction data and construction permits, along with production survey results from Fed Philadelphia.

See more news related to gold price here ...