After a solid start to the first half of the year, the US economy is showing signs of cooling as economic activity slowed more than expected from July to September, according to Kitco.

The U.S. Bureau of Economic Analysis released its first report on the country's third-quarter gross domestic product on Wednesday. The report showed the economy grew at a 2.8% annual rate over the past three months, down from 3.0% in the second quarter.

Economic activity missed economists' expectations as the consensus forecast showed growth unchanged at 3.0%.

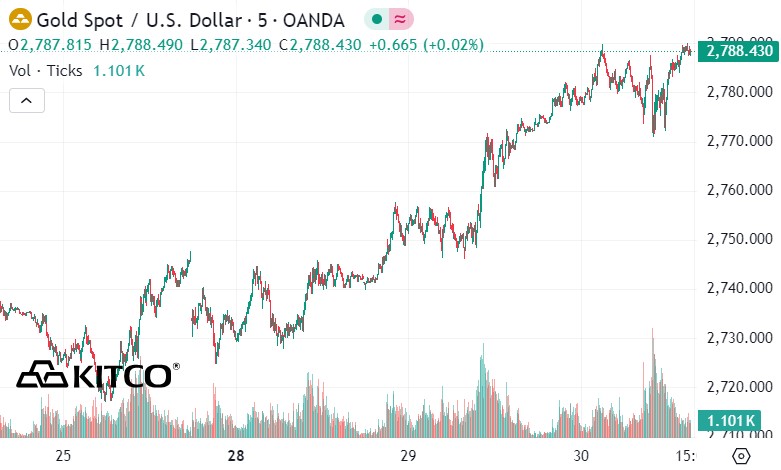

Although the gold market did not react much to the US economic data, it still maintained its upward momentum and approached the threshold of 2,800 USD/ounce.

Not only was spot gold rising, December gold futures last traded at $2,790.90 an ounce, up 0.35% on the day.

Some experts say that the precious metal is currently being driven largely by technical momentum. Michael Brown, senior research strategist at Pepperstone, noted that despite slightly weaker-than-expected economic activity, the US economy remains quite strong.

“While the data was slightly weaker than expected, such a pace still marked the eighth quarter in the last nine that the US economy has posted quarterly growth in excess of 2%,” he said in a note.

Overall, the data reaffirms that the US is indeed on track for a soft landing, with growth remaining solid as price pressures continue to ease. As a result, the Federal Open Market Committee (FOMC) will continue to ease policy on interest rates, cutting another 25 basis points at its meeting next week; with the possibility of such cuts at each subsequent meeting until policy returns to a neutral stance next summer.

Looking at some of the report's components, consumer spending rose 3.7% in the third quarter. The report also noted that inflation picked up slightly. The US personal consumption expenditures (PCE) index rose 2.2% in the quarter; higher than the consensus forecast of 2.1%.

Market participants are closely watching the release of the US PCE index as it will influence the Fed to cut interest rates by 25 basis points at each of the remaining FOMC meetings this year. This expected change in monetary policy has contributed to the appeal of gold as a safe haven for cash flows.

Investors are now focused on the US September jobs report due out Friday morning. A worse-than-expected report would boost bets on the Fed cutting interest rates at a faster pace, opening up a breakout opportunity for gold.

In addition to US economic data, the gold market is receiving a series of supportive factors including political conflicts and continued strong demand from global central banks.

In particular, uncertainty over the outcome of the upcoming US presidential election and the possibility of further fiscal stimulus measures are key ingredients driving gold prices higher.

See more news related to gold prices HERE...