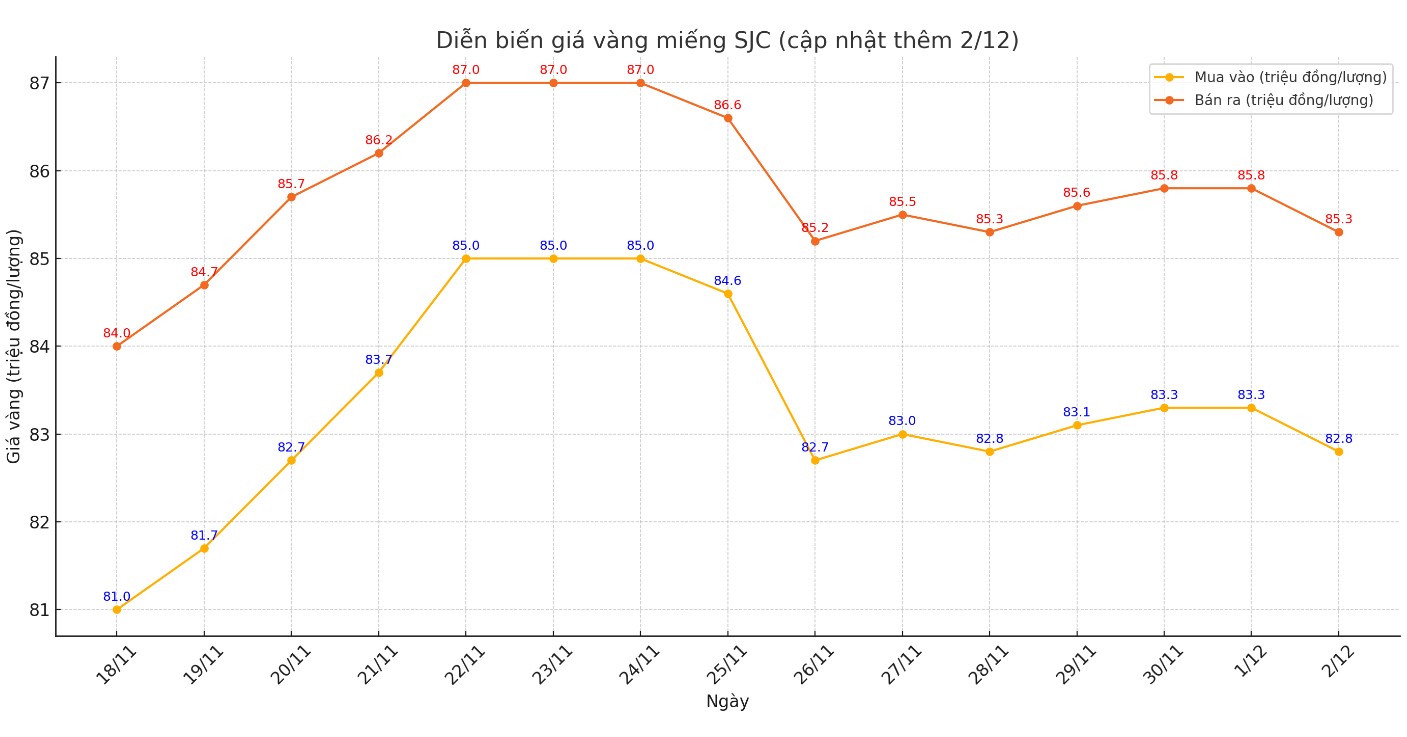

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars listed by DOJI Group was at 82.8-85.3 million VND/tael (buy - sell); down 500,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell); down 500,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.3-85.8 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

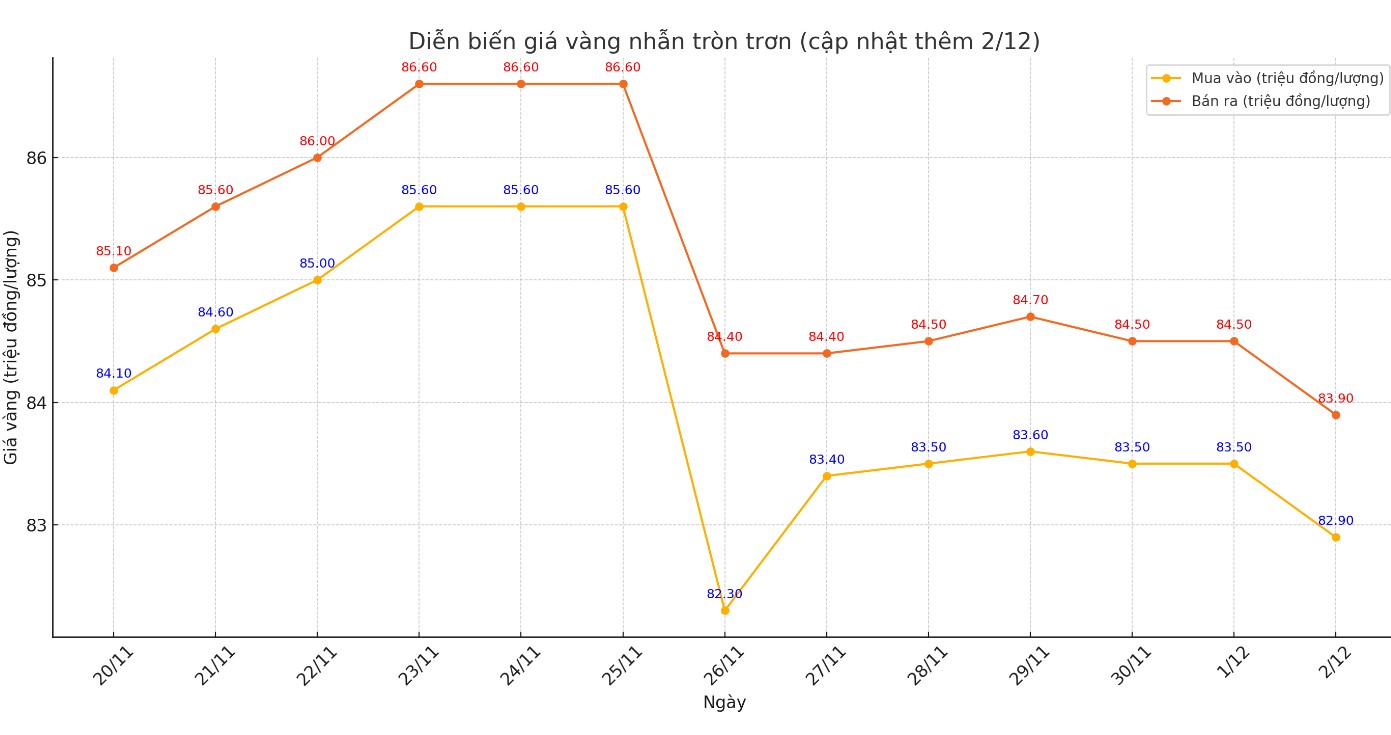

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.9-83.9 million VND/tael (buy - sell); down 600,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.68-84.78 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

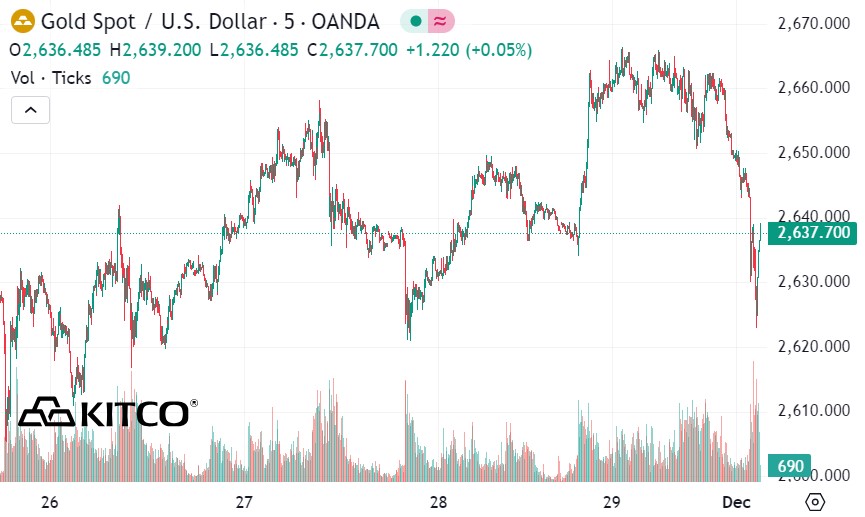

World gold price

As of 8:45 a.m., the world gold price listed on Kitco was at 2,637.7 USD/ounce, down 12.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid an increase in the US dollar. At 8:45 a.m. on December 2, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.189 points (up 0.34%).

Kitco's latest gold survey found expert opinion divided between bullish and accumulation, while investors were less optimistic than last week.

Darin Newsom, senior market analyst at Barchart.com, is bullish on gold this week: “February gold futures remain in a short-term uptrend despite the sharp sell-off early last week.” However, he warned that low trading volumes due to the holiday could lead to volatility.

James Stanley, senior market strategist at Forex.com, also agreed with the bullish view: “The buying reaction at the 2,617-2,621 support zone has been remarkable. This suggests that investors see this as a buying opportunity.”

On the other hand, Naeem Aslam, chief investment officer at Zaye Capital Markets, said that gold's correction is not over yet and the precious metal could fall lower in the short term.

According to market analyst Alex Kuptsikevich of FxPro, it is not impossible that gold prices will fall to $2,400/ounce if the $2,540/ounce mark is broken.

This week, US non-farm payrolls data will attract a lot of attention. The JOLTS jobs report on Tuesday, ADP data on Wednesday, and the non-farm payrolls report on Friday will be important indicators.

In addition, Fed Chairman Jerome Powell's speech at the New York Times DealBook Summit on Wednesday will also be closely watched before entering a "silent" period for the US Federal Reserve (FED).

See more news related to gold prices HERE...