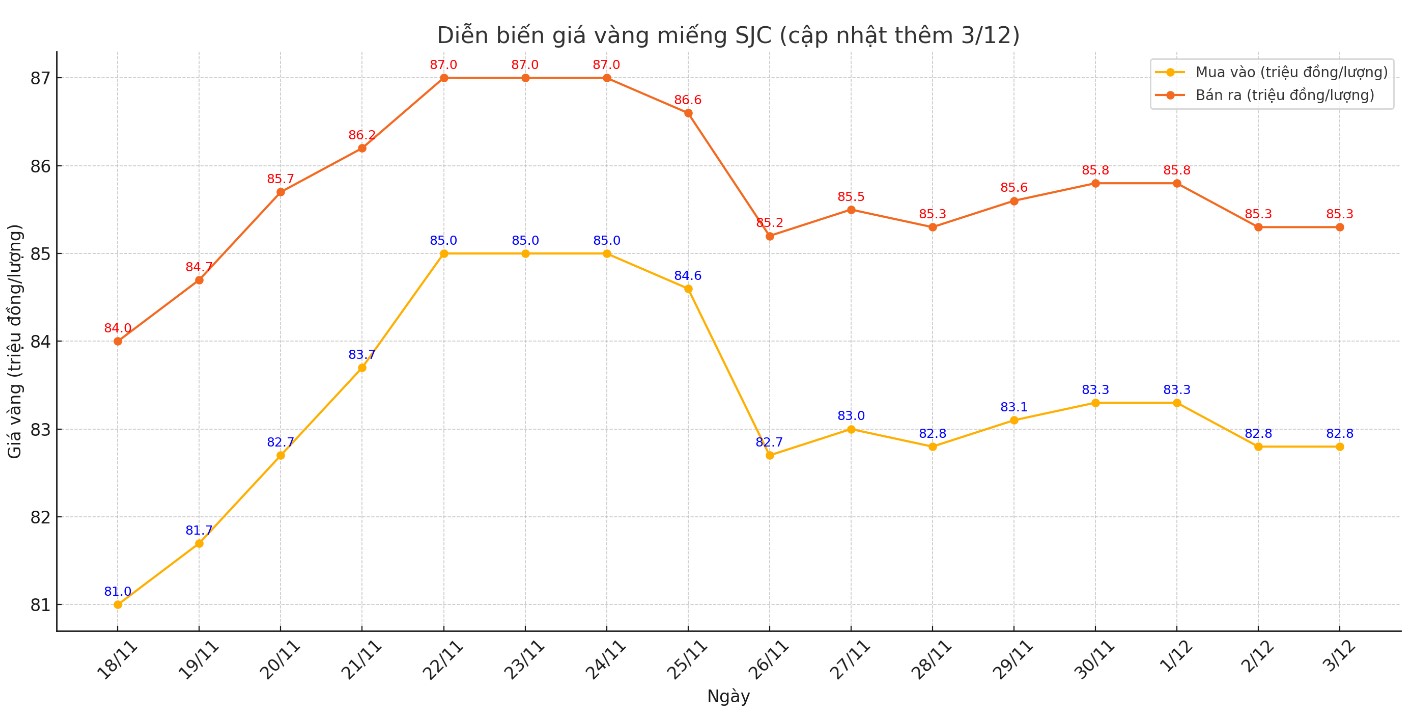

Update SJC gold price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND82.8-85.3 million/tael (buy - sell); down VND500,000/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell); down 500,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.8-85.3 million VND/tael (buy - sell); down 500,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

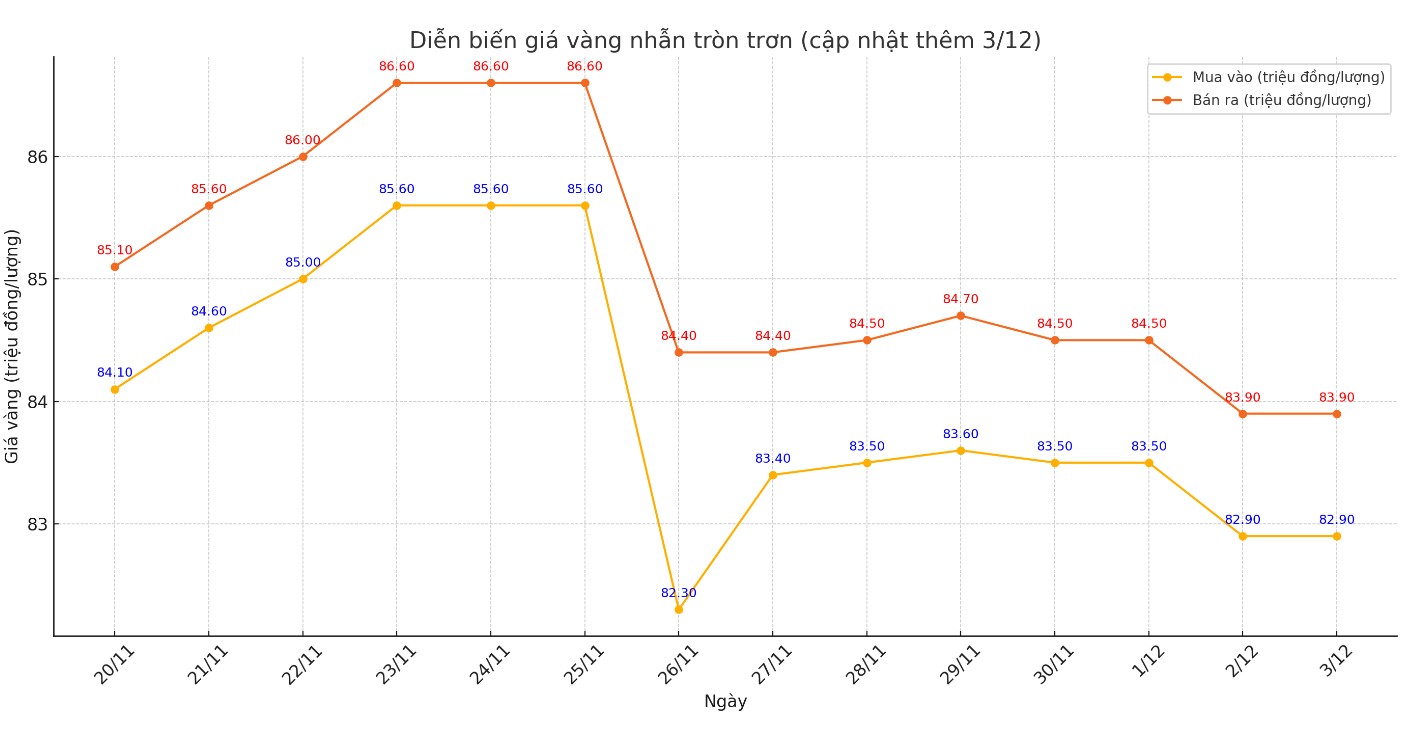

Price of round gold ring 9999

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 gold rings at DOJI is listed at 82.9-83.9 million VND/tael (buy - sell); down 600,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.08-84.28 million VND/tael (buy - sell); down 600,000 VND/tael for buying and down 500,000 VND/tael for selling.

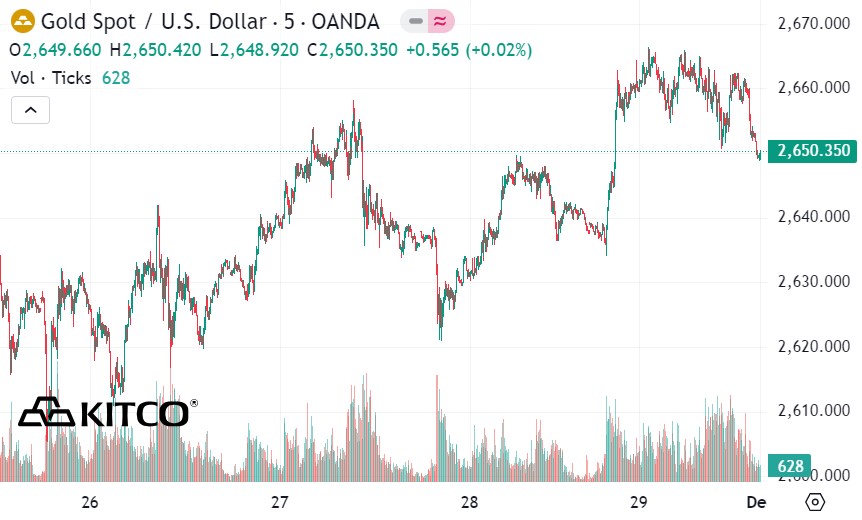

World gold price

As of 10:30 p.m. on December 2 (Vietnam time), the world gold price listed on Kitco was at 2,646.9 USD/ounce, down 3.4 compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid an increase in the USD index. Recorded at 22:30 on December 2, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.620 points (up 0.73%).

"President-elect Donald Trump's comments calling on BRICS countries not to shift away from the US dollar are supporting the greenback and putting some pressure on gold prices," said Giovanni Staunovo, an analyst at Union Bank of Switzerland.

Meanwhile, analysts at National Australia Bank (one of the four largest banks in Australia) commented: "Gold's status as a safe-haven asset could continue to support demand - amid prolonged policy uncertainty that could negatively impact the global economy, along with various geopolitical tensions - as well as central bank buying."

There is a lot of important economic data coming out of the US this week, including the monthly jobs report on Friday. Hiring is likely to have increased sharply in November after hurricanes and a major strike dented job growth last month.

US nonfarm payrolls likely rose by around 200,000 in November, according to a Bloomberg survey. Federal Reserve Chairman Jerome Powell will participate in a panel discussion on Wednesday. The Organisation for Economic Cooperation and Development (OECD) will release new economic forecasts on Wednesday, and the Organization of the Petroleum Exporting Countries (OPEC) meets on Thursday.

Investors are watching upcoming economic data and speeches from Fed officials for clues on the future of US interest rates.

Important outside markets today include Nymex crude oil futures rising and trading around $68.75 a barrel. The yield on the 10-year US Treasury note is currently at 4.212%.

See more news related to gold prices HERE...