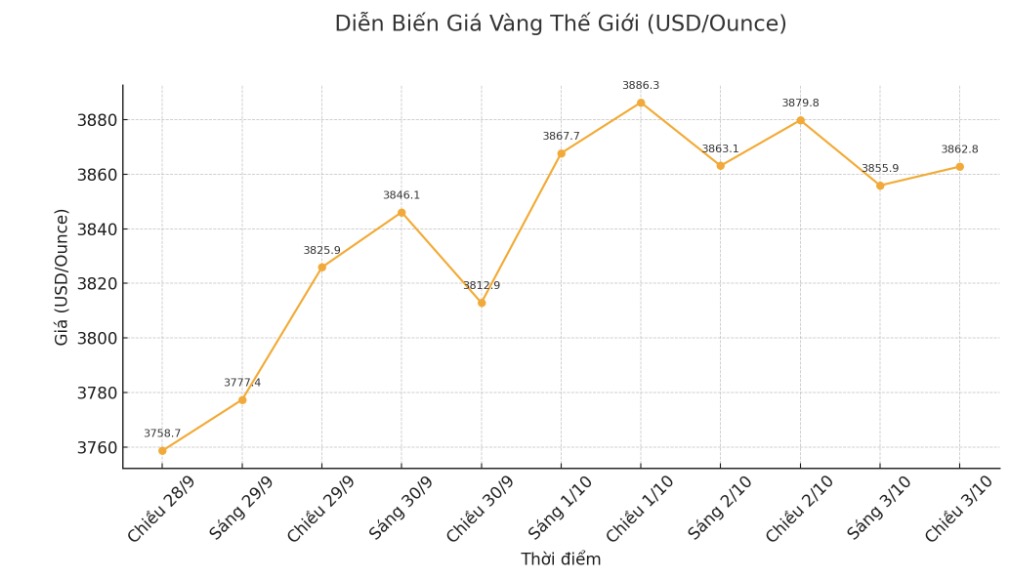

Gold prices last week received support from expectations of continued interest rate cuts in the US and concerns about the economic impact of prolonged government closures.

Spot gold stood at $3,859.69 an ounce at 7:39 a.m. GMT (ie2,39 a.m. Vietnam time), after hitting a record high of $3,896.49 on Thursday. As of the beginning of the week, the precious metal has increased by 2.7%. December gold futures on Comex increased by 0.4% to $3,883 an ounce.

The US government's closure, which has entered its third day, has delayed many important economic data, including the non-farm payrolls report due today.

Alternative data from public and private sources showed that the US labor market was almost stuck in September, with weak recruitment and unchanged unemployment.

These figures show that the US Federal Reserve should cut interest rates, and as we expect more rate cuts, this will continue to support gold prices in the coming months, said UBS analyst Giovanni Staunovo. Gold is likely to surpass the $4,000/ounce mark by the end of this year.

According to CME Group's FedWatch tool, investors are betting on a 97% chance of a 25 basis point cut in October and an 88% chance of another similar cut in December.

FED President Dallas - Ms. Lorie Logan - said that the decision to cut interest rates last month was a reasonable "insurance" against the risk of a sharp decline in the labor market, but emphasized that the FED needs to "be cautious".

Gold - often seen as a safe haven in times of political and financial uncertainty - benefits particularly in a low-interest-rate environment. Since the beginning of the year, this precious metal has increased by 47%.

Meanwhile, demand for physical gold in India increased last week despite record prices, while the Chinese market closed for the holidays.

In other precious metals, spot silver rose 0.7% to $47.30 an ounce, platinum inched 0.2% to $1,571.91 an ounce, and palladium rose 0.7% to $1,250 an ounce.

See more articles about gold prices on Lao Dong Newspaper here...