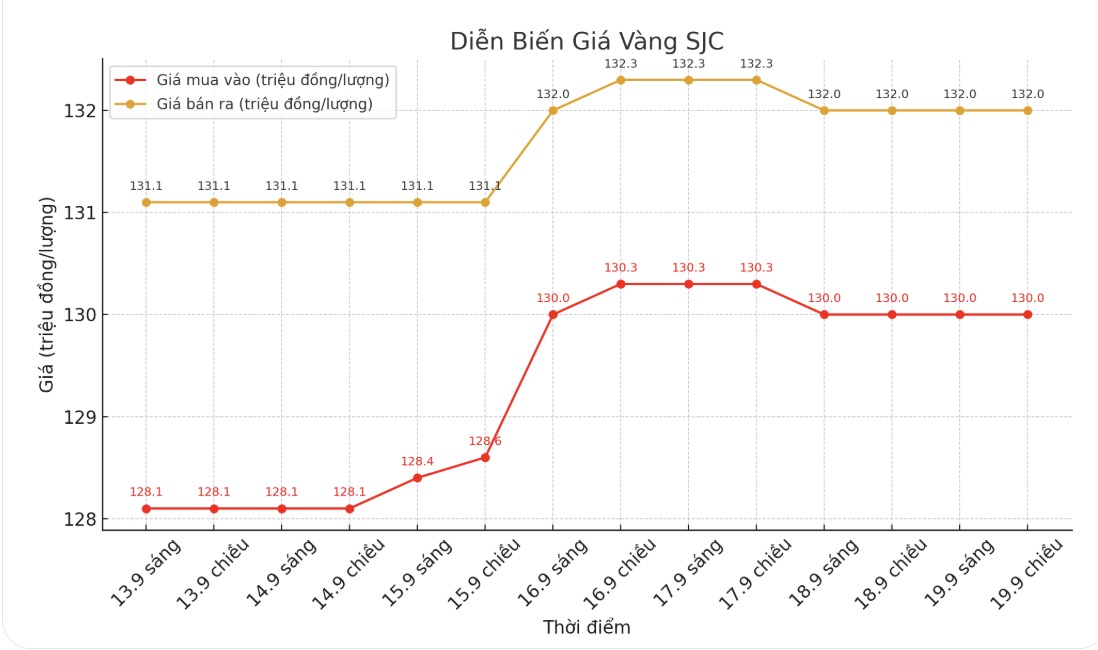

SJC gold bar price

As of 7:40 p.m., DOJI Group listed the price of SJC gold bars at 130-132 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130-132 million VND/tael (buy - sell), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129.3-132 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

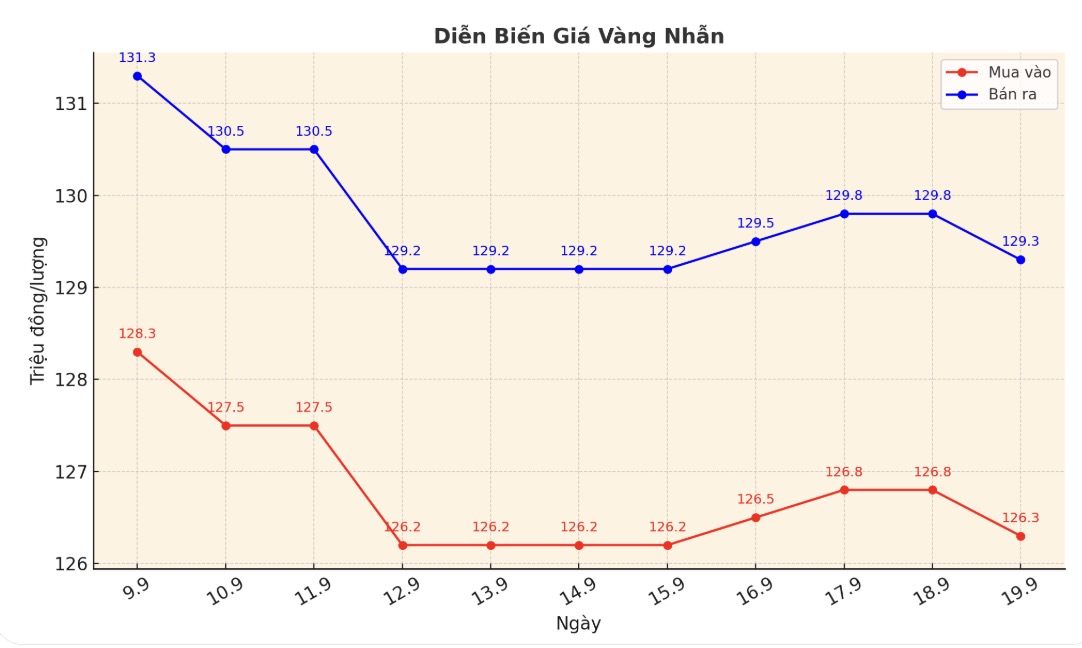

9999 gold ring price

As of 7:40 p.m., DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

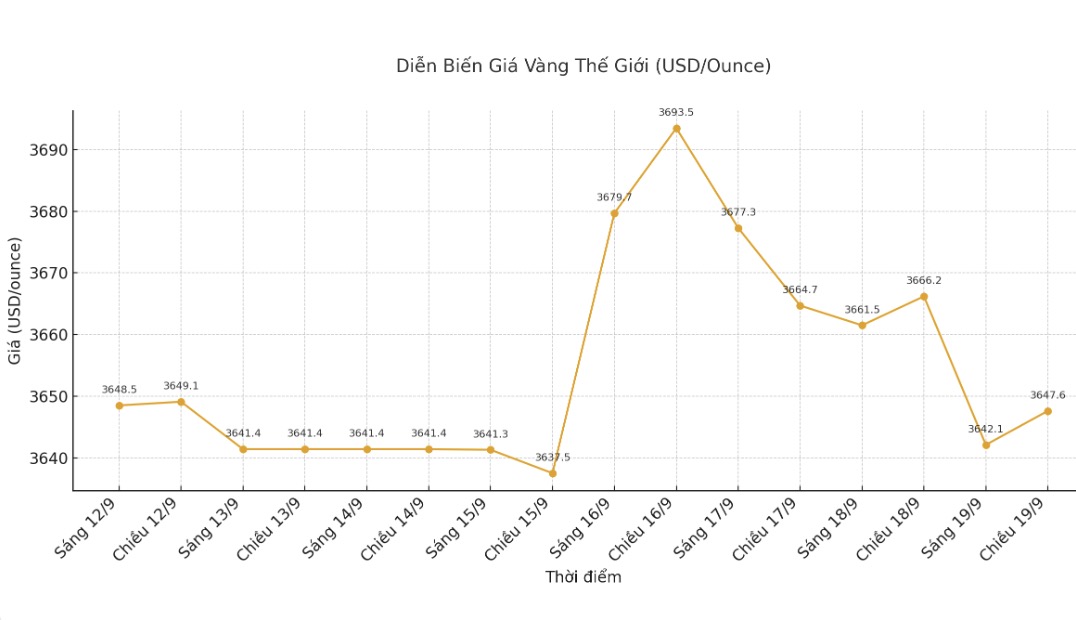

World gold price

The world gold price was listed at 7:40 at 3,647.6 USD/ounce, down 18.6 USD.

Gold price forecast

The world gold market is under strong profit-taking pressure as the US Federal Reserve (FED) launched a cautious easing cycle.

On Wednesday, the FED cut interest rates by 25 basis points and signaled that it would cut them further for the rest of the year. However, economists say the move is still not in line with expectations of a stronger cut.

Metals Focus notes that the Fed's latest "dot plot" chart shows only one cut next year, while the CME FedWatch tool predicts that the interest rate at the end of 2025 could be lower by 100 basis points.

With the FOMCs statement largely in line with market forecasts, short-term technical profit-taking on gold is not too surprising, said Metals Focus.

Experts emphasize that gold's increase is not only based on interest rate policy. The macroeconomic and geopolitical context continues to support gold investment. The buying trend when prices fall is likely to continue, helping gold set new peaks until 2026.

Even if the Fed signals to be stronger for the 2026-2027 period, interest rate cuts are still expected to occur - Metals Focus analyzed.

Metals Focus CEO Philip Newman said that a major risk that has not been reflected in prices is political pressure on the Fed's independence. He cited US President Donald Trump repeatedly urging the FED to deeply cut interest rates.

Analysts note that the USD could be under pressure if the market is concerned about the level of independence in the Fed's monetary policy. The Feds independence is a big unknown. If this is eroded, the role of the US dollar as a global reserve currency could be questioned, Newman said.

Although central bank demand for gold has slowed in the summer, the expert predicts that reserves will continue to increase as banks seek to diversify away from the USD.

He said that if the FED gives in to political pressure, the risk of inflation outbreak will be high - the scenario is even more beneficial for gold.

Metals Focus also shares the same view, saying that falling interest rates and rising inflation will reduce real interest rates, reducing the cost of holding gold - a non-interest-bearing asset.

According to Deutsche Bank's forecast, gold prices could reach $4,000/ounce by 2026. The Fed also signaled that it will continue to cut interest rates this year, thereby reducing the opportunity cost of holding gold - a non-interest-bearing asset.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...