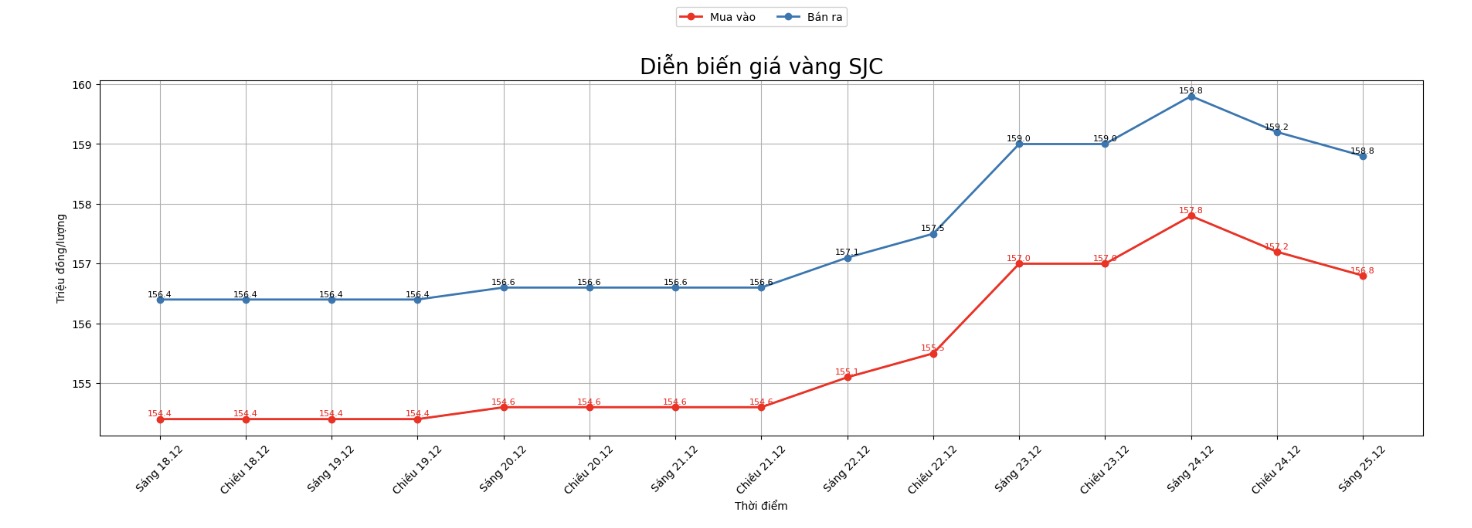

Updated SJC gold price

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at 157.6-159.6 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156.6-159.6 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 157.2-159.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

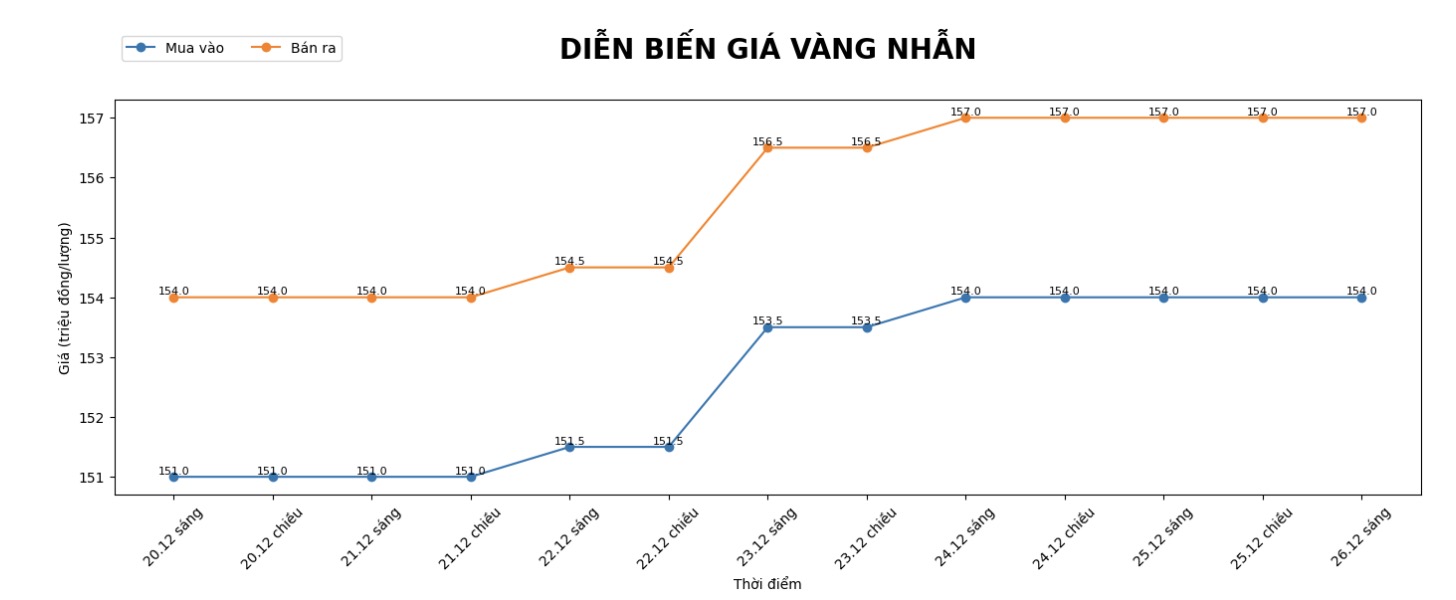

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.8-158.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 155.2-158.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 9:18 a.m., the world gold price was listed around 4,506.9 USD/ounce, up 28.3 USD compared to a day ago.

Gold price forecast

The outlook for gold prices in 2026 is receiving a lot of attention. In the context of many uncertainties in the world economy, gold continues to be highly appreciated for its safe-haven role.

In the most active forecast group, J.P. Morgan Global Research ( global research and analysis department of JPMorgan Chase & Co., one of the world's largest investment banks) believes that gold prices could average around $5,055/ounce in the fourth quarter of 2026.

According to this research team, in the scenario of continued increase in investment demand and central banks maintaining strong net buying, gold prices could even approach the 5,400 USD/ounce range.

J.P. Morgan Global Research emphasized that prolonged geopolitical risks, along with high public debt levels in many major economies, will continue to drive capital flows to safe-haven assets such as gold.

Sharing the same view on the uptrend, Goldman Sachs (a multinational investment bank and financial services corporation headquartered in the US) predicts that gold prices could reach around $4,900/ounce in December 2026.

According to Goldman Sachs, the global monetary policy cycle is gradually shifting from a tightening to an easing phase, causing the opportunity cost of holding gold to drop significantly.

The organization also noted that inflation, despite signs of cooling down in some economies, still risks staying above medium-term targets, thereby strengthening gold's risk-off role.

From a market structure perspective, the World Gold Council believes that 2026 may witness strong fluctuations in gold prices.

The World Gold Council believes that the interweaving of supporting and hurting factors will prevent the gold market from following a direct uptrend. While demand from central banks and long-term investors continues to play a pivotal role, the possibility of a global economic recovery or the strengthening of the USD could create deep corrections in the short term.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...