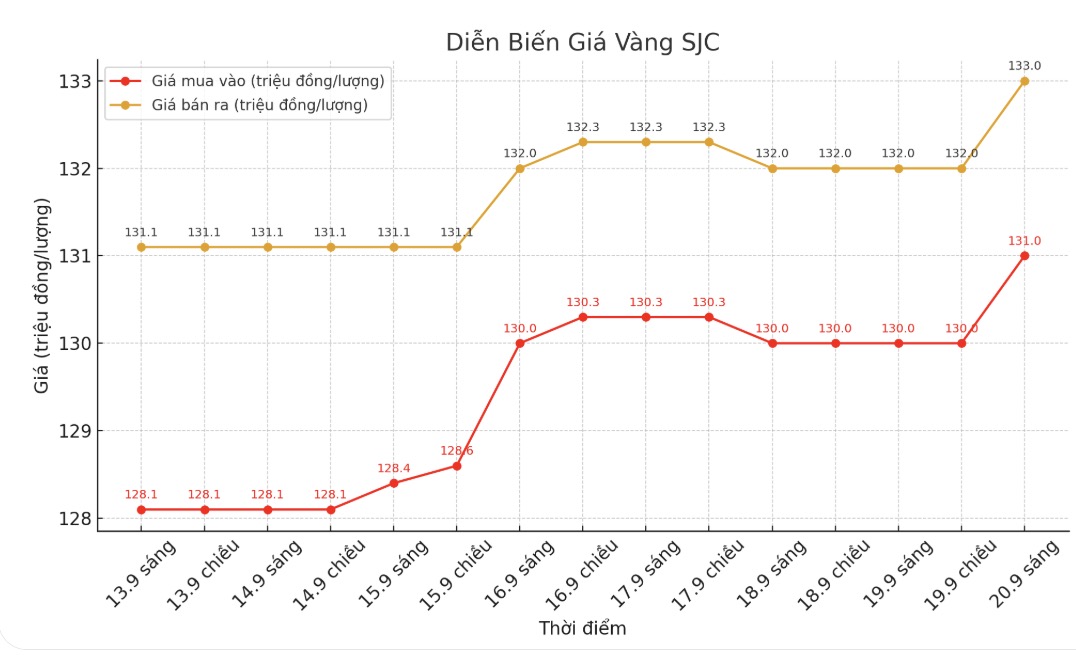

Updated SJC gold price

As of 9:50 a.m., DOJI Group listed the price of SJC gold bars at VND131-133 million/tael (buy in - sell out), an increase of VND1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 131-133 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 130.5-133 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

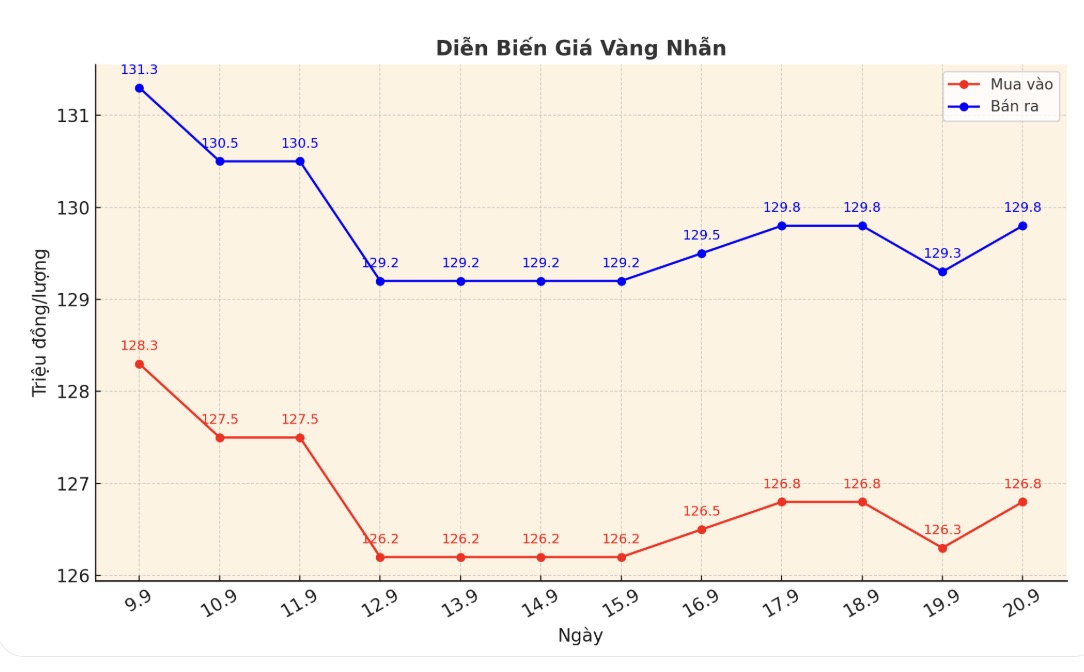

9999 round gold ring price

As of 9:50 a.m., DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

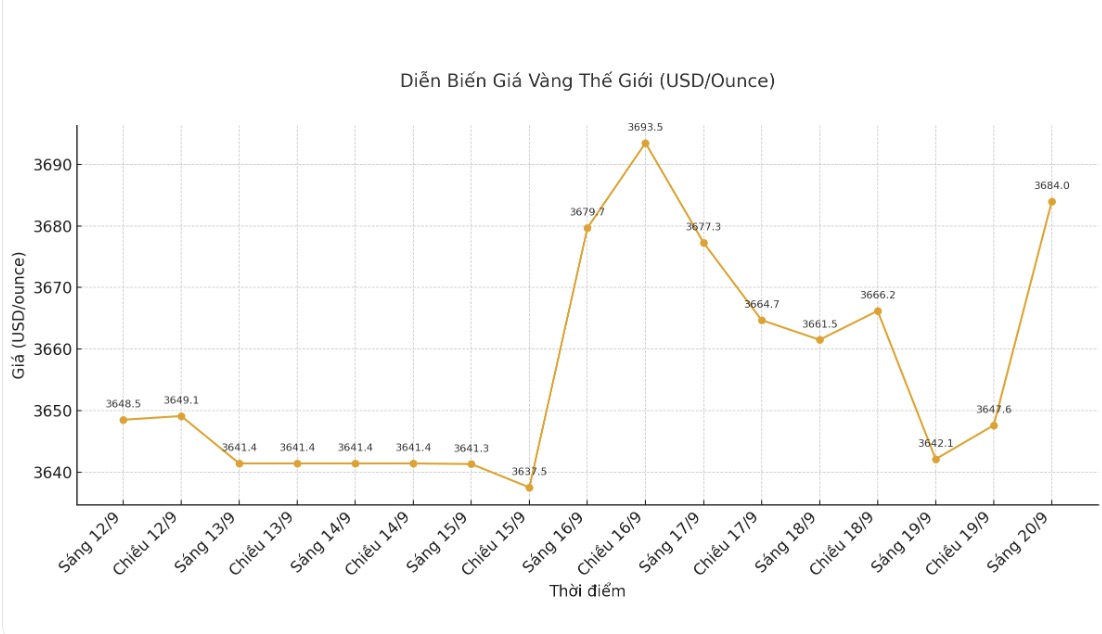

World gold price

At 9:50 a.m., the world gold price was listed around 3,684 USD/ounce, up 41.9 USD.

Gold price forecast

Philippe Gijsels - Strategy Director of BNPbas Pari Fortis, said that gold prices may fluctuate around $3,600/ounce in the short term, but it is unlikely to fall further as the Fed has started its easing cycle.

He said that investors are only just starting to return to the market, and in the context of economic instability, strong buying will appear every time prices are adjusted.

Although this price increase seems too much with an increase of nearly 40%, we are still in the early stages of the bull market. With so much uncertainty in the world, the demand for gold is still very large and prices could well reach $4,000 by the end of this year or early 2026" - Gijsels said.

Christopher Vecchio - Director of futures and foreign exchange strategy at Tastylive.com, also said that gold continues to have great value when playing the role of an essential currency asset in the global financial market.

Is gold at $3,700 an ounce still worth buying? In this context, the definitive answer is yes. I still try to find a reason to be optimistic about gold, but I have not seen any such scenario, he said.

Vecchio added that even with high prices, central banks will continue to buy gold as confidence in the US dollar weakens. He pointed out that not only is the US government looking for a way for the Fed to cut interest rates aggressively despite high inflationary pressures, but the country's public debt continues to increase at unsustainable levels.

Central banks will continue to gradually diversify away from the US dollar, and their only real choice is gold, he said.

Schedule for releasing US economic data next week

Monday: Stephen Miran speaks at the New York Economic Club.

Tuesday: US S&P Flash PMI.

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...