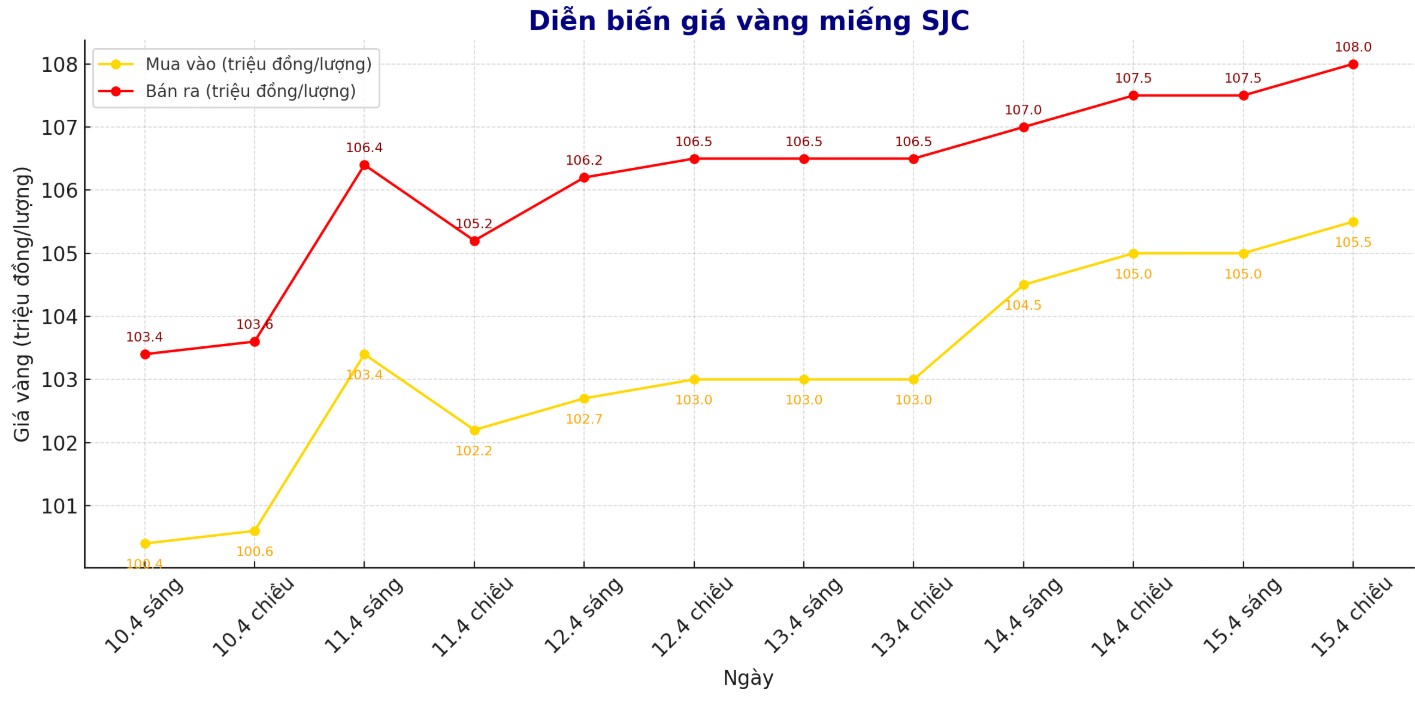

On the afternoon of April 15, the domestic gold price in the country reached a record of 108 million dong per tael. At many business units such as Bao Tin Minh Chau, Doji, Saigon Jewelry Company (SJC), gold bar price is listed at 105.5 - 108 million VND/tael.

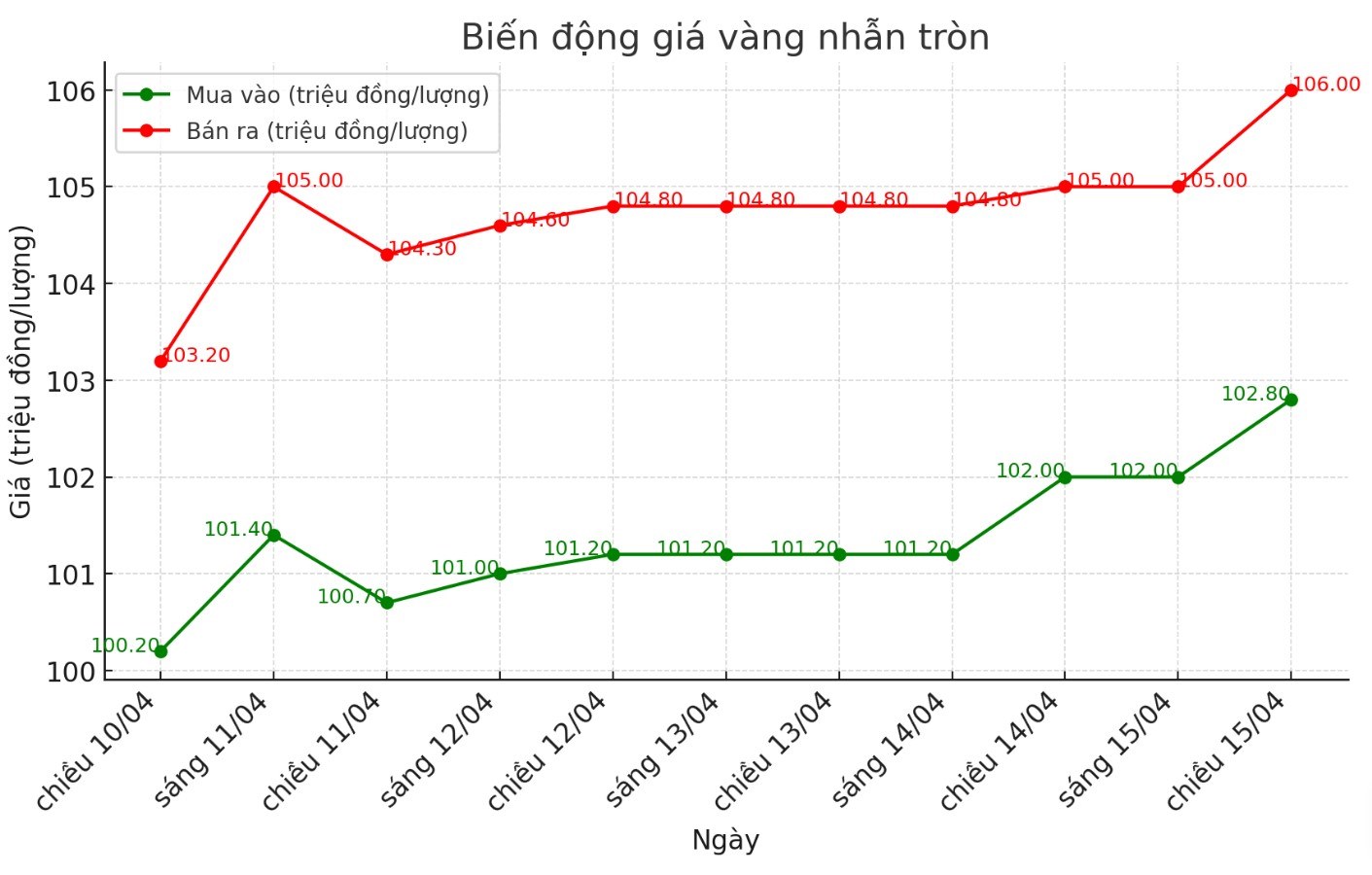

While SJC's smooth gold ring also increased significantly to 102.5 - 105.5 million dong per tael. Bao Tin Minh Chau also announced the price of smooth gold rings at 104.13-107.2 million dong per tael. Doji adjusted the price of gold rings to 102.8-106 million VND/tael.

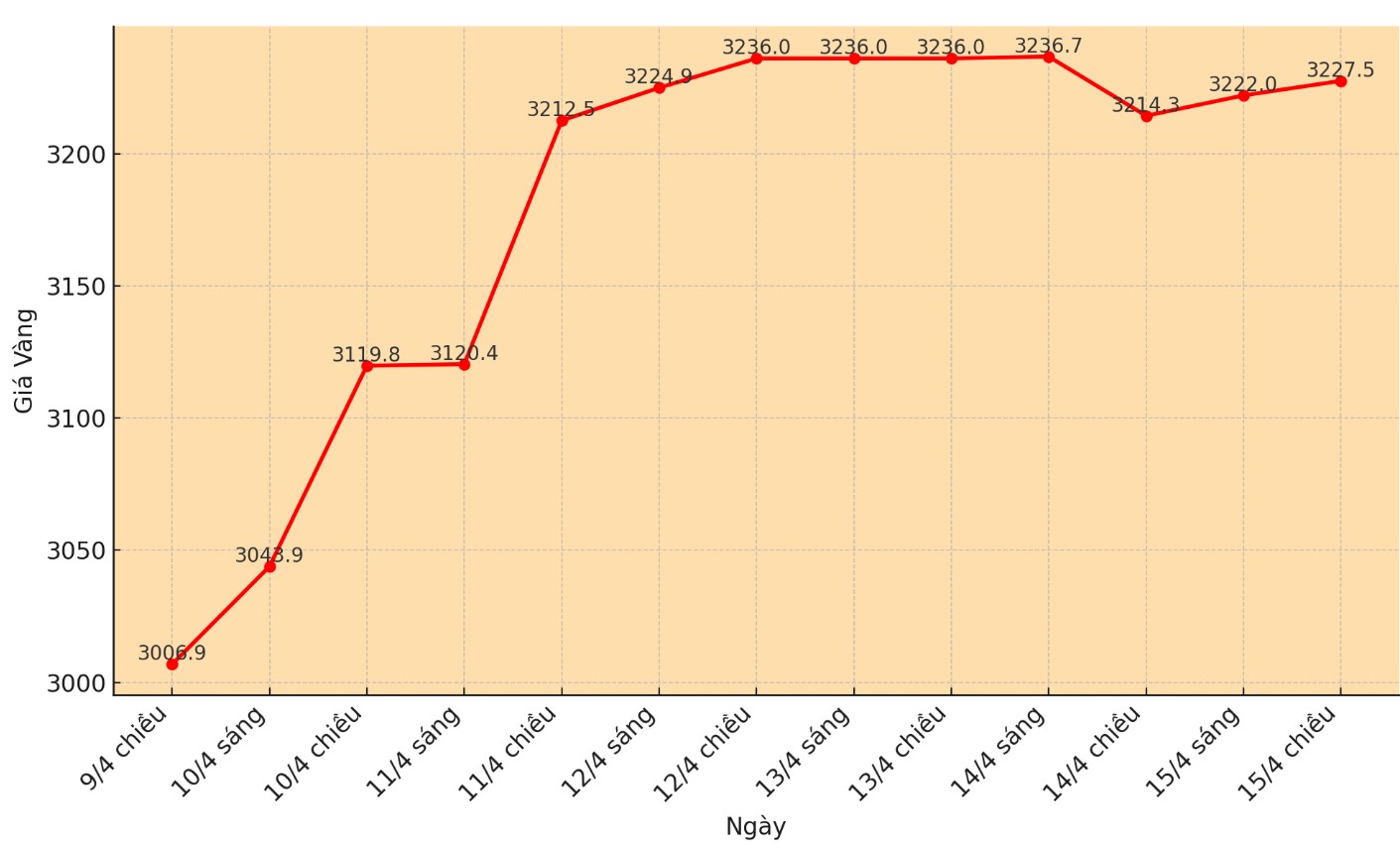

The rapid increase of domestic gold price has created a significant difference compared to the international market. 15h30 today (15.4), the world gold price ranges around US $ 3,227.5/ounce. With the USD/VND selling rate of VND 25,690 (updated at 9:15 am on the same day), the gold price converted at this exchange rate is equivalent to about 101.2 million dong per tael.

Compared to the domestic gold price at 108 million dong per tael, there is a difference of more than 6.8 million, showing that the domestic gold price is significantly higher than the world price.

The big difference between buying and selling prices is becoming a significant risk for individual investors in the gold market. With the current difference of up to 2.5 - 3 million VND/tael, investors can withstand losses as soon as they have just made trading in the day, regardless of the gold price does not decrease.

High difference reflects the risk defense from gold businesses, in the context of strong price fluctuations. However, this also means that buyers will have to spend much higher cost than the actual value of gold at the time of resale. If gold price is slightly adjusted or sideways, it is difficult for investors to earn profits, even "prison capital" or loss.

In the short term, the large price amplitude makes the gold market less attractive to the surfers and only suitable for those who have long -term storage needs. The lack of synchronization between the domestic market and the world increases risks, as domestic prices are over the world more than 6.8 million dong/tael.

Therefore, investors should be cautious, consider the price difference and the time of holding. Buying when the market is "virtual fever" can cause buyers to fall into losses, despite the increase in gold price.