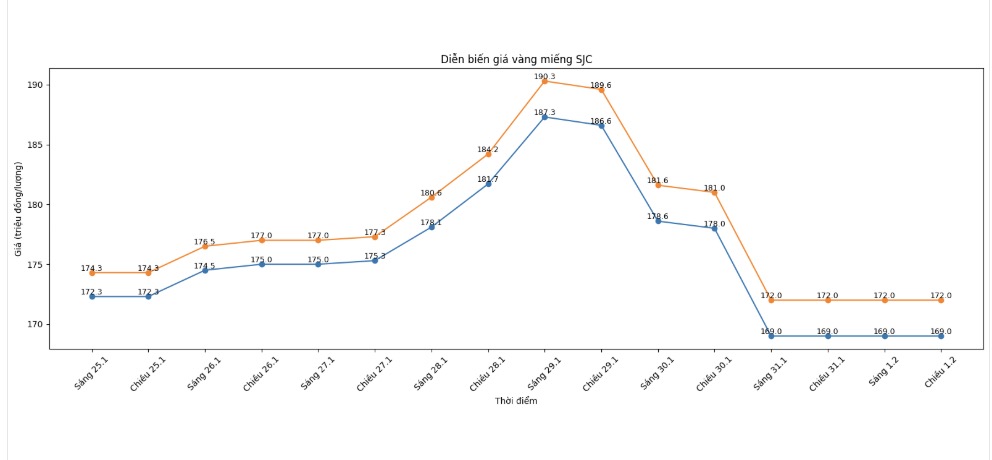

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 169-172 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 169-172 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 169-172 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

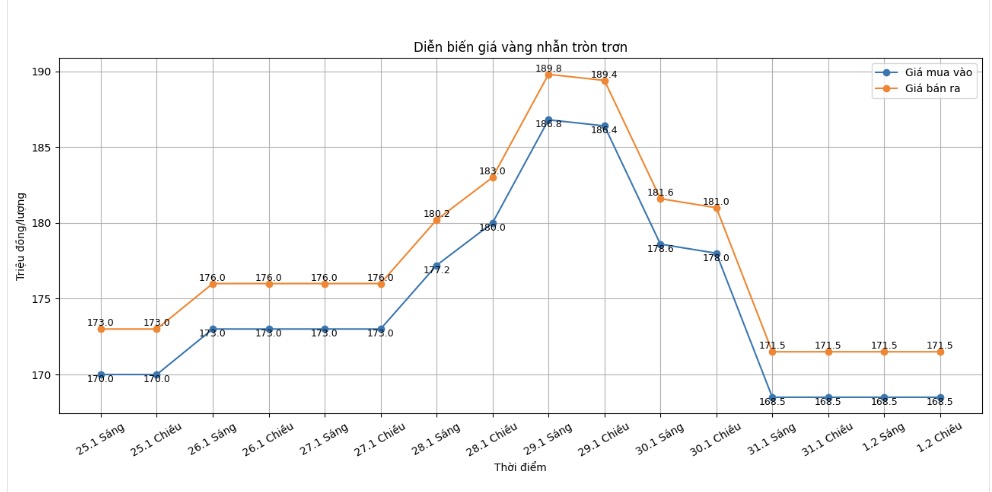

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 168.5-171.5 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169-172 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 168.8-171.8 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

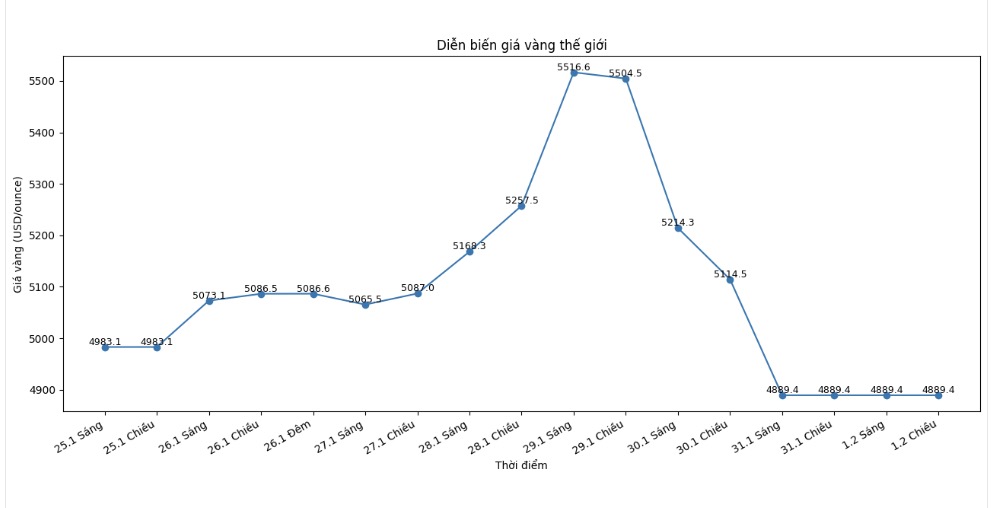

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4,889.4 USD/ounce.

Gold price forecast

Domestic and world gold prices are experiencing volatile trading sessions after a rare "hot" increase period. The sharp drop in world gold prices from record levels quickly impacted market sentiment, but analysts believe that this is mainly a technical correction, not changing the long-term trend.

According to international experts, the current deep decline stems from investors taking strong profits after gold continuously peaked in January. Prices increased too quickly, pushing the market into a state of over-buying, especially for positions using high leverage. As the USD recovers and expectations of US monetary policy change, selling waves are almost unavoidable.

Mr. Neil Welsh, Head of Metals at Britannia Global Markets, said that the level of strong volatility in recent days is not unusual if placed in the context that gold has increased at too high a rate. According to him, this is more like a position adjustment in the ongoing upward trend, than a reversal signal. Macroeconomic factors that once supported gold such as economic instability, geopolitics and global public debt risk have not disappeared.

Sharing the same view, Mr. Ole Hansen, Head of Commodity Strategy at Saxo Bank, said that current trading conditions are becoming more difficult as liquidity is thin and the buying-selling gap increases. However, if viewed in a longer timeframe, deep declines after a period of excitement are often seen as "necessary breaks" for the market.

This week, 18 experts participated in the gold survey. The results showed that Wall Street shared views on the short-term trend of gold prices after a week of strong fluctuations with many mixed signals.

7 experts, equivalent to 39%, believe that gold prices may return to the 5,000 USD/ounce zone next week, while 7 others predict prices will continue to fall. The remaining 4 experts, accounting for 22%, believe that gold prices may fluctuate in both directions in the short term.

This week, the global market will closely monitor a series of important economic data, especially US jobs data, to assess the interest rate outlook of the Federal Reserve (Fed). At the same time, many major central banks will also announce monetary policy decisions.

At the beginning of the week, the US announced the ISM manufacturing PMI for January, while the Reserve Bank of Australia held a policy meeting. On Tuesday, there was a JOLTS report on the number of jobs in the US. On Wednesday, the market welcomed private job data ADP and ISM service PMI.

The focus is Thursday with policy decisions from the Bank of England and the European Central Bank, along with weekly US jobless claims. The week ends with a non-farm payroll report and a consumer psychology survey from the University of Michigan on Friday.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...