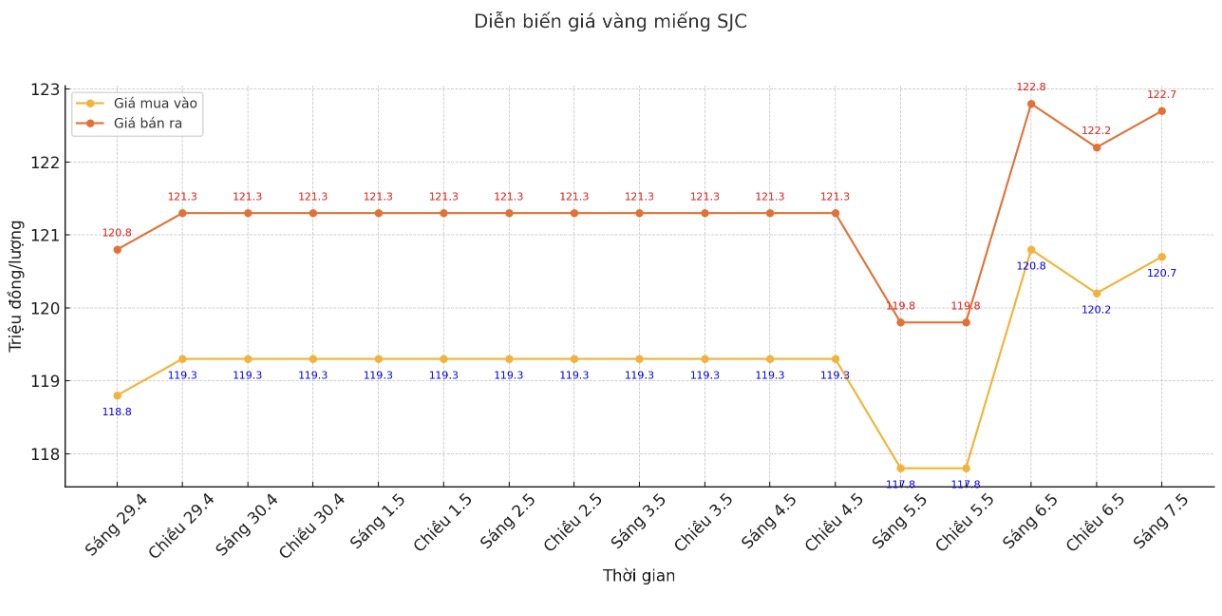

Updated SJC gold price

As of 9:05, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120.7-122.7 million/tael (buy in - sell out), down VND 100,000/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120.7-122.7 million VND/tael (buy - sell), down 100,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.7-122.7 million VND/tael (buy - sell), down 100,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.7-122.7 million/tael (buy in - sell out), down VND 100,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

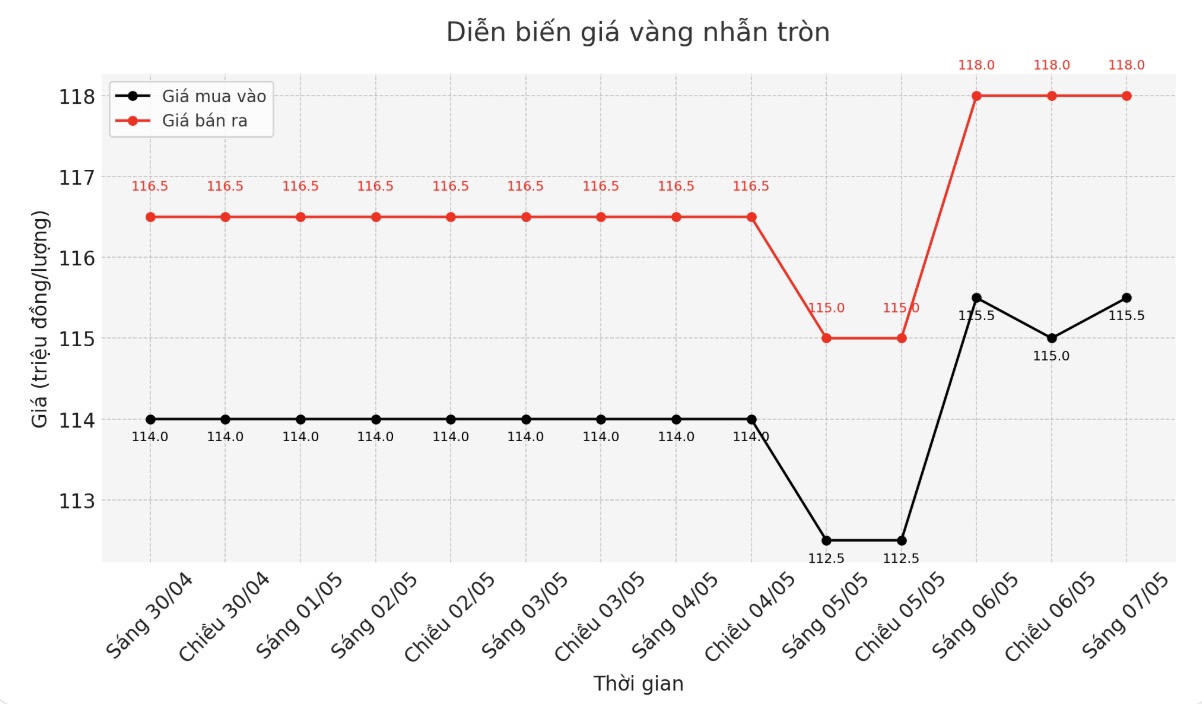

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND115.5-118 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

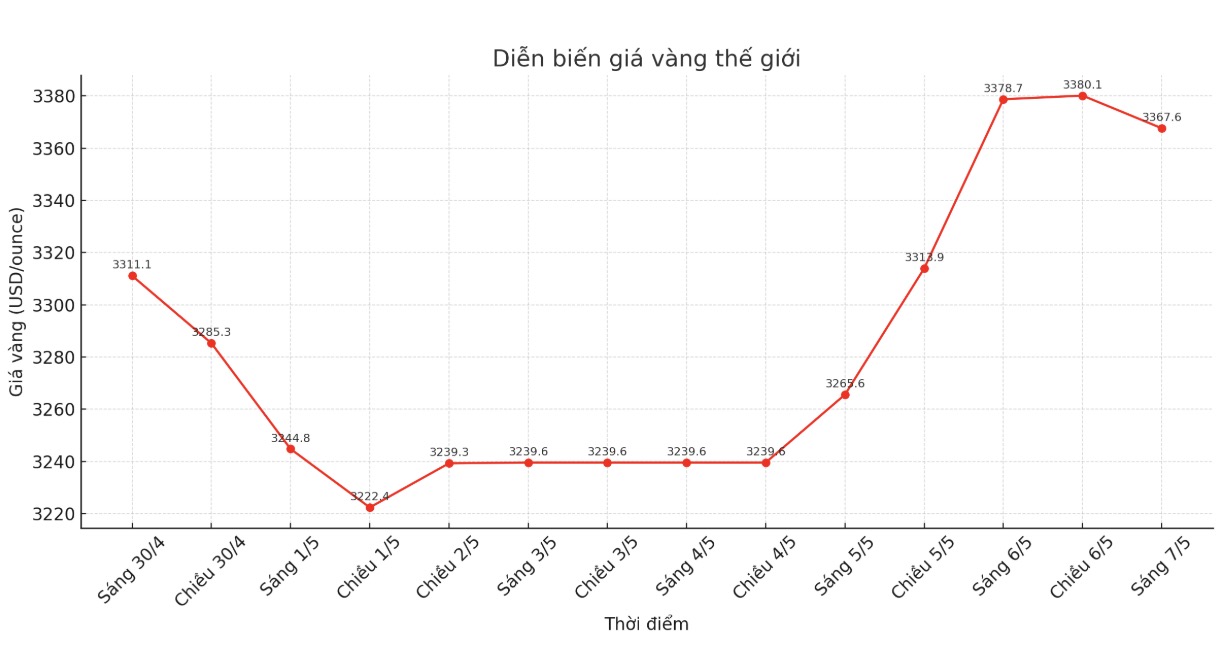

World gold price

At 8:45 a.m., the world gold price listed on Kitco was around 3,367.6 USD/ounce, down slightly by 11.1 USD/ounce.

Gold price forecast

Gold prices fell after two sessions of steady increase, but remained anchored at a high level.

According to Kitco, gold prices recovered strongly, erasing all of last week's declines as investors prepare to welcome the interest rate decision from the US Federal Reserve (FED). Caution is everywhere as the monetary policy meeting begins.

The meeting of the Federal Open Market Committee (FOMC) ended at 1:00 a.m. on May 8 (Vietnam time) was considered very important. Although the market does not expect any changes in interest rates, the tone of the FED's announcement will strongly affect gold prices.

If the Fed shows downhill (cautious, maintaining low interest rates), gold could continue to be supported. Conversely, if the FED is leaning towards a hawl (supporting interest rate increases), gold prices may weaken.

According to CME's FedWatch tool, there is a 95.6% chance that the Fed will keep interest rates unchanged in the range of 4.25%-4.50%, while the possibility of interest rate cuts is only 4.4%.

On Kitco, Mr. Naeem Aslam - Investment Director at Zaye Capital Market commented that this gold price increase is mainly due to three main factors, including trade tensions, doubts about the role of the USD and uncertainty in the policy of the US Federal Reserve (FED).

The tax war between the US and China has not shown any signs of cooling down. In such an uncertain environment, investors often turn to gold as a safe haven. Although there are some signs of cooling down, instability still makes the market cautious.

Next week, the CPI data will be released. If inflation increases, investors tend to buy gold to prevent the risk of depreciation. But if inflation cools down, the US dollar could recover and gold will lose its appeal.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...