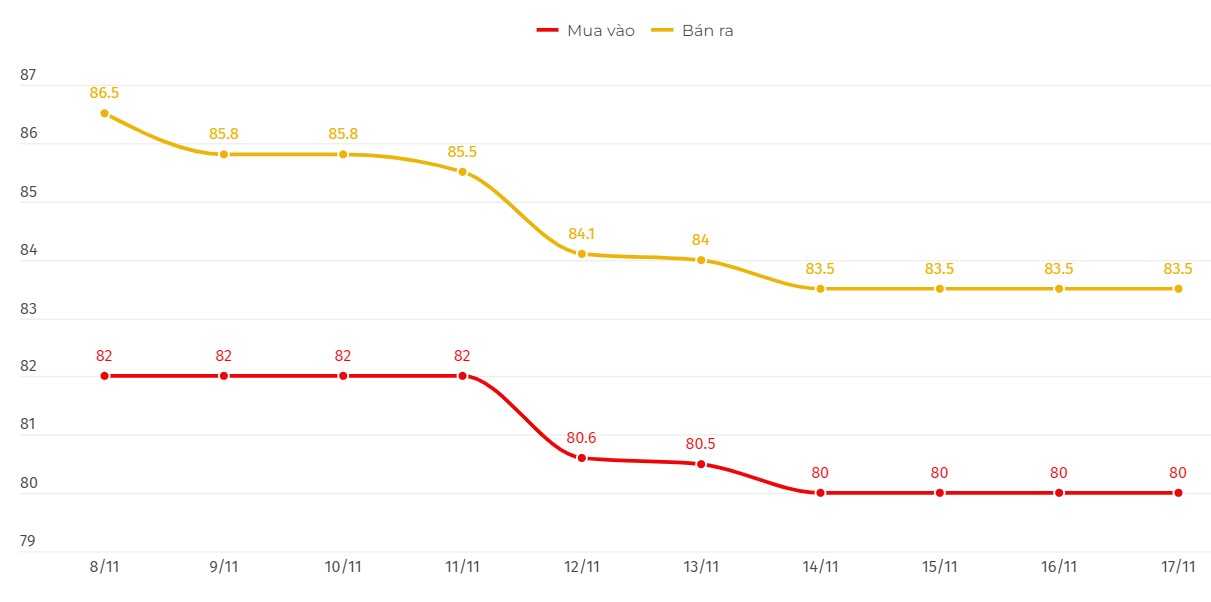

SJC gold bar price

At the end of the weekly trading session, DOJI Group listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI decreased by 2 million VND/tael for buying and 2.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company decreased by VND 2 million/tael for buying and VND 2.3 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Last week, the price of SJC gold fell sharply, combined with the difference between buying and selling prices due to listed businesses, investors suffered heavy losses. If they bought SJC gold at DOJI Group in the session of November 10 and sold it today (November 17), investors would lose VND5.8 million/tael. Similarly, those who bought gold at Saigon Jewelry Company SJC also lost VND5.8 million/tael.

Currently, the difference between buying and selling gold prices is listed at around 3.2-3.5 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

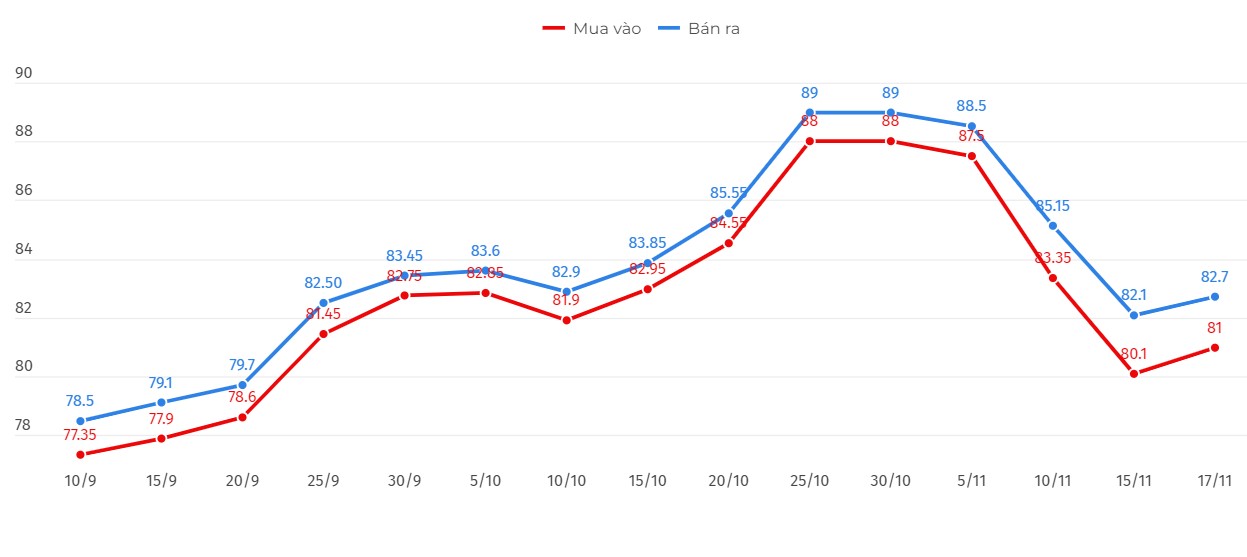

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 81-82.7 million VND/tael (buy - sell); down 2.35 million VND/tael for buy and down 2.45 million VND/tael for sell compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 81.03-82.68 million VND/tael (buy - sell); down 2.29 VND/tael for buying and down 2.44 million VND/tael for selling compared to the closing price of last week's trading session.

After a week of decline, if investors buy gold rings in the session of November 10 and sell them in today's session (November 17), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 4.15 million VND/tael and 4.09 million VND/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

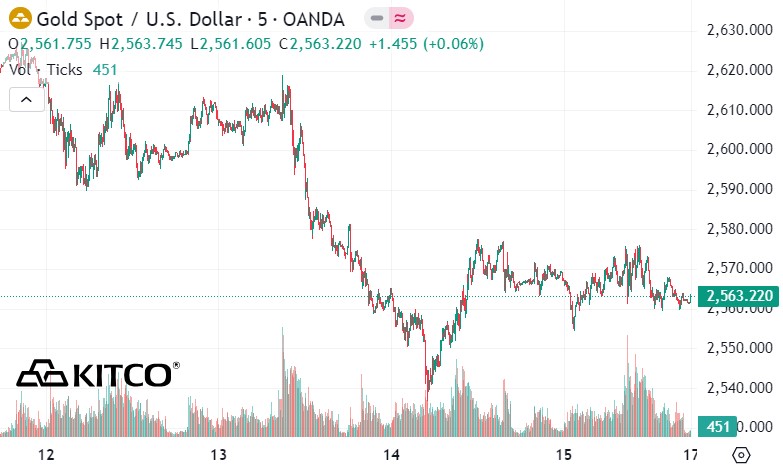

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,563.2 USD/ounce, down 121.2 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices fell amid a high USD index. Recorded at 8:45 a.m. on November 17, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.620 points (up 0.02%).

According to Kitco, the world gold price continues to decline. In just the week, the gold price has fallen nearly 5%, marking the largest weekly decline in about 3 years. From the peak, this metal has lost more than $ 250 (about 9%), making this the longest price decline since the beginning of the month.

Precious metals were pressured by a strong combination of post-US presidential election euphoria, new hawkish moves by the US Federal Reserve (FED), a strong US dollar and a relatively calm geopolitical environment.

The latest Kitco News weekly gold survey shows strong bearish sentiment among industry experts, while traders are also increasingly concerned about the precious metal’s near-term outlook.

This week, 12 analysts participated in the Kitco News gold survey. Once again, only a handful of experts see gold’s near-term potential. Only three experts see gold prices rising next week. Six analysts predict further declines in the precious metal. The remaining three analysts see gold prices remaining flat.

Meanwhile, 181 votes were cast in Kitco’s online poll. While the number of investors who forecast positive prices remains high, the percentage is down significantly from previous weeks.

Seventy-eight retail traders expect gold prices to rise next week, while 71 expect the precious metal to fall. The remaining 32 investors see gold moving sideways in the coming week.

Zaye Capital Markets chief investment officer Naeem Aslam said there are still factors that could help gold reverse in the future.

This person pointed out that in recent days, gold has been under significant downward pressure due to the pressure of the USD and expectations of changes in monetary policy of the US Federal Reserve (FED). According to him, a number of factors could change the trajectory of gold prices in the coming months.

See more news related to gold prices HERE...