Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.8-120.8 million/tael (buy in - sell out), an increase of VND 800,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.8-120.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.8-120.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

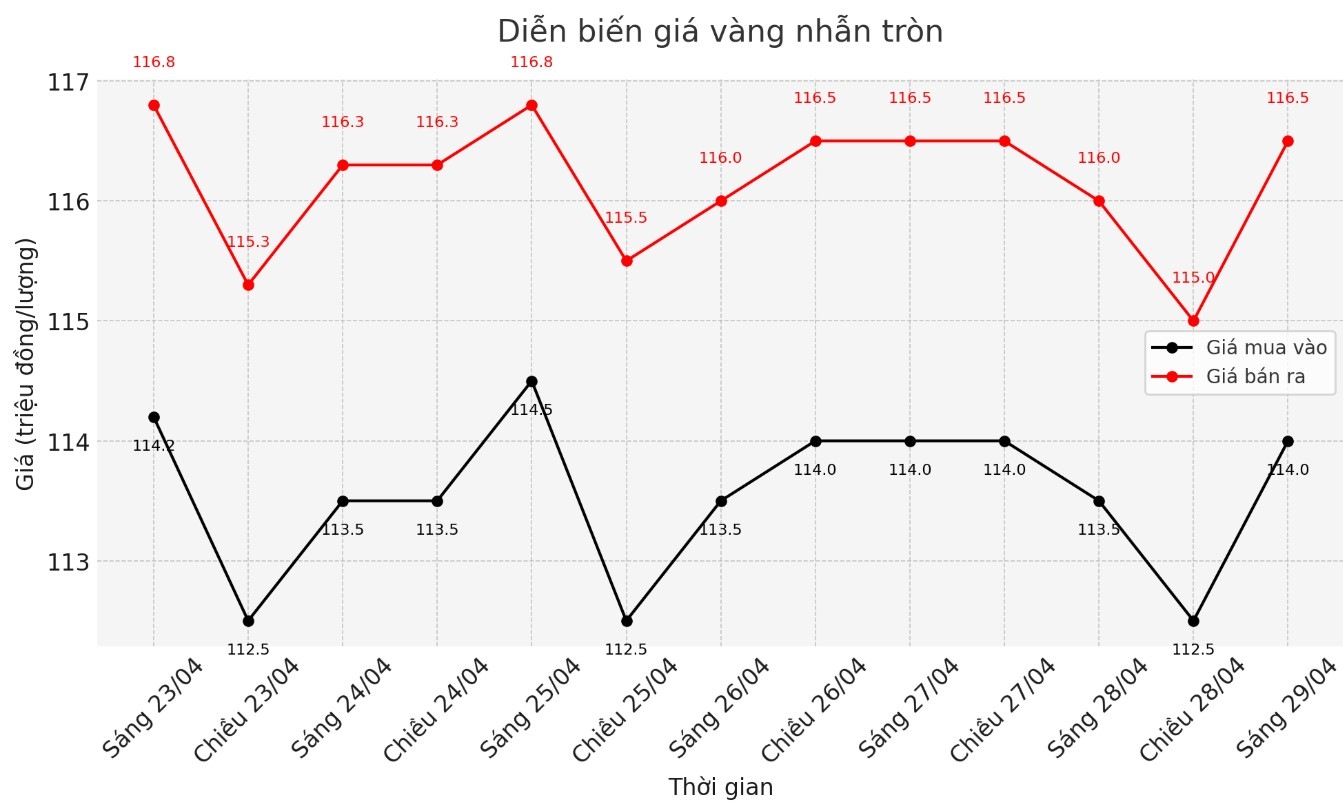

9999 round gold ring price

As of 9:10 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.8-117.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 9:13, the world gold price listed on Kitco was around 3,330.2 USD/ounce, up 57.5 USD.

Gold price forecast

Gold prices increased sharply when US stocks and the USD index both decreased. This comes after a report on unfavorable production prospects in Texas, showing that global tariffs and trade tensions are starting to weigh on businesses.

A Chinese official said over the weekend that the US should lift unilateral tariffs if it is to resolve a trade dispute with China.

The Chinese Ministry of Commerce spokesperson also said that China and the US are not currently holding any negotiations, and the US needs to show goodwill if it wants to negotiate.

The amount of Chinese goods exported to the US has decreased by up to 60% since the US raised the tariffs to 145% in April - according to brokerage SP Angel.

TD Securities commodity strategist Daniel Ghali said that selling pressure in the gold market is depleted and the risk of depreciation is currently at an extremely low level. He said that large investment funds and Western investors have not participated strongly in this price increase, so the market has little pressure to take profits, and recent price increases have clearly reflected that.

Gold - often seen as a safe store of value during times of uncertainty - set a new record of $3,500.05/ounce last week, thanks to escalating trade tensions, central bank buying demand and solid investment demand.

Meanwhile, market analyst Fawad Razaqzada of City Index and FOREX.com predicted that gold prices could continue to peak if there were no substantial trade deals.

Important economic data for the week

Tuesday: New Employment ratio (JOLTS) and US Consumer Confidence Index.

Wednesday: ADP Employment Report, Preliminary Q1 GDP, US pending housing contracts; Japanese Central Bank monetary policy meeting.

Thursday:Weekly jobless claims and the US Manufacturing across Market Management Index (ISM Manufacturing PMI).

Friday: Non-farm Payrolls report in the US.

See more news related to gold prices HERE...