Update SJC gold price

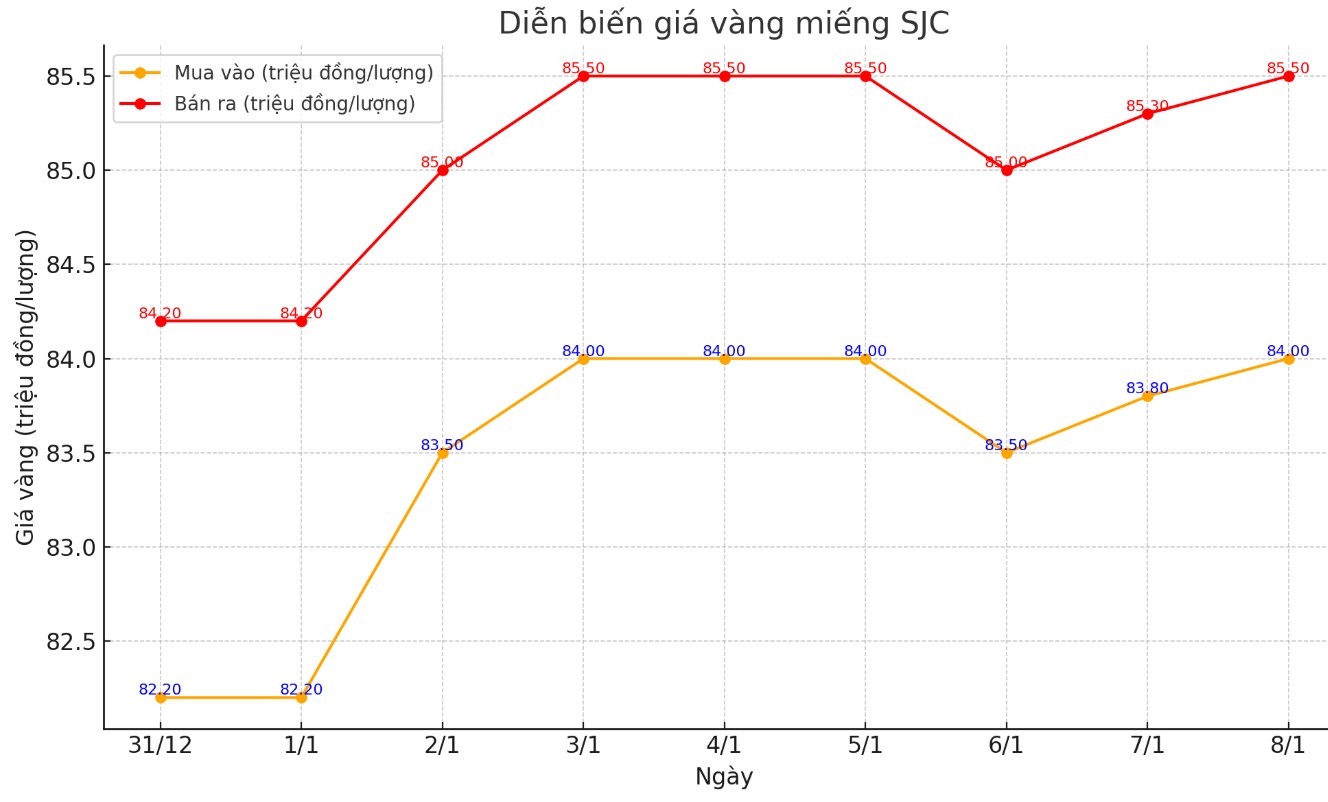

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); an increase of VND200,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84-85.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.1-85.5 million VND/tael (buy - sell); increased 400,000 VND/tael for buying and increased 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.4 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

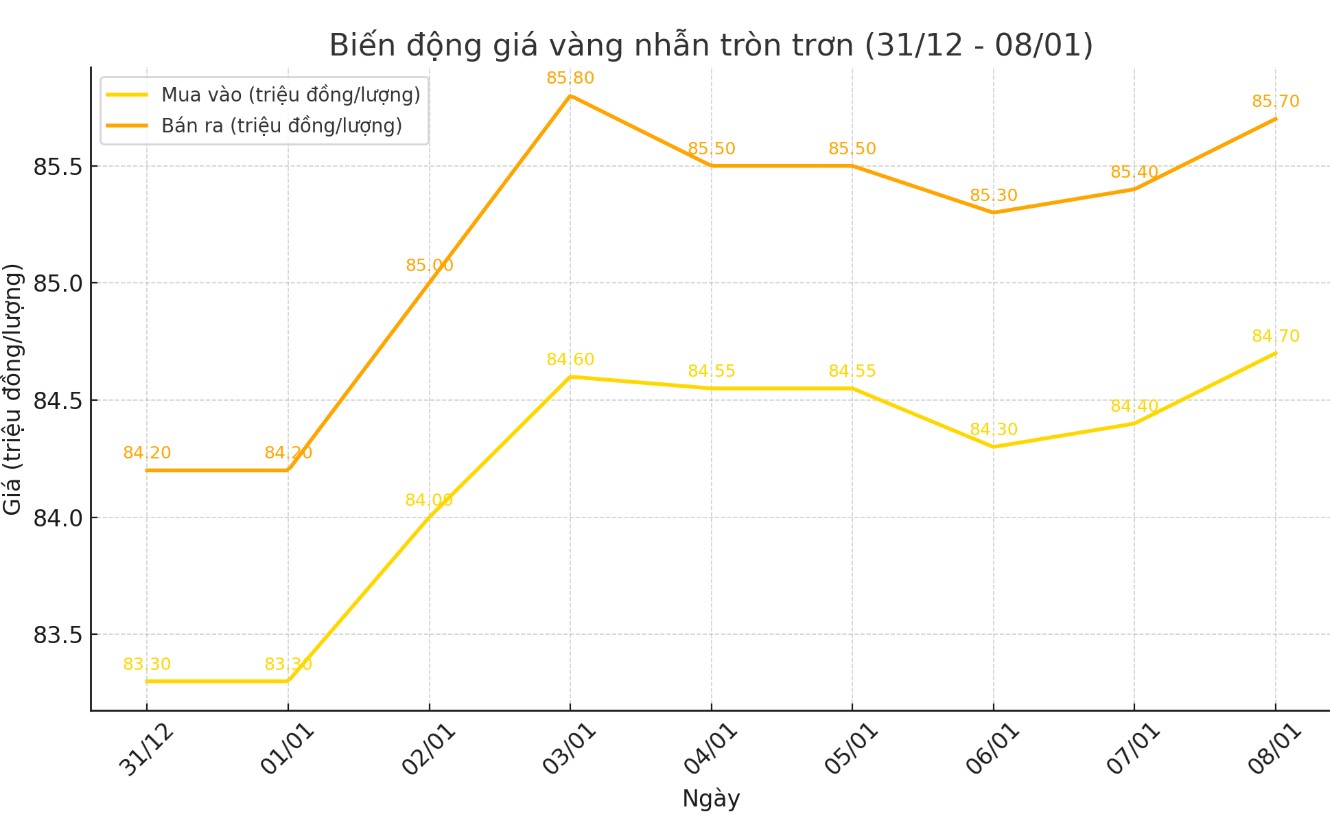

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.7-85.7 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.7-85.9 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:45 a.m., the world gold price listed on Kitco was at 2,648.1 USD/ounce, up 10.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased amid a decline in the US dollar. At 9:45 a.m. on January 8, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108.420 points (down 0.1%).

Gold prices rose on news that the People’s Bank of China was buying more gold. The People’s Bank of China reportedly increased its gold reserves in December, buying 300,000 ounces to bring its total reserves to 73.3 million ounces. This shows that China has resumed buying gold after a 6-month pause last year.

Gold prices rose after a report said aides to President-elect Donald Trump were considering plans to impose tariffs only on sectors deemed important to U.S. national security or the economy. However, Trump "ignored" the report, adding to uncertainty over future U.S. trade policies.

Peter Grant, vice president and senior metals strategist at Zaner Metals, said the higher-than-expected jobs report and strong service sector activity both point to a strong economy. However, he said the Federal Reserve is still facing the threat of persistent inflation, so the central bank may have to keep interest rates at current levels through March.

Traders are awaiting the US jobs report, along with the minutes of the Fed's last policy meeting of 2024, for further clues on the Fed's future interest rate path. Since gold is often sensitive to economic data and monetary policy, prices could be volatile in the short term when these are released.

See more news related to gold prices HERE...