Update SJC gold price

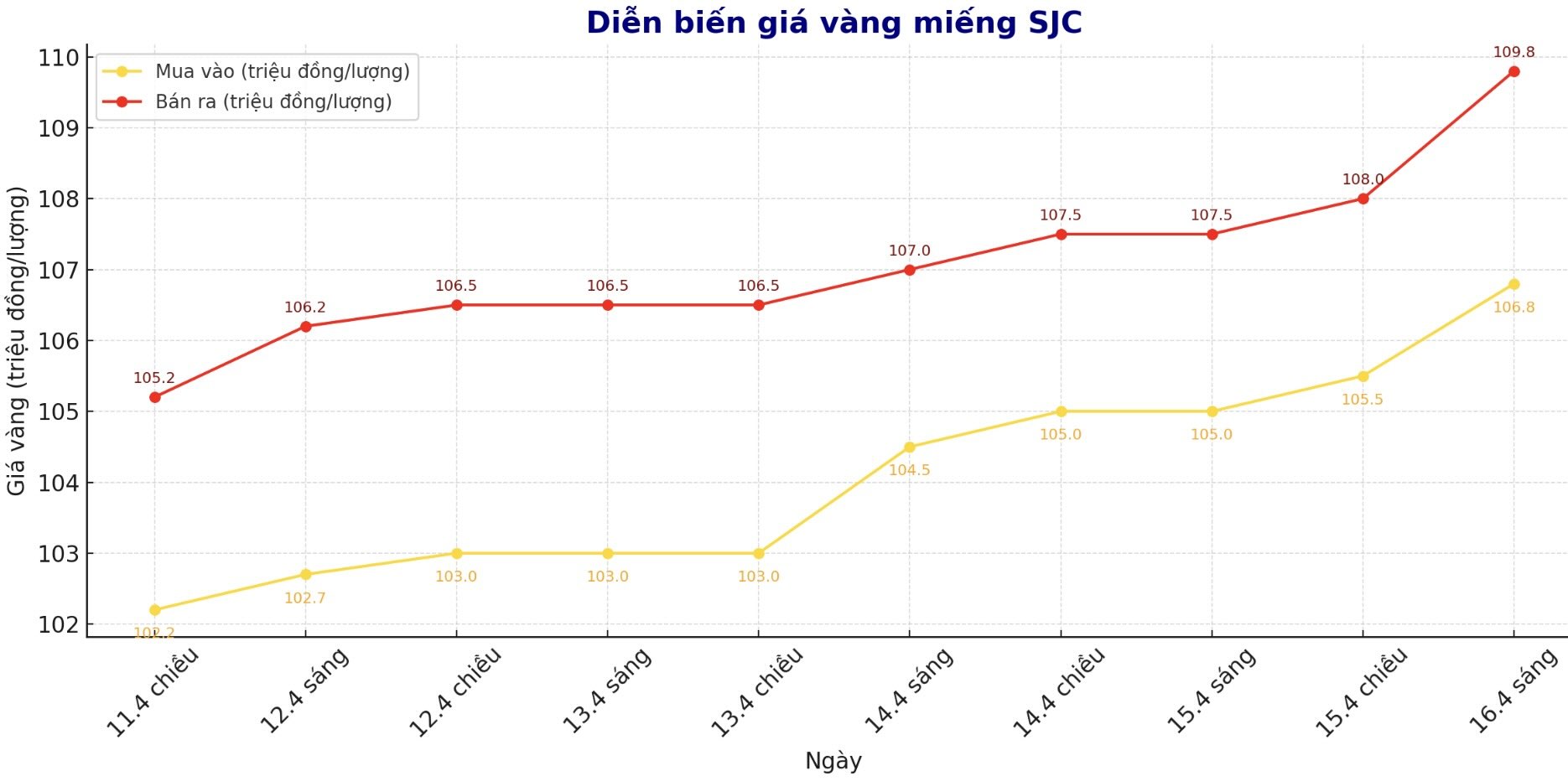

As of 9:00 am, SJC gold price was listed by Saigon SJC VBD at 106.8-109.8 million VND/tael (purchased - sold), an increase of 1.8 million VND/tael to buy and an increase of 2.3 million VND/tael sold. Buying price difference - sold at the threshold of 3 million VND/tael.

At the same time, SJC gold price was listed by DOJI Group at the threshold of 106.8-109.8 million VND/tael (buying - selling), an increase of 1.8 million VND/tael purchased and increased by 2.3 million VND/tael to sell. Buying price difference - sold at the threshold of 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed SJC gold price at 106.8-109.8 million dong/tael (bought - sold), an increase of 1.8 million dong/tael purchased and increased by 2.3 million dong/tael to sell. Buying price difference - sold at the threshold of 3 million VND/tael.

Gold price round 9999

As of 9:00 am today, the price of 9999 prosperous gold rings at Doji listed at the threshold of 104.8-107.8 million VND/tael (bought - sold), an increase of 2.8 million VND/tael both in the buying and selling directions. Buying price difference - sold at the threshold of 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 106.5-109.5 million VND/tael (buying - selling), an increase of 3.9 million VND/tael to buy and an increase of 3.6 million dong/tael sell. Buying difference - sold at 3 million VND/tael.

In the context that the domestic gold price fluctuated strongly, the bought and selling distance was pushed up too high, causing risks for individual investors to rise.

In the context that the world gold market has many fluctuations, the difference in purchasing - large sale of the domestic market is a clear warning sign. If the price of gold turns down, the buyer will face a huge loss. Individual investors, especially those who have the psychology of "surfing", should consider carefully before falling money.

World gold price

At 8:45 pm, the world gold price listed on Kitco around the threshold of US $ 3,264/ounce, decreasing by 42 USD compared to the beginning of the trading session last morning.

Gold price forecast

According to Reuters, gold price receives support thanks to the safe shelter when US President Donald Trump's tariff plan makes investors worried about trade policies, and the dollar also weakened.

Jim Wyckoff, a senior analyst at Kitco Metals, said: "The traders are waiting for the next important event that can affect the gold market. Currently, the charts still show the trend of gold price increases. Gold demand as a safe asset remains."

"The increase in gold price also partly reflects the long -lasting weakness of the dollar, which indicates the gradual decline in the position of the dollar as a safe asset. Gold can become an alternative to many USD investors," Commerzbank said in a note.

According to the World Gold Council (WGC), the Chinese gold market operates strongly when prices and investment demand increases, while importing and gold jewelry demand decrease.

The Chinese gold market has shown significant strength in March and the first quarter, with the price of domestic gold reaching a record high and capital flows into the Gold ETF, along with the central bank to continue to buy. However, the increase in gold price continues to reduce the need for imports and gold jewelry, according to Ray Jia - Head of WGC's Chinese Research Division.

Jia said gold price continued to increase sharply in March, reaching a record high in China and internationally. "ShauPm in the yuan has had the strongest month in a year, while the gold price of USD gold has increased the most since July 2020.

The situation of geopolitical tensions and US President Donald Trump's trade policies has increased the attractiveness of gold as a safe shelter. The weak dollar and the large gold capital flows have pushed the price of gold up, "he said.

Investors are waiting for the speech of the US Federal Reserve (Fed) Jerome Powell on Wednesday at the Chicago Economic Club, where he will share his views on economic prospects.

Also on the fourth day, the central bank of Canada (BOC) will announce the monetary policy decision. Analysts predict that the BOC will keep the interest rate.

On Thursday, the European Central Bank (ECB) is expected to lower interest rates to continue supporting the regional economy.

See more news related to gold price here ...