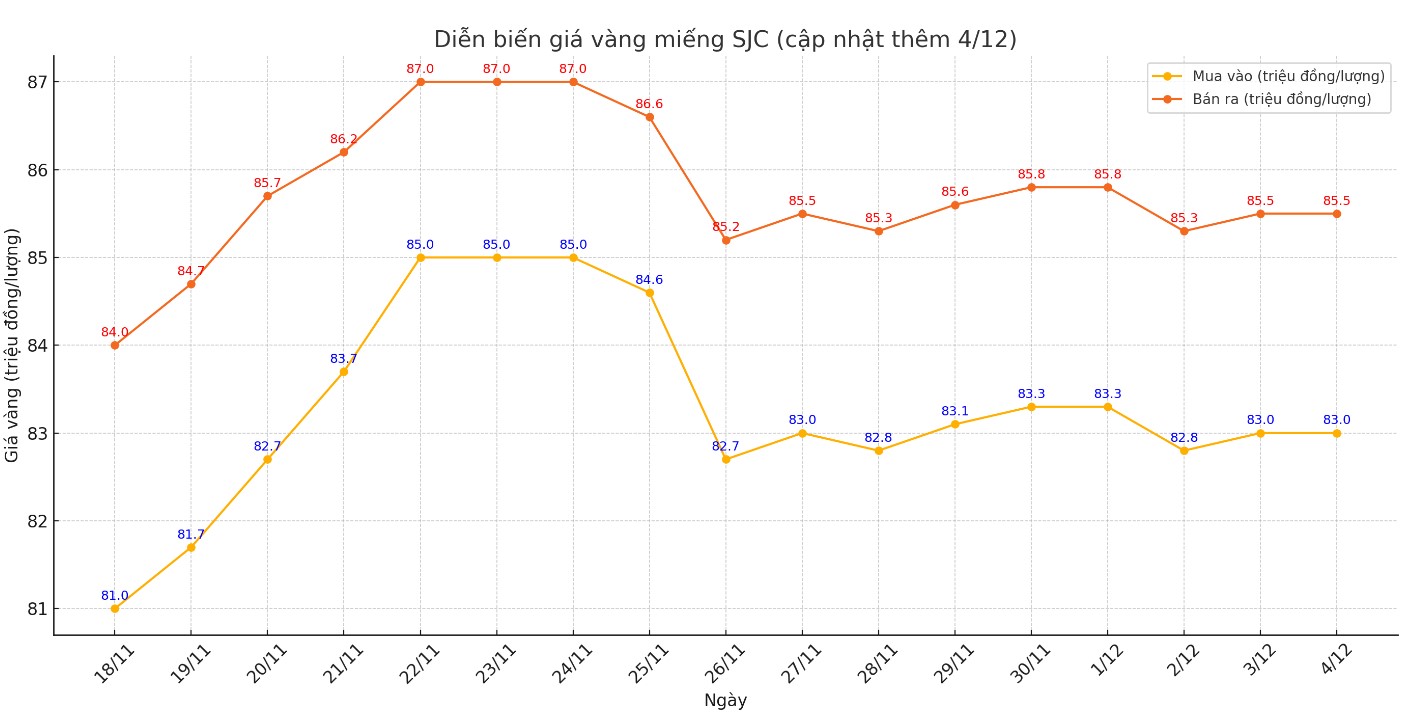

Update SJC gold price

As of 7:30 p.m., the price of SJC gold bars listed by DOJI Group was at 83-85.5 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

The difference between the buying and selling price of gold is listed at around 2.5 million VND/tael. This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

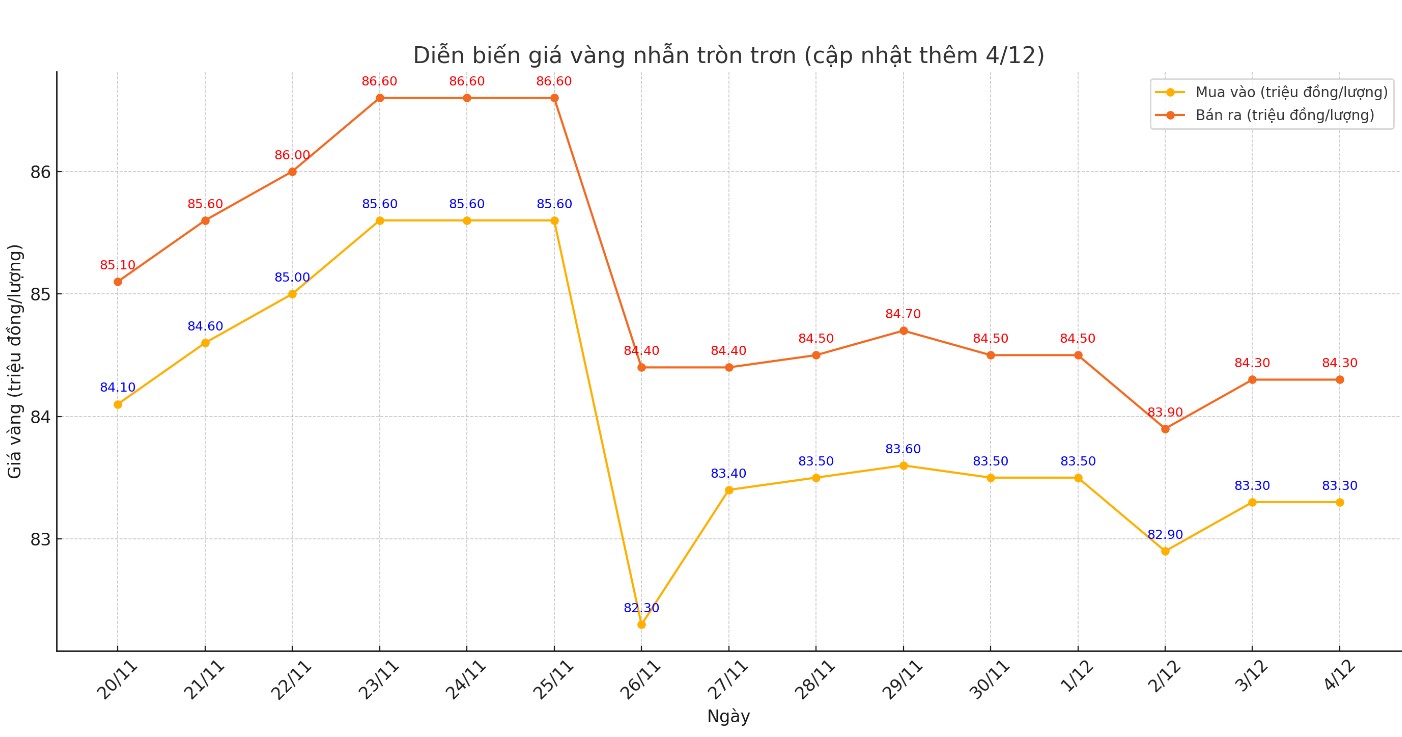

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); both buying and selling prices have not changed compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.28-84.38 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

World gold price

As of 7:30 p.m., the world gold price listed on Kitco was at 2,643.2 USD/ounce, up 0.4 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices remained almost unchanged as the USD index increased. Recorded at 7:30 p.m. on December 4, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.514 points (up 0.16%).

Jigar Trivedi, senior analyst at Reliance Securities, said gold prices were supported by safe-haven buying amid escalating geopolitical tensions in South Asia and the Eurozone.

Gold is often seen as a safe haven during times of economic or political uncertainty.

The market is now waiting for the US jobs report and the speech of the Chairman of the US Federal Reserve (FED) Jerome Powell on December 4, US time. This is expected to be his last public speech before the FED meeting in December. A strong jobs report could make the FED cautious about cutting interest rates.

Traders estimate there is a 73% chance the Fed will cut interest rates by 25 basis points this month, according to CME Group's FedWatch tool. Gold typically benefits in a low-interest-rate environment.

Mr. Kelvin Wong - senior market analyst for the Asia-Pacific region of financial company OANDA, said that gold will still maintain an upward trend in the long term due to increasing trade tensions and issues related to the US budget deficit.

According to Kitco, falling interest rates and stable demand from central banks could sustain gold's bullish momentum until 2025. Lina Thomas - commodity strategist at Goldman Sachs Research commented:

“We don’t see a drop in central bank demand. With the Fed cutting rates, investors are also returning to the gold market.”

Commodity analysts at Goldman Sachs - one of the world's largest investment banks and financial institutions - have reaffirmed their view that gold prices will reach $3,000 an ounce by the end of 2025.

See more news related to gold prices HERE...