The US Federal Reserve's cautious resumption of the easing cycle has somewhat reduced gold's momentum, as prices have not been able to hold steady above the $3,700/ounce mark.

Philippe Gijsels - Strategy Director of BNPbas Pari Fortis, said that gold prices may fluctuate around $3,600/ounce in the short term, but it is unlikely to fall further as the Fed has started its easing cycle.

He said that investors are only just starting to return to the market, and in the context of economic instability, strong buying will appear every time prices are adjusted.

Although this price increase seems too much with an increase of nearly 40%, we are still in the early stages of the bull market. With so much uncertainty in the world, the demand for gold is still very large and prices could well reach $4,000 by the end of this year or early 2026" - Gijsels said.

Christopher Vecchio - Director of futures and foreign exchange strategy at Tastylive.com, also said that gold continues to have great value when playing the role of an essential currency asset in the global financial market.

Is gold at $3,700 an ounce still worth buying? In this context, the definitive answer is yes. I still try to find a reason to be optimistic about gold, but I have not seen any such scenario, he said.

Vecchio added that even with high prices, central banks will continue to buy gold as confidence in the US dollar weakens. He pointed out that not only is the US government seeking to force the Fed to cut interest rates aggressively despite high inflationary pressures, but the country's public debt continues to increase at unsustainable levels.

Central banks will continue to gradually diversify away from the US dollar, and their only real choice is gold, he said.

Although the Fed has launched a less aggressive monetary policy roadmap than many investors expected - with signals of a potential two more cuts this year and one in 2026, some experts believe there is still room for stronger easing, especially in the case of a new member of the Board of Governors appointed by the US President.

The only objection in Wednesday's policy decision came from Stephen Miran, who was recently appointed, when he approved a 50 basis point cut.

The market is especially waiting for Stephen Miran's speech on Monday at the New York Economic Club.

Although gold is still in a solid uptrend, some analysts warn investors to prepare for price fluctuations when profit-taking appears in the highlands.

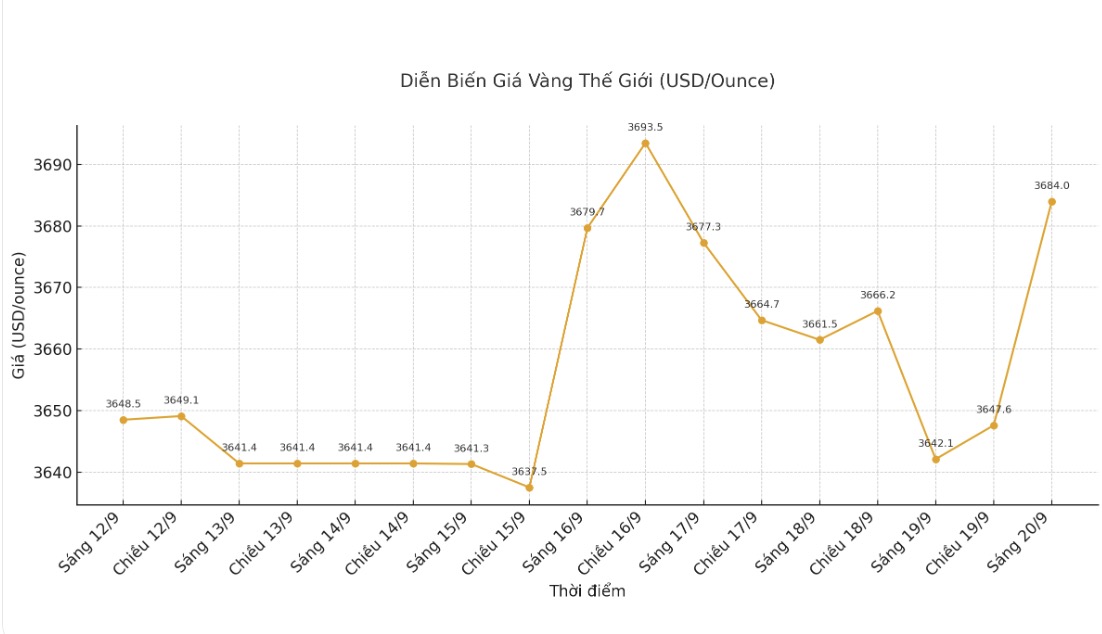

The short breakthrough of over $3,700/ounce this week has sent gold prices up more than 40% since the beginning of the year, recording the strongest increase annually since the late 1970s.

Gold traders, when observing the increase since the beginning of the year and seeing the Fed's monetary policy path becoming clearer, see this as an opportunity to take profits. This has certainly triggered a sale, causing prices to adjust. Therefore, I believe it is likely that we will see prices moving sideways and accumulating, said Naeem Aslam, Investment Director of Zaye Capital Markets.

However, Aslam stressed that gold will be particularly sensitive to inflation data due next week. If inflation is stiffer than expected or new political news appears, gold could quickly rise to $3,750-3,800, he said.

In addition to inflation data, the market will also monitor manufacturing and home sales figures.

Schedule for releasing US economic data next week:

Monday: Stephen Miran speaks at the New York Economic Club.

Tuesday: US S&P Flash PMI.

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).