If investors were surprised by the decline in gold prices this week, they may not have been really monitoring the market. On Wednesday, with just one presented board, Mr. Donald Trump turned the global trade balance upside down.

Neils Christensen - an analyst at Kitco News commented that US tariffs and the trade war it has led to the largest disruption to the global supply chain since the COVID-19 pandemic.

The stock market is experiencing a strong shock as investors are forced to sell shares due to concerns about slowing the economy and rising inflation. The S&P 500 index fell 9% last week - its biggest decline since May 2020.

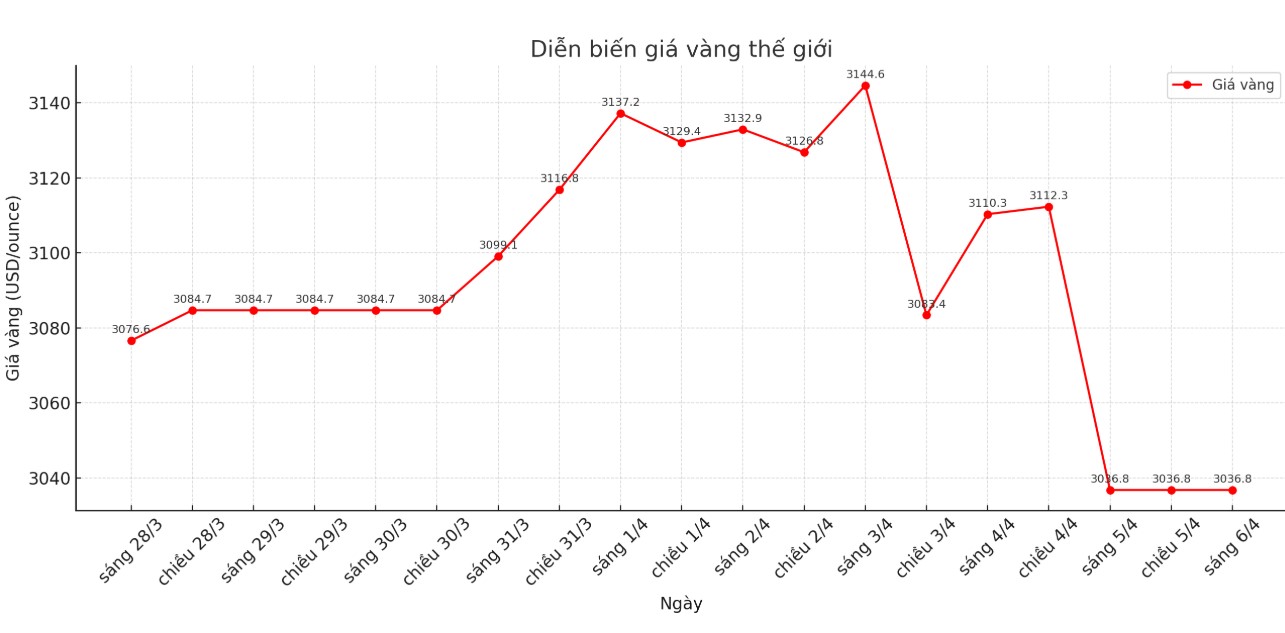

However, amid this panic, gold is still fulfilling its role. Despite losing 2.5% of the week, ending a 5-week streak of continuous increases, it still outperformed the stock market.

Spot gold is still holding the support level above 3,000 USD/ounce, although analysts warn that prices may continue to decrease, even retreating to the level of 2,800 USD/ounce.

Many experts believe that this adjustment could open up new opportunities, attracting investors back to gold. In the context of the current changing market, the factors that once brought gold to 3,000 USD/ounce are further consolidated.

Even before the announcement on Wednesday, major banks warned that the US First policy could soon transition to US alone as other countries seek new trade partners.

If global trade tensions escalate, central banks could accelerate plans to reduce dependence on the US dollar. And as a monetary asset, gold will continue to benefit the most.

Although gold still plays a positive role in the current situation, not all precious metals are like that. Silver is also considered a currency, but more than half of the demand for silver comes from the industry.

Investors' massive withdrawals from the global market have caused silver prices to plummet, falling nearly 14% for the week and falling below $30/ounce. The ratio between gold and silver prices also skyrocketed to over 100, the highest since June 2020.

Many analysts have previously been optimistic about silver thanks to the global electrification trend, but it is clear that silver is not immune to recession. When economic growth slows due to trade disruptions, demand for industrial metals such as silver or else will decrease.

However, despite the poor performance of silver, experts have not given up hope. They believe that silver will soon catch up with gold once global trade tensions ease.