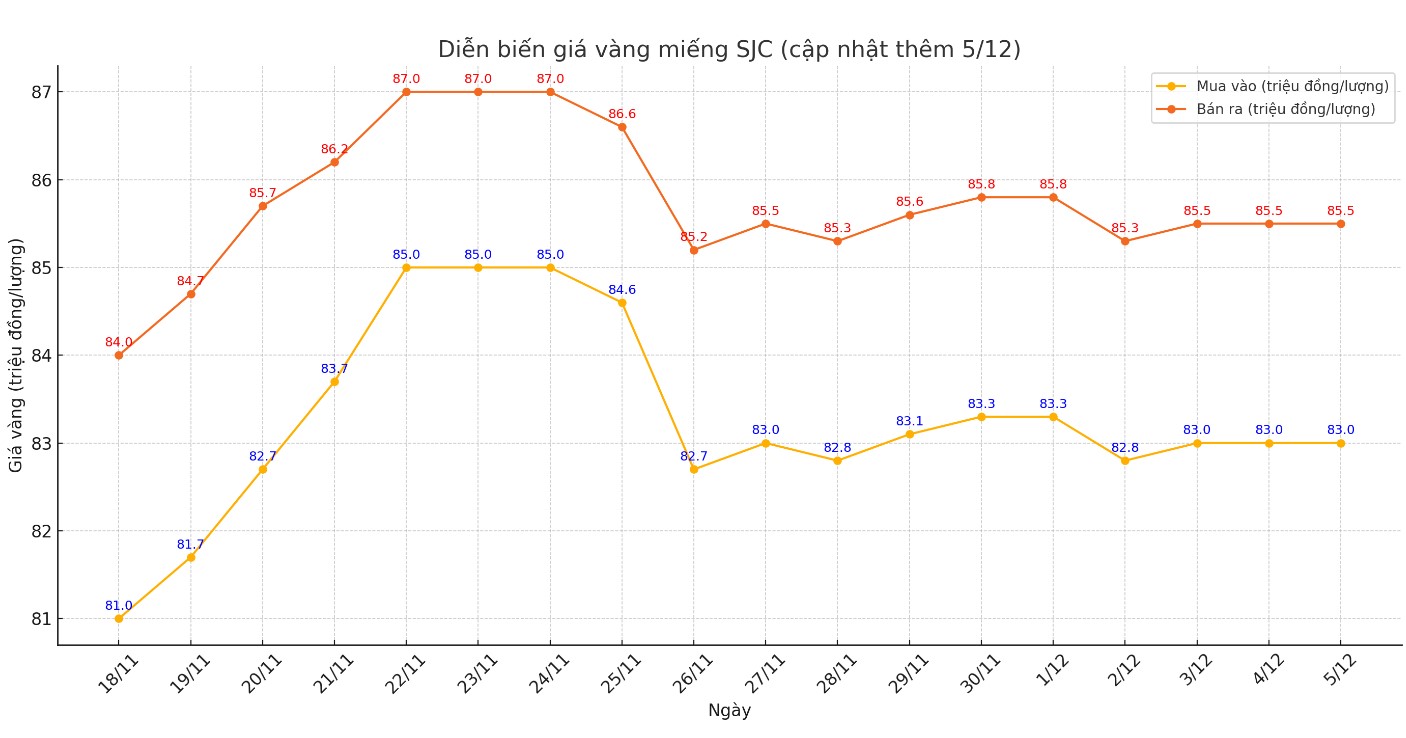

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars listed by DOJI Group was at 83-85.5 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell); unchanged in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

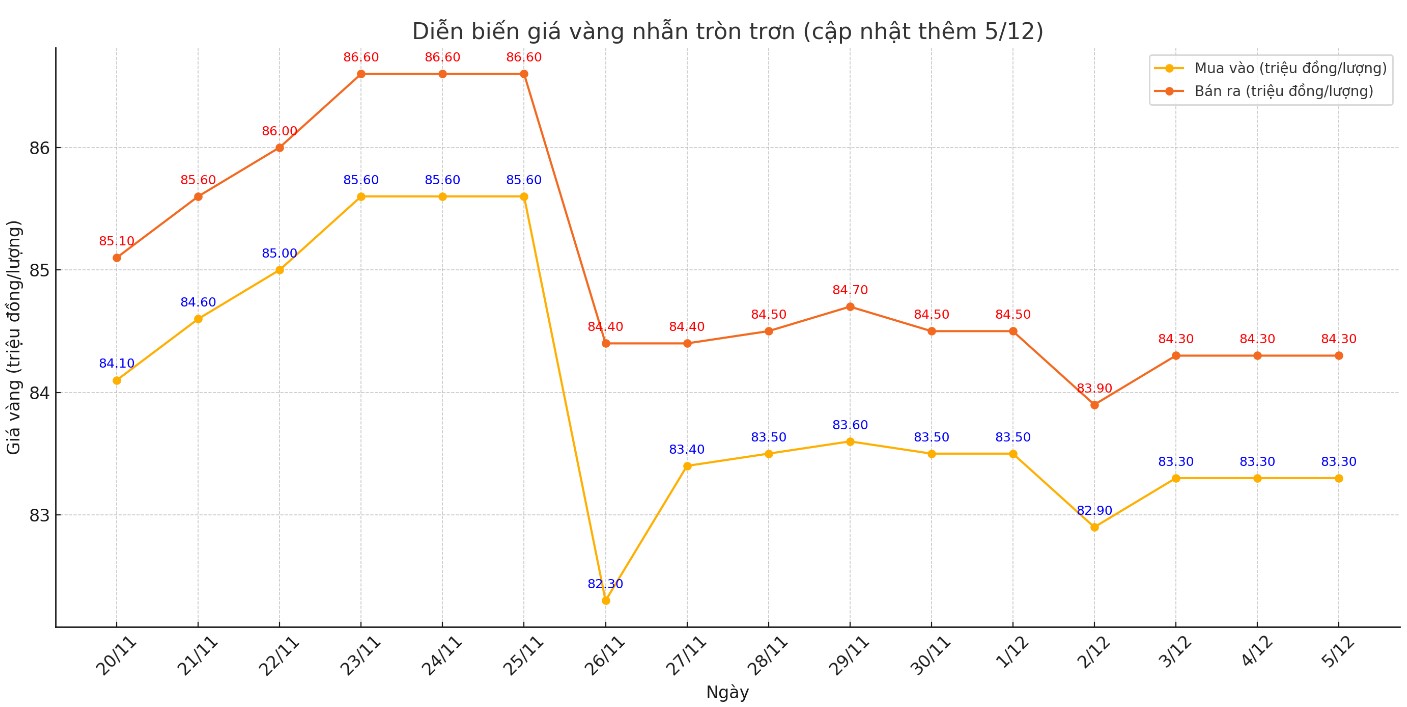

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); both buying and selling prices remain the same compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.28-84.38 million VND/tael (buy - sell), an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

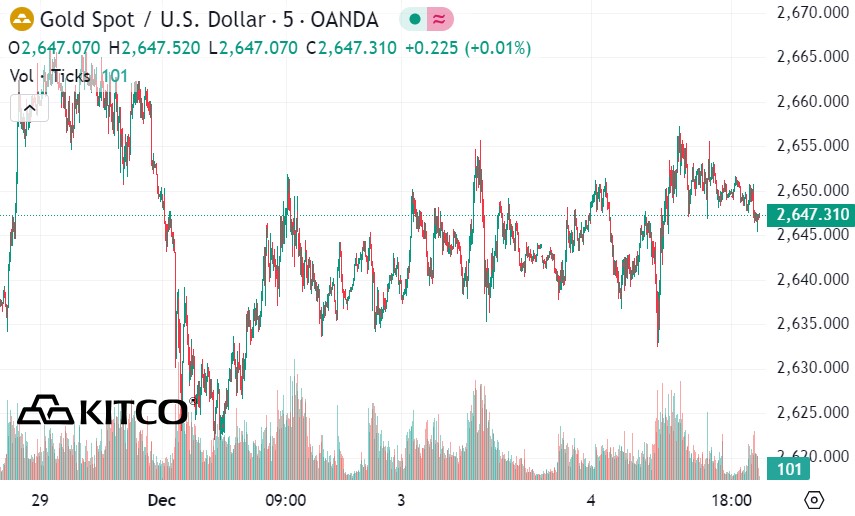

World gold price

As of 9:20 a.m., the world gold price listed on Kitco was at 2,647.3 USD/ounce, up 3.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased while the US dollar decreased. Recorded at 9:25 a.m. on December 5, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.272 points (down 0.07%).

Speaking in a press conference hosted by the New York Times yesterday, Federal Reserve Chairman Jerome Powell said the US economy is stronger now than when the Fed began cutting interest rates in September.

According to Mr. Powell, the positive news is that the Fed may be more cautious in setting a neutral interest rate - an interest rate that neither promotes nor inhibits growth. However, the Fed Chairman did not directly mention the Fed's policy direction at the meeting from December 17-18. However, some analysts believe that the Fed's rate-cutting process may slow down.

Gold prices are often sensitive to changes in the Fed's interest rate policy. When interest rates fall, the opportunity cost of holding non-yielding gold also decreases, increasing its appeal as an investment. Conversely, if the Fed slows down in cutting interest rates or keeps them higher than expected, this could reduce demand for gold, putting downward pressure on prices.

Gold is becoming less attractive as tensions in Ukraine appear to be easing, although Russia says there is no basis for negotiations. Observers are betting on the possibility that US President-elect Donald Trump could soon intervene to end tensions in Ukraine that have lasted for more than 1,000 days.

However, gold prices still received solid support from strong buying. Central banks bought a net 60 tonnes of gold in October, led by the Reserve Bank of India (RBI). India added 27 tonnes of gold in October, taking its year-to-date total to 77 tonnes. India's net purchases were five times higher than its 2023 activity," wrote Marissa Salim, Head of APAC Research at the World Gold Council.

Several other central banks also reported net increases of 1 tonne or more in their gold reserves in October.

See more news related to gold prices HERE...