Gold - safe-haven assets decreased by more than 2% in the trading session on Monday, as risk- Taking sentiment returned after the US and China announced a temporary agreement to cut tariffs.

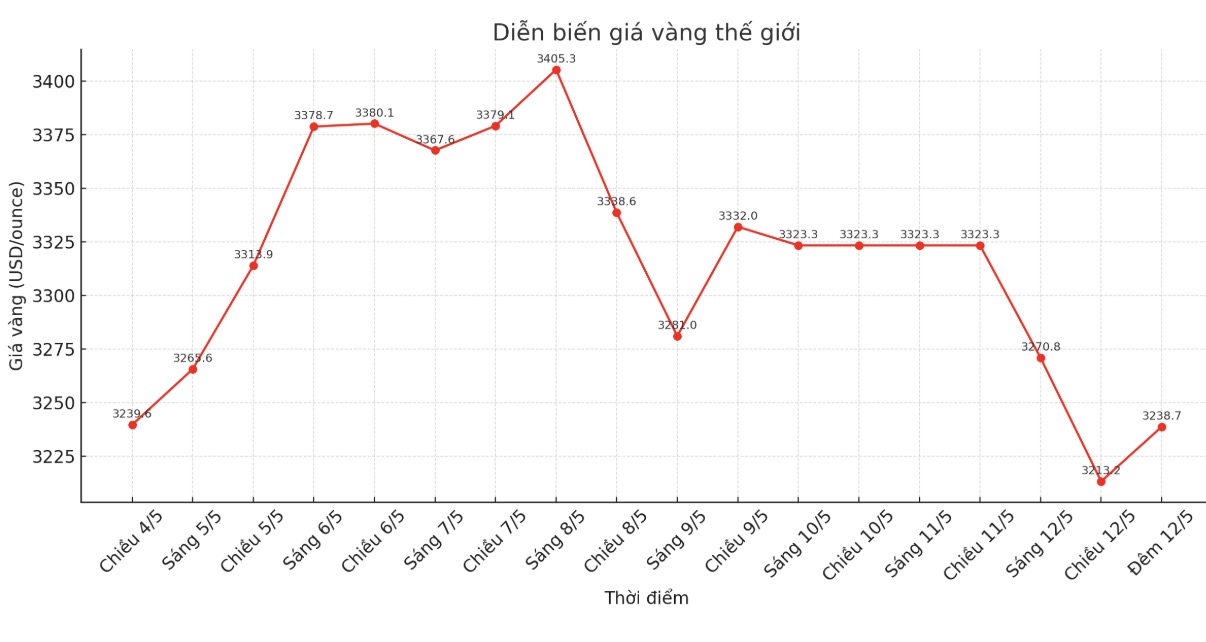

At 22:00 on May 12 (Vietnam time), the world gold price listed on Kitco was around 3,238.7 USD/ounce. Gold previously hit a record $3,500.05 an ounce last month due to concerns about tax clashes between the two countries.

Golds strong reaction to the chaotic news from the White House last month made the precious metal vulnerable if Donald Trump changed his stance.

Now that the atmosphere is somewhat more positive, gold will only increase again if this optimism is interrupted" - Adrian Ash - Research Director at Bullion Vault commented.

According to the joint statement, the US will reduce the additional tax rate on imports from China from 145% to 30%, while China will also reduce the tax on US goods from 125% to 10%. These measures will be effective for 90 days.

Immediately after the deal, the US dollar rose to its highest level in more than a month, while the global stock market boomed. A stronger US dollar makes gold more expensive for investors holding other currencies.

June gold futures speculators have lost their short-term technical advantage. The next target for buyers is to push prices above the strong resistance level at $3,350. The most recent resistance levels are $3,250 and $3,275 an ounce, according to Jim Wyckoff, senior analyst at Kitco Metals.

The market is now waiting for the US Consumer Price Index (CPI) data on Tuesday to assess the policy direction of the US Federal Reserve (FED). Other important data to be released this week include the Producer Price Index (PPI) and retail sales.

Spot silver prices fell 0.2% to 32.64 USD/ounce; platinum fell 1.7% to 977.77 USD and palladium fell 1.6% to 960 USD.