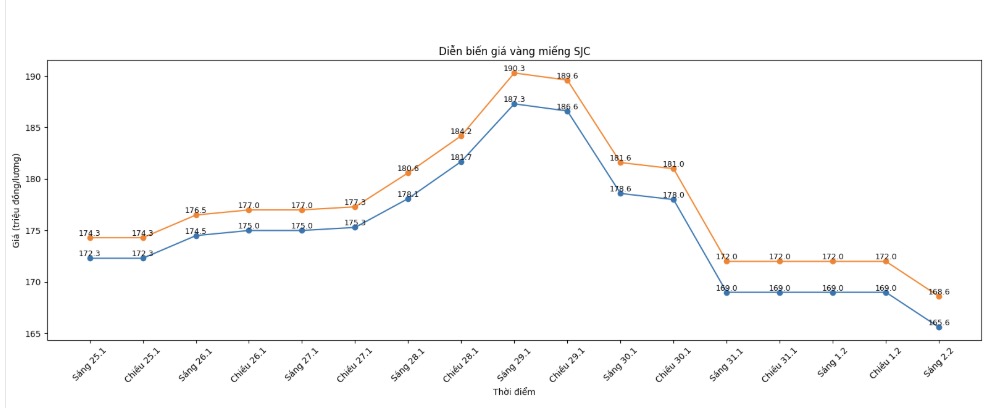

SJC gold bar price

As of 6:30 PM, SJC gold bar prices were listed by DOJI Group at 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar prices were listed by Bao Tin Minh Chau at the threshold of 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 163-166 million VND/tael (buying - selling); down 6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

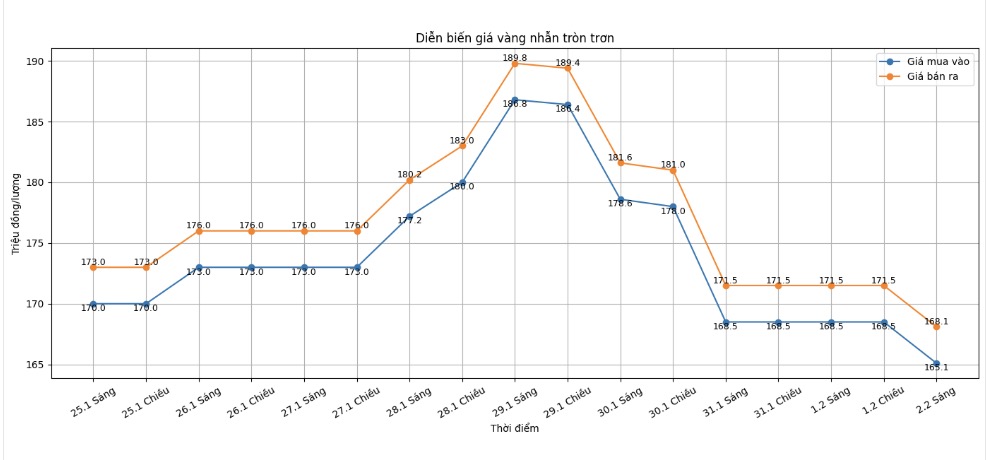

9999 gold ring price

As of 6:40 PM, DOJI Group listed the price of gold rings at 162.8-165.8 million VND/tael (buying - selling); down 5.7 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 164.5-167.5 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 163-166 million VND/tael (buying - selling), down 5.8 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

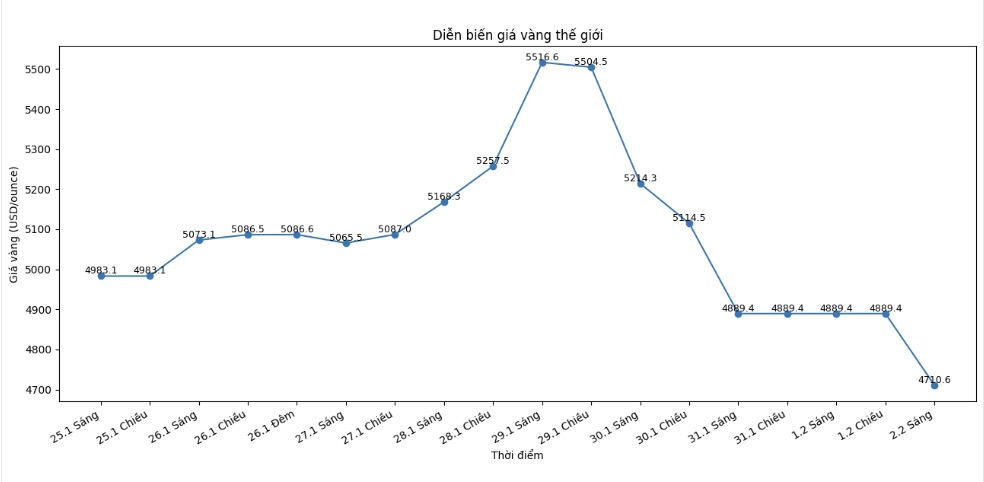

World gold price

At 6:30 PM, world gold prices were listed around the threshold of 4,760.45 USD/ounce; down 128.95 USD compared to the previous day.

Gold price forecast

Gold and silver prices simultaneously fell sharply in the first session of the week, as the Chicago Mercantile Exchange (CME) raised margin requirements, increasing selling pressure after the market's sharp decline last week.

Previously, in the January 30 session, gold prices evaporated more than 9.8% - the strongest daily decrease since 1983. Compared to the historical peak of 5,594.82 USD/ounce set on January 29, gold prices have now lost about 900 USD, wiping out most of the increase from the beginning of the year to date.

According to CME, the increase in margin ratio for precious metal futures contracts will officially take effect after the market closes Monday. This move makes speculative positions less attractive, especially putting great pressure on individual investors with limited capital.

Mr. Zain Vawda - an analyst at MarketPulse of OANDA - said that higher margin requirements could create a "chain effect" "This creates a negative spiral: the lower the price, the more traders are called to margin, forced to sell, causing prices to continue to plummet deeper" - he said.

Meanwhile, Barclays Bank believes that in the medium and long term, factors such as interest rate cuts, financial easing, quantitative easing, currency devaluation trends and dedollarization can still help maintain investment demand for gold.

In other precious metals, spot silver prices fell 3.4% to 81.65 USD/ounce. Spot platinum prices fell 4.3% to 2,070.64 USD/ounce, after setting a record high of 2,918.80 USD on January 26. Palladium prices also fell 2.1% to 1,662.68 USD/ounce.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...