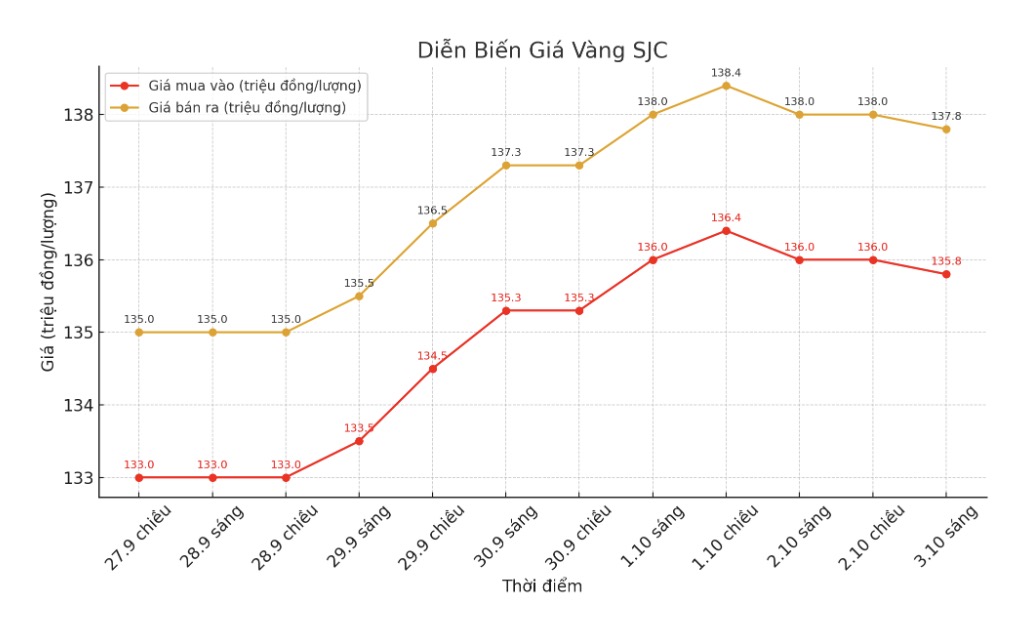

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 135.8-137.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 135.1-137.8 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

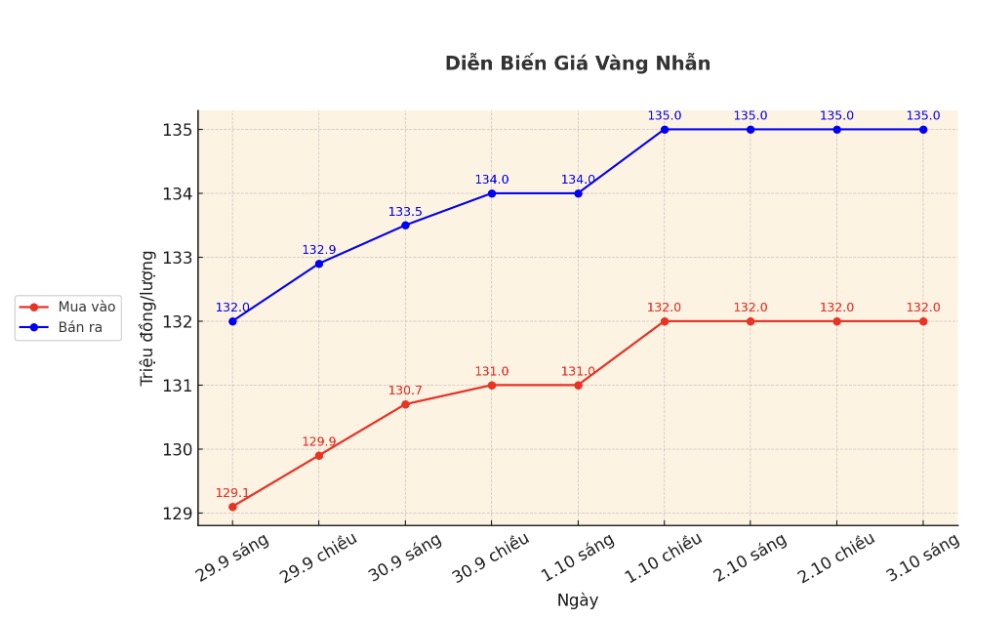

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 132-135 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 132.8-135.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 132-135 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

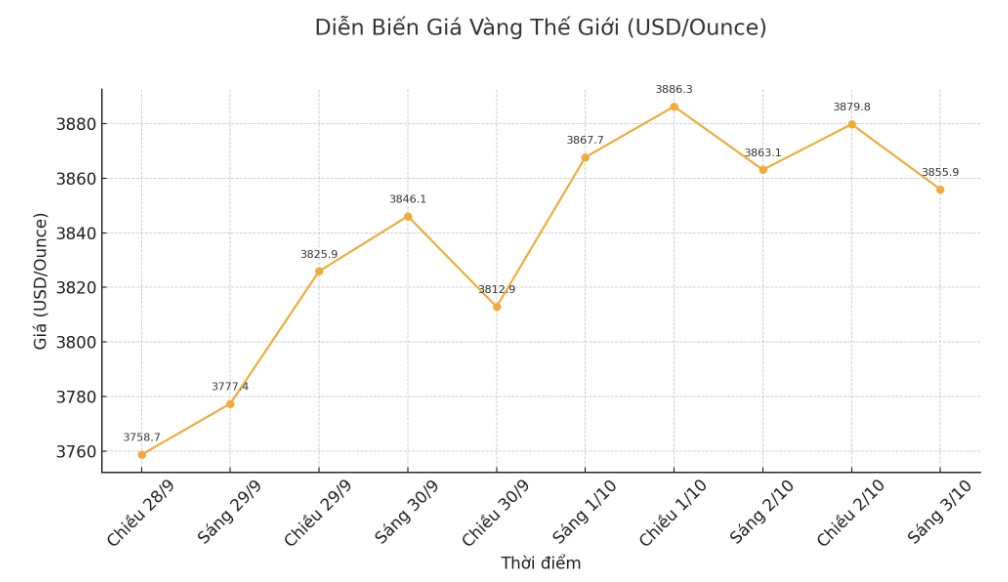

World gold price

At 9:11 a.m., the world gold price was listed around 3,855.9 USD/ounce, down 7.2 USD compared to a day ago.

Gold price forecast

Gold prices fell slightly but remained high. The precious metal has encountered a wave of profit-taking in the context of prices continuously breaking the peak. However, stable safe-haven demand prevented gold prices from falling too deep last night.

In a recent interview, David Miller - Investment Director (CIO), co-founder of Catalyst Funds and also manager of ETF Strategy Shares Gold Enhanced Yield (GOLY) said that even though gold has increased by more than 40% this year, this precious metal is still valuable to investors, because it is the only asset that can maintain purchasing power.

The important thing is not how next week or next year will be, but how the next 10 years will be. Holding assets by any legal basis is a bad way to preserve wealth and purchasing power, he stressed.

The above assessment was made in the context of gold prices continuing to trade near record levels, towards the threshold of 4,000 USD/ounce.

Meanwhile, Mr. Aakash doshi - Head of Gold Strategy at State Street Investment Management said that the gold price reaching 4,000 USD/ounce is just a matter of time, as investment demand has become a key factor supporting gold prices at the current record high.

Mr. doshi noted that gold holdings in ETFs are still significantly lower than the peak in 2020. The explosive increase in gold prices in August created a fear of missing opportunities in the market.

Aakash doshi expects investment demand to remain stable until the end of the year, but it may be slower than the pace in September. He explained that the sharp increase in gold prices is due to investors looking to protect and protect their assets against unusual market conditions.

This expert commented that gold is still an attractive insurance policy, because lower interest rates are supporting stock markets that are at record valuations.

Technically, December gold futures continue to maintain a clear technical advantage in the short term. The next target for buyers is to close above the strong resistance level of 4,000 USD/ounce. The target for the sellers is to push the price below the solid support of 3,750 USD/ounce.

The first resistance level recorded at the record peak this week was 3,922.7 USD/ounce, followed by 3,950 USD/ounce. immediate support was at an overnight low of $3,877 an ounce, then $3,850 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...