Update SJC gold price

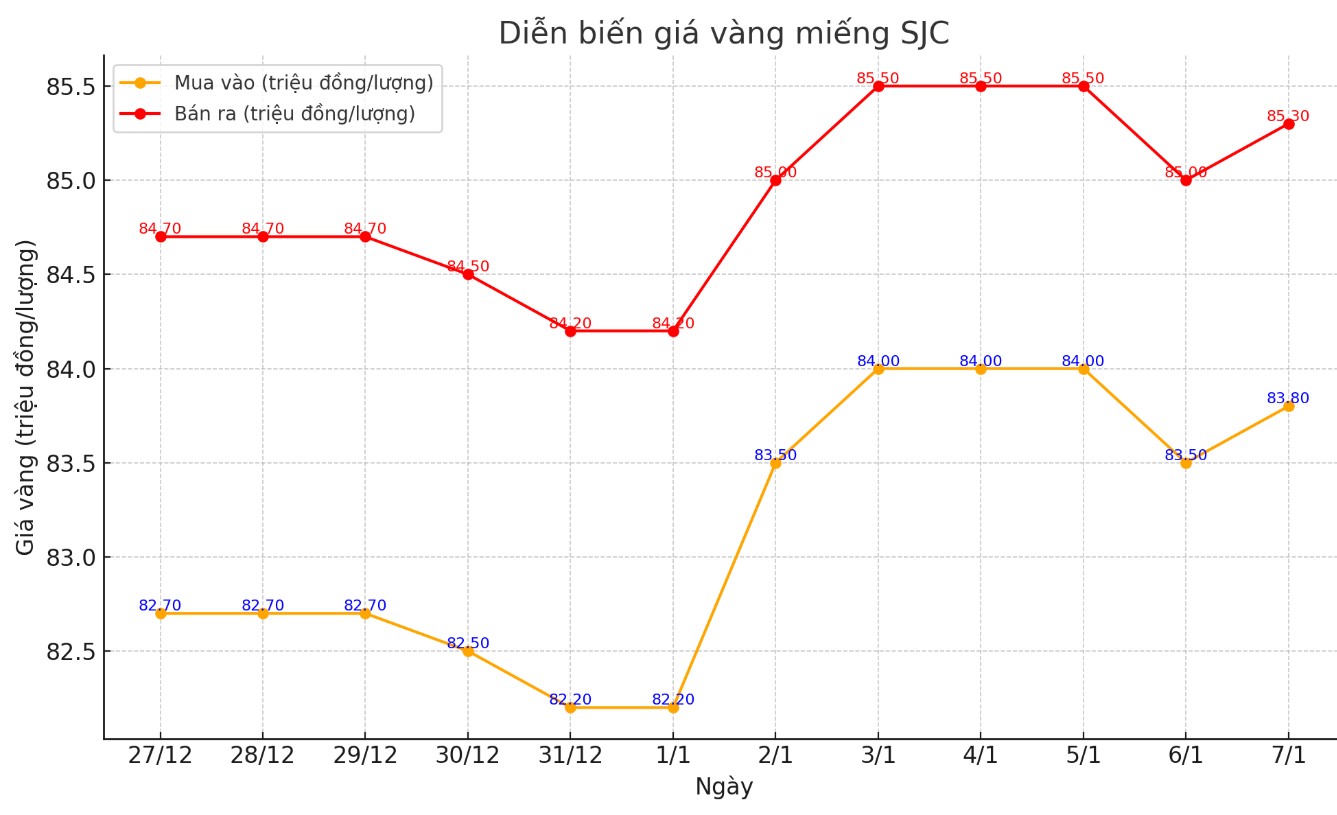

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.8-85.3 million/tael (buy - sell); an increase of VND300,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 83.8-85.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-85.6 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.2 million VND/tael.

Price of round gold ring 9999

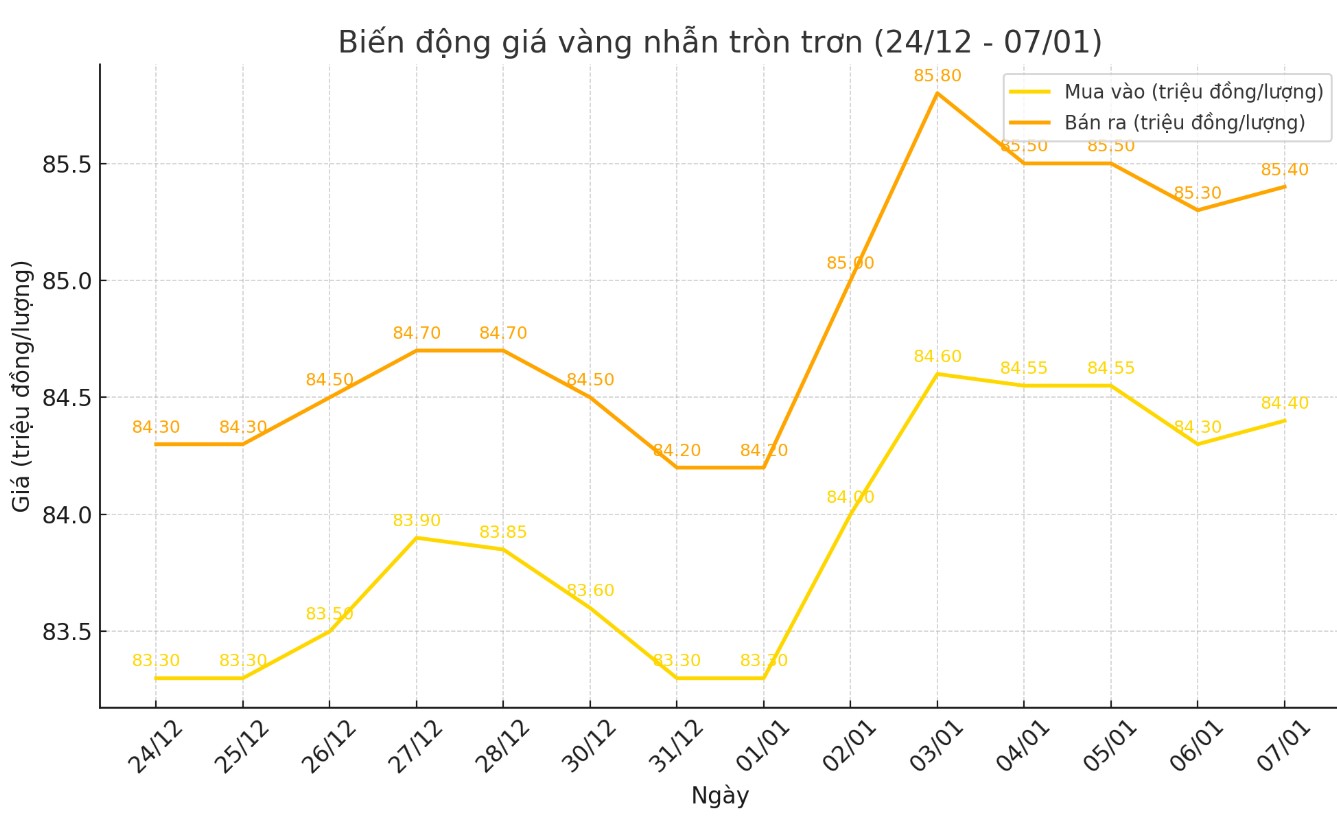

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.4-85.4 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and a decrease of 250,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.6 million VND/tael (buy - sell), keeping the buying price unchanged and increasing the selling price by 100,000 VND/tael compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 6:00 p.m., the world gold price listed on Kitco was at 2,644 USD/ounce, up 5.2 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 6:00 p.m. on January 7, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.780 points (down 0.3%).

Gold prices are steady amid a weaker US dollar, but rising US Treasury yields could remain a key factor limiting further gains, said IG market strategist Yeap Jun Rong.

The dollar fell against other major currencies after a report said aides to President-elect Donald Trump were considering plans to impose tariffs only on sectors deemed important to US national security or the economy. However, Mr Trump “ignored” the report, adding to uncertainty over future US trade policies.

Gold prices are set to see steady and strong growth in 2024, but physical gold demand - reflected in capital flows into ETFs (Exchange Traded Funds) - is uneven, as investors take advantage of major fluctuations to anticipate or lock in profits at record prices.

Data from the World Gold Council (WGC) shows that, among major regions, ETF demand from Asian investors has been the most stable, with the majority of weekly inflow reports recording net increases.

This comes on the back of a weakening yuan and the Chinese property market situation, boosting safe-haven demand for gold.

In contrast, ETF demand in Europe and North America is opportunistic and whimsical, with OECD investors moving in and out of the gold market depending on the movements of interest rates, equity prices and precious metals prices on a weekly basis.

Investors are currently waiting for the US to release employment data, scheduled for Friday (January 10) to predict the interest rate policy of the US Federal Reserve (Fed).

See more news related to gold prices HERE...