In a recent interview, David Miller - Investment Director (CIO), co-founder of Catalyst Funds and also manager of ETF Strategy Shares Gold Enhanced Yield (GOLY) said that even though gold has increased by more than 40% this year, this precious metal is still valuable to investors, because it is the only asset that can maintain purchasing power.

The important thing is not how next week or next year will be, but how the next 10 years will be. Holding assets by any legal basis is a bad way to preserve wealth and purchasing power, he stressed.

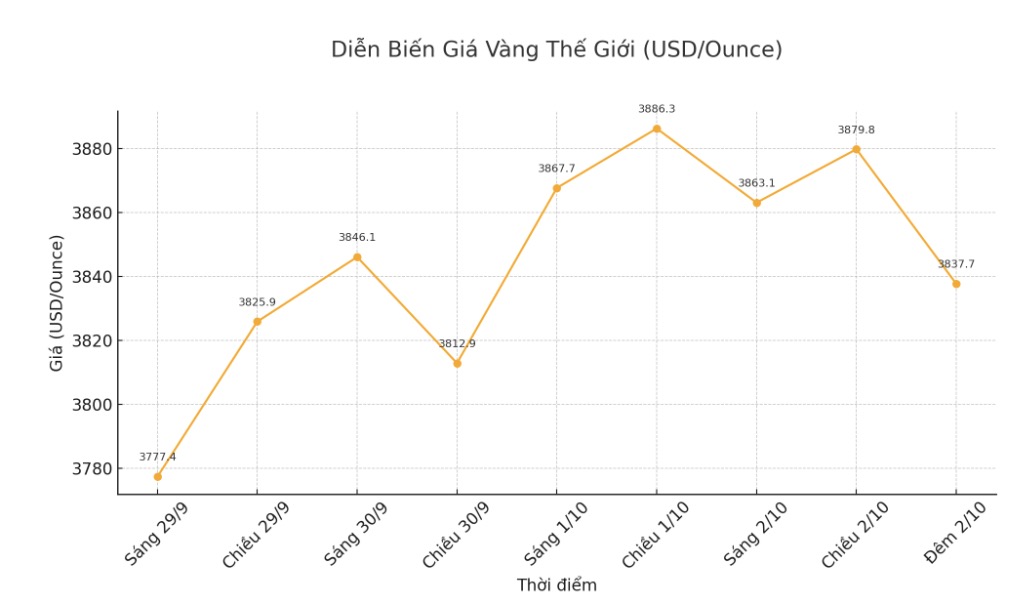

The above assessment was made in the context of gold prices continuing to trade near record levels, towards the threshold of 4,000 USD/ounce.

According to Mr. David Miller, inflation has always eroded the purchasing power of currency, but the global depreciation trend has been accelerated since the COVID-19 pandemic, when governments pumped money and liquidity into the economy.

Although the global health emergency has ended since 2023, many countries continue to print money and increase the burden of unsustainable debt. Gold has now hit a peak against most major currencies, with the strongest increase coming against the USD.

Gold is not overpriced, it is just catching up with the growth rate of money supply, he said.

Mr. David Miller also noted that the US budget deficit has increased by $1,900 billion this year, pushing the total federal debt to $17,000 billion, which is an important factor driving gold prices.

According to David Miller, if a country is carrying a huge debt, continues to spend more than its annual budget revenue of thousands of billions of dollars and is still able to print more money, then it is almost inevitable that the currency will gradually lose value. In this context, instead of tightening spending or increasing taxes strongly, many governments choose to make currencies lose value slowly. If the deficit continues without proper debt handling, the USD could fall by about 5% per year. For investors and consumers, a way to preserve asset value is to hold hard assets such as gold, instead of relying only on USD, euro or Yen.

In addition to public debt, another factor weakening the US dollar is the US use of the currency as a sanctions tool after the Russia-Ukraine conflict broke out. Confidence in the US dollar has been further weakened over the past 6 months due to the trade war and global tariff measures that US President Donald Trump is pursuing.

Miller said that when combining many factors such as tariffs, dependence on the international payment system and large-scale monetary easing packages, holding the USD as a reserve is no longer considered the optimal choice.

In this context, he said that central banks will continue to diversify reserves, gradually withdraw from the USD and return to gold.

Supplacing US dollar reserves with gold will not happen overnight. This will be a decades-long process, but enough to maintain a high gold price level in the near future, he stressed.

See more news related to gold prices HERE...