Gold futures today fell sharply, closing the session at $3,694.6 an ounce, down $22.9, down 0.88% from the previous session.

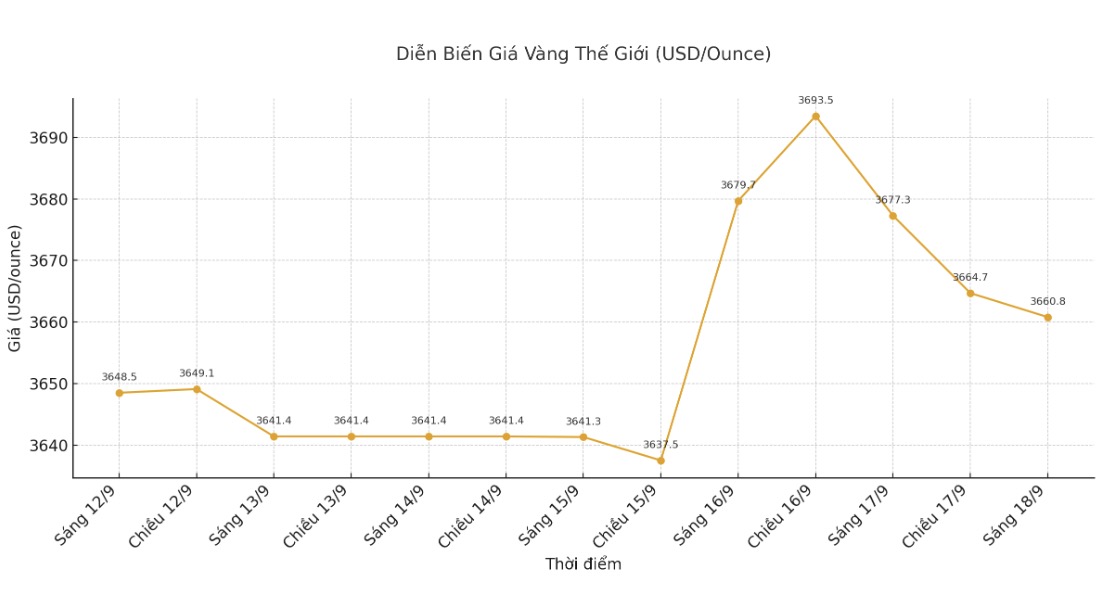

Spot gold prices have also been adjusted down. Recorded at 9:20 a.m. on September 18, the world gold price was listed at 3,660.8 USD/ounce.

This decline came after the US Federal Reserve (FED) announced an additional interest rate cut of 0.25 percentage points - a decision that investors and monetary policy observers had predicted in advance.

The Fed's move was in line with market expectations and was largely reflected in the surge in gold prices before the announcement time.

However, after Fed Chairman Jerome Powell's speech, investors have adjusted their positions, causing gold prices to reverse direction, even though the precious metal had previously hit a record high ($3,705/ounce) right after the decision to cut interest rates was announced.

The Fed president admitted: We must both keep an eye on inflation and not ignore the labor-use target. The signal shows that the job market is weakening and we do not want it to get worse any more.

Policy signals continue to loosend

The Fed's latest "dot plot" chart - a tool that shows the interest rate forecast of policymakers - provides an important look at the upcoming orientation.

According to the updated forecast, the FED is likely to continue cutting interest rates at both remaining meetings of this year, implying a loose monetary stance.

This is an important message for gold prospects. In reality, extended policy easing periods often bring advantages to precious metals, as low interest rates reduce the opportunity cost of holding non-yielding assets, while increasing the risk of inflation - a factor that strengthens the role of gold in preserving value.

Technical prospects remain positive

Despite the decline in this session, the fundamental drivers supporting the upward trend of gold have not changed. Current analysis models predict gold could reach $3,880 an ounce by the end of the year if the Fed follows its signalled easing path.

Analysts say that the combination of monetary policy continues to be loose, prolonged inflationary pressures and global geopolitical instability are creating a favorable environment for gold to maintain its upward momentum. Therefore, today's price decrease is seen mainly as a technical adjustment after a series of consecutive strong increases, not a signal to reverse the trend.

In the coming time, investors will monitor new economic indicators and information from the FED to assess whether the US central bank will continue to maintain a soft policy orientation in the last months of the year.

See more news related to gold prices HERE...