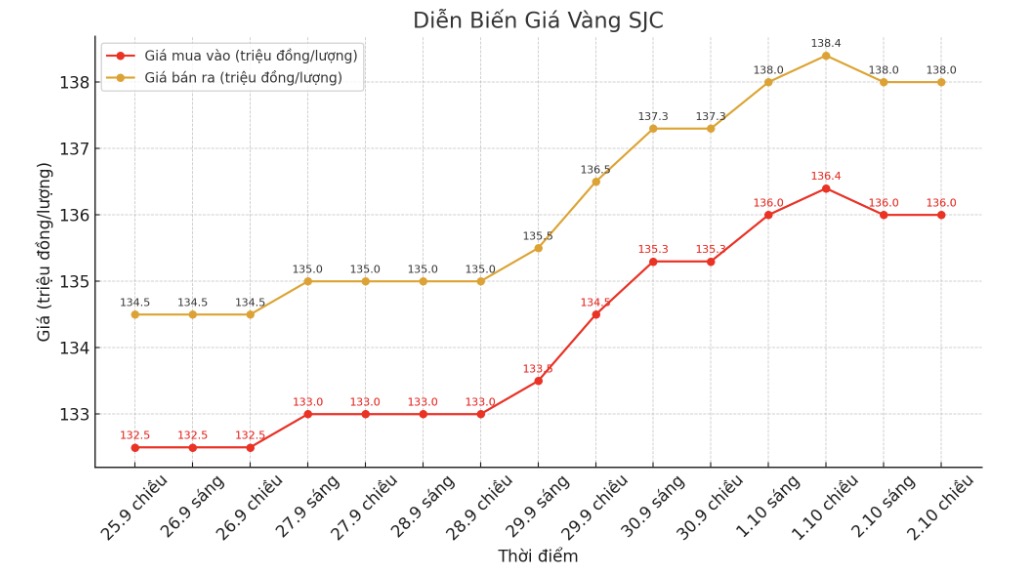

SJC gold bar price

As of 5:35 p.m., DOJI Group listed the price of SJC gold bars at VND136-138 million/tael (buy - sell), down VND400,000/tael in both directions compared to a day ago. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 136-138 million VND/tael (buy - sell), down 400,000 VND/tael in both directions compared to a day ago. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 135.3-138 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 400,000 VND/tael for selling compared to a day ago. The difference between buying and selling prices is at 2.7 million VND/tael.

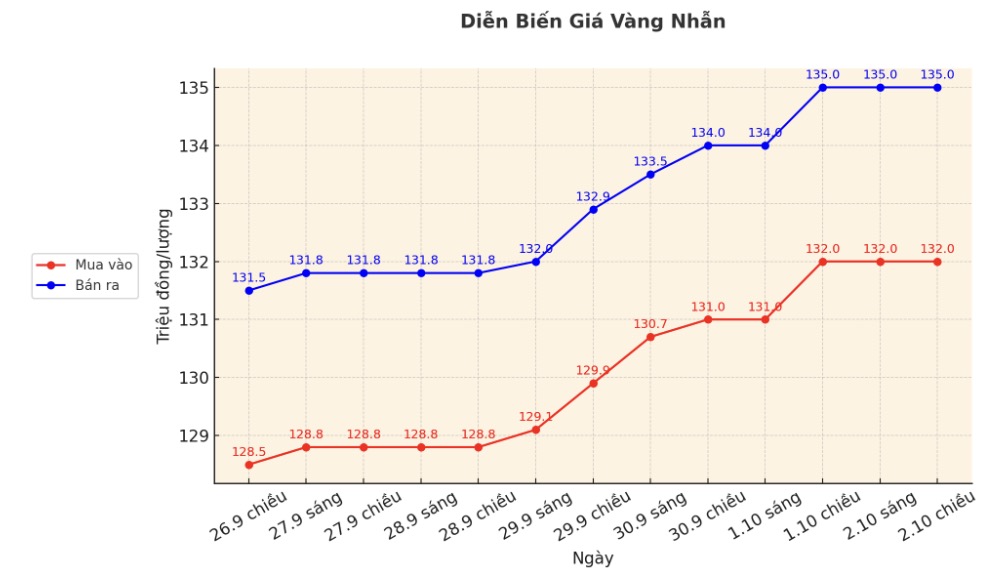

9999 gold ring price

As of 5:35 p.m., DOJI Group listed the price of gold rings at 132-135 million VND/tael (buy in - sell out), unchanged in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 132.8-135.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Phu Quy listed the price of gold rings at 132-135 million VND/tael (buy - sell), down 300,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

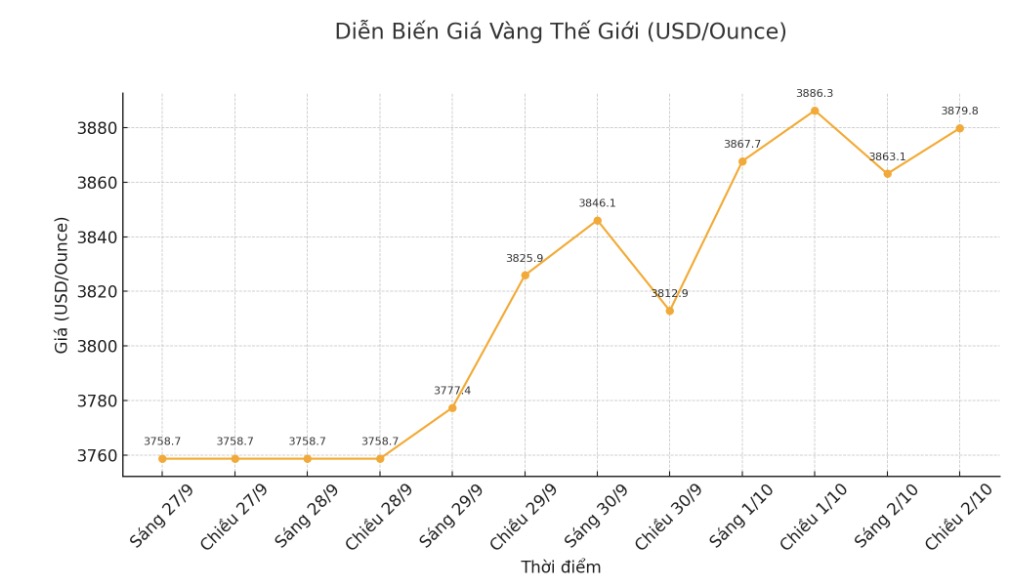

World gold price

The world gold price was listed at 5:37 p.m. at 3,879.8 USD/ounce, down 6.4 USD compared to a day ago.

Gold price forecast

World gold prices continued to stay at a high level in the session of October 2 thanks to expectations of the US to soon cut interest rates and a budget deadlock in Washington.

Matt Simpson, senior expert at City Index, said the ADP's weak employment data has reinforced the possibility of the US Federal Reserve cutting interest rates, while the US government's closure is supporting gold's safe-haven role.

According to CME FedWatch, traders are almost certain that the FED will cut 25 basis points this month.

Meanwhile, Chicago Fed President Austan Goolsbee warned against cautiousness with rate cuts amid concerns about inflation.

According to the latest report from Goldman Sachs Research (market research and analysis department of Goldman Sachs - USA) led by expert Lina Thomas, world gold prices could reach 4,000 USD/ounce by the middle of next year.

The main reasons come from struttured demand from central banks and policy easing by the Fed, which supports ETF inflows into gold.

Goldman Sachs classifies gold buyers into two main groups. The first is the group of credulous buyers including central banks, ETFs and speculators. This is a stable demand, often buying at any price, based on economic viewpoints or to prevent risks. According to estimates, for every 100 tons of gold purchased net, gold prices will increase by about 1.7%.

The remaining group is chance buyers mainly households in emerging markets who typically only participate when prices are considered reasonable. This group can create a floor when prices fall and put pressure on when prices increase.

Meanwhile, commodity analysts at BMO Capital Markets (investment banking and capital market services bank of Montreal - one of the largest financial groups in Canada) have just released a Q4 price forecast, with a strong correction for gold.

The bank expects gold prices to average around $3,900 an ounce in the last three months of 2025, up 8% from its forecast. Gold prices are expected to continue to rise, surpassing $4,000/ounce next year.

BMO raised its forecast for the average gold price in 2026 to $4,400/ounce, up 26% from the previous estimate. In the long term, the bank believes that gold prices will remain around $3,000/ounce, instead of $2,200 as previously forecast.

In another development, the SPDR Gold Trust said its holdings have increased by 0.59% to 1,018.89 tons - the highest since July 2022.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...