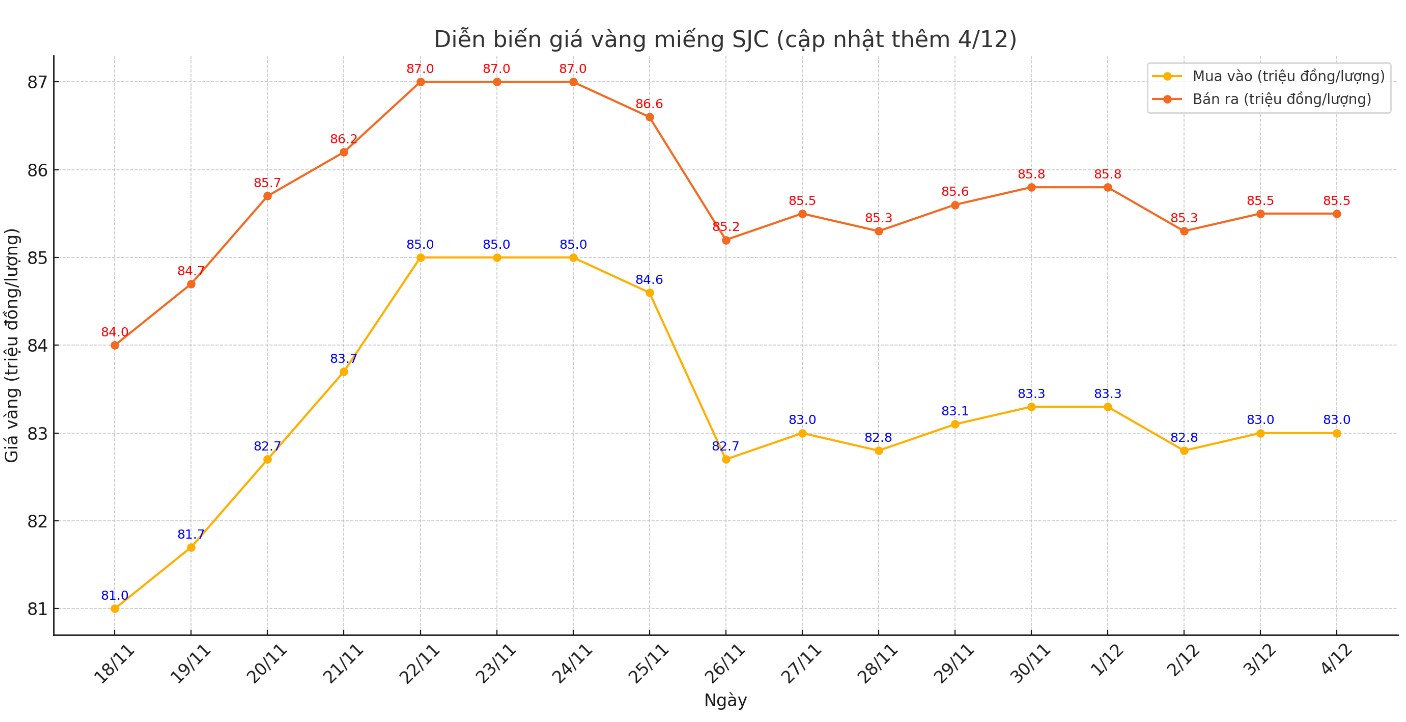

Update SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at VND83-85.5 million/tael (buy - sell); an increase of VND200,000/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

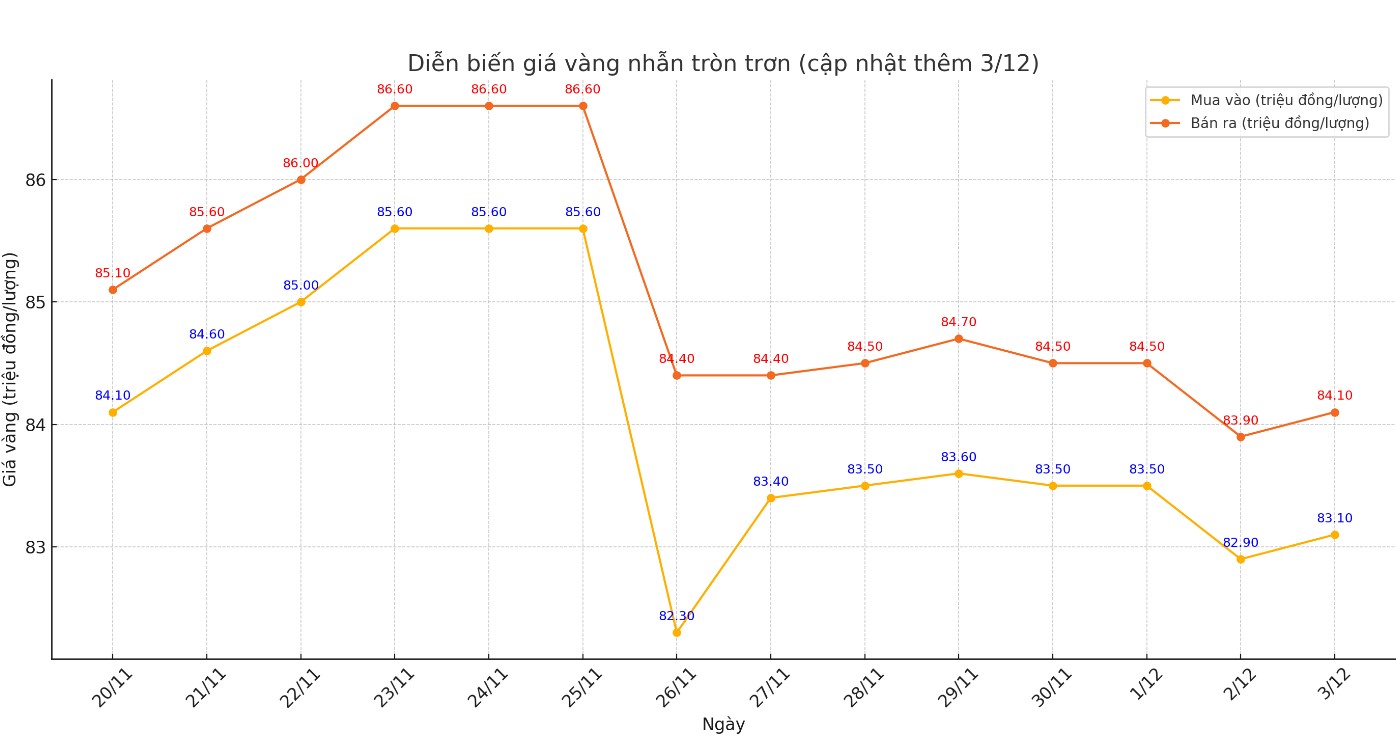

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.18-84.28 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

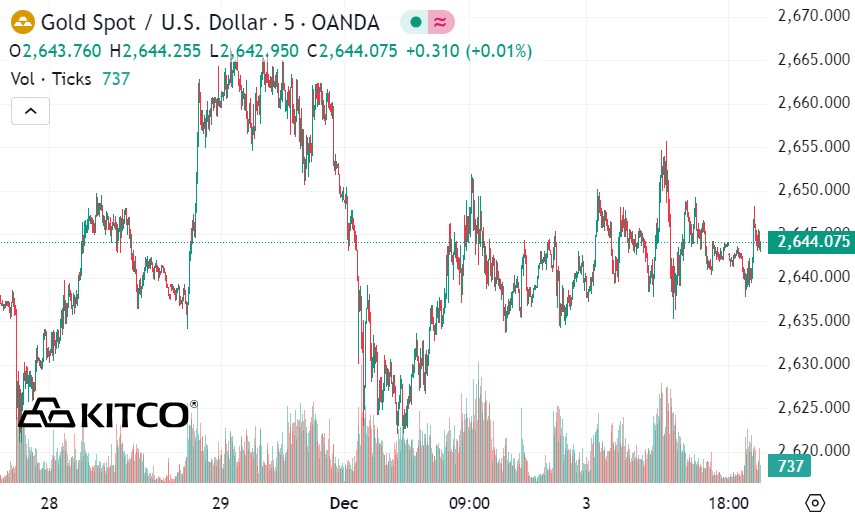

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,644 USD/ounce, up 5.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD. Recorded at 9:50 a.m. on December 4, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.415 points (up 0.09%).

Gold prices are receiving support from global geopolitical turmoil. Early on December 4, South Korean President Yoon Suk Yeol announced the lifting of martial law after the National Assembly voted against it.

President Yoon Suk Yeol's Cabinet approved the end of martial law at 4:30 a.m. local time, about six hours after he issued a surprise emergency declaration, accusing the country's opposition of "paralyzing" the government with "anti-state" activities - a decision that has caused concern across the country and the world, Yonhap reported.

Elsewhere, the French government faced a no-confidence vote on Wednesday against Prime Minister Michel Barnier, after he tried to pass part of the 2025 government budget by invoking a constitutional provision that allows him to bypass the legislative process.

According to Bloomberg, the French parliament failed to address the country's growing budget deficit, raising concerns that investors could continue to turn away from the country. Prime Minister Michel Barnier warned of a "storm" in financial markets if he was dismissed: "The collapse of the government is a scenario that investors have not fully considered," a Bloomberg report said. This situation is also being closely watched by financial markets and precious metals traders.

If Mr Barnier’s government is forced to resign, it would be the first time a French government has been brought down by a no-confidence motion since 1962. This would create a power vacuum in Europe, especially as Germany heads into an election and the US prepares for the return of President-elect Donald Trump.

According to Kitco, falling interest rates and steady demand from central banks could sustain gold's bullish momentum through 2025.

“Gold has rallied 40% since 2022, even as US interest rates have continued to rise. This is very strange. Normally, higher interest rates make gold less attractive – because gold does not pay interest like bonds,” said Lina Thomas, commodity strategist at Goldman Sachs Research.

Central bank buying has supported gold prices even as investors seek higher yields from other assets. “We have not seen a decline in central bank demand,” she added. “With the US Federal Reserve cutting interest rates, investors are also returning to the gold market.”

See more news related to gold prices HERE...