Updated SJC gold price

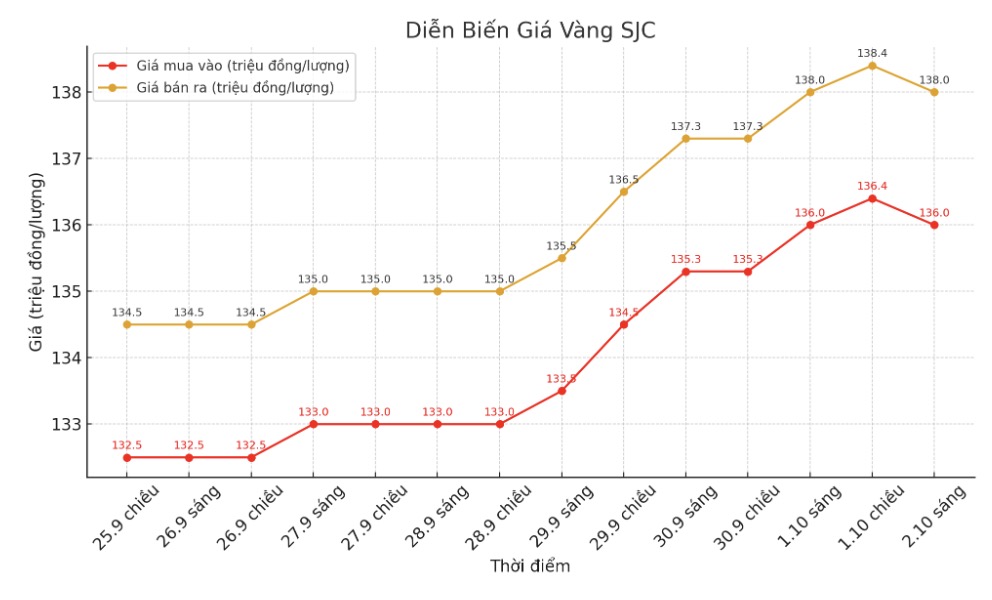

As of 9:23, the price of SJC gold bars was listed by DOJI Group at 136-138 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 136-138 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 135.3-138 million VND/tael (buy - sell), increased by 100,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 round gold ring price

As of 9:25, DOJI Group listed the price of gold rings at 132-135 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 132.6-135.6 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 132-135 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

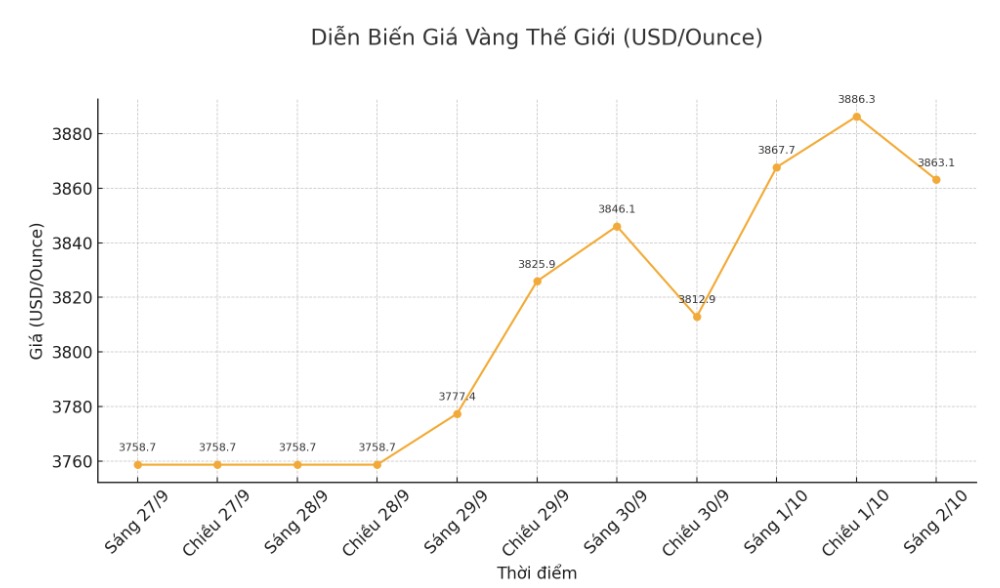

At 9:30 a.m., the world gold price was listed around 3,863.1 USD/ounce, down 4.6 USD compared to a day ago.

Gold price forecast

Since the beginning of the year, world gold prices have increased by more than 48%. Gold prices have recently seen support as the US government entered a closure for the first time in nearly seven years.

The White House has asked agencies to implement plans for the lack of funding. This will cause hundreds of thousands of workers to temporarily lose their jobs, many public services to stagnate, and risk pushing up the unemployment rate and delaying the September employment report expected to be released at the end of the week.

In the context of economic and political instability, gold - non-interest-bearing assets, is often considered a safe haven and benefits from a low interest rate environment. Investors are now pricing in a 99% chance of a rate cut by the Federal Reserve this month, according to the CME FedWatch tool.

BMO Capital Markets has also just released a report, sharply raising the gold price forecast for the fourth quarter of 2025 to an average of 3,900 USD/ounce, 8% higher than the previous forecast. The bank also believes that the increase has not stopped, with the prospect of gold prices surpassing $4,000/ounce by 2026, and even reaching $4,400/ounce on average for the whole year.

Currently, investors are waiting for the US employment report to be published in the near future, for more information on the "health" situation of the US economy.

Technically, the upward trend of December gold futures still dominated strongly. The next target for buyers is to close above the resistance level of 4,000 USD/ounce. On the contrary, the sellers will aim to bring the price below the solid support zone of 3,750 USD/ounce.

The most recent resistance level was recorded at the peak overnight of 3,922.7 USD/ounce and then 3,950 USD/ounce. The first support was at the bottom of overnight at $3,880.30/ounce, followed by $3,850/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...