Gold is superior to the stock market

The global financial market is witnessing a widespread sell-off, including precious metals, as US President Donald Trump's trade tariffs disrupt global trade and risk sending the world into recession.

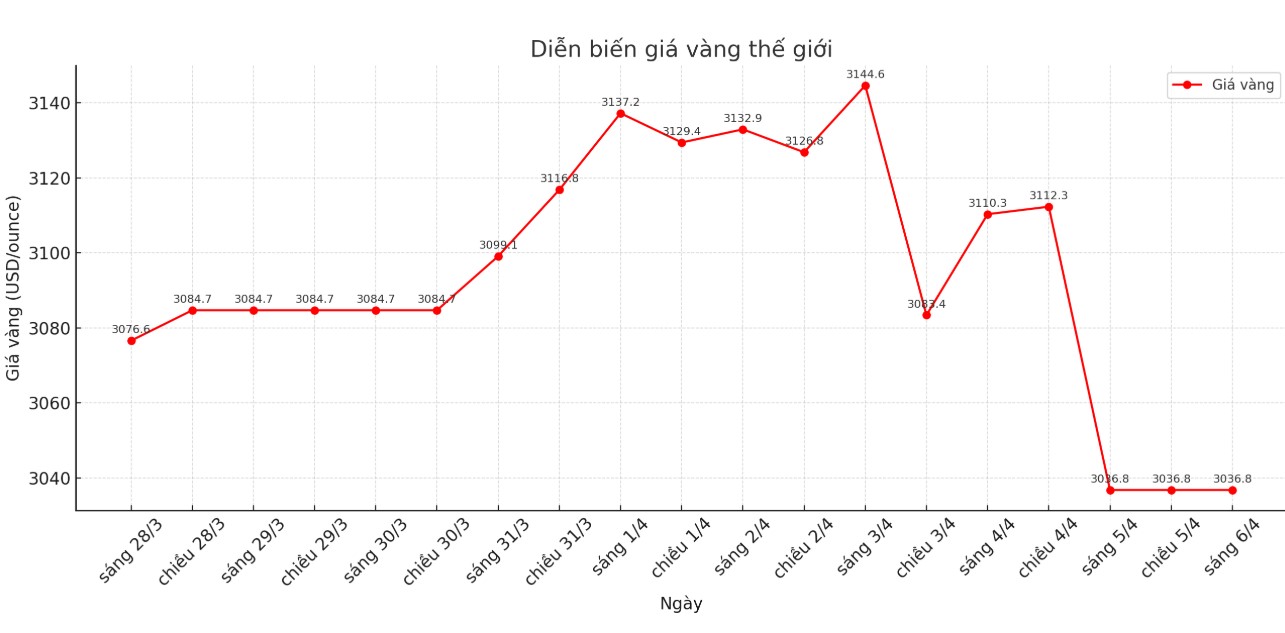

Gold prices ended the week on a downward trend, testing the support level around $3,000/ounce. The latest spot price was $3,023/ounce, down 2% from last Friday and down nearly 4.5% from the record high set on Thursday night.

However, gold is still superior to the stock market. The S&P 500 is heading for its biggest week of decline since the COVID-19 lockdown, losing nearly 500 points (equivalent to 8.7%).

Chris Vecchio, director of futures and foreign exchange strategy at Tastylive.com, said: Its no surprise that stocks are selling off so strongly, as Mr Trumps global tax rate is the biggest shock to world trade in the past 100 years.

Although gold is falling, Vecchio believes that gold is still playing a role in preventing risks. Without gold and bonds, I would have lost more. In an environment where everyone needs cash, everything is sold, but I believe gold will recover strongly after this period".

Long-term buying opportunities

According to Chris Vecchio, the factors that cause gold prices to surpass $3,000/ounce are still intact. "Current prices are a good opportunity for long-term buying, especially when central banks in many countries are gradually reducing their dependence on the USD" - this expert said.

David Morrison - an analyst at Trade Nation - commented that although gold prices have fallen quite deeply, this is not surprising because they have previously fallen into the overbought zone. However, he does not think that the gold rally has ended.

If gold holds the $3,000 or even $2,900 mark and accumulates, it could set the stage for a new rally that will last for years, the expert said.

Neil Welsh - Head of metals at Britannia Global Markets - is also not concerned about this adjustment. He said that the market has not changed much fundamentally and the stock market decline further strengthens the safe-haven role of gold.

As long as the US Federal Reserve (FED) remains neutral, gold will have the opportunity to accumulate or increase again. If the Fed slows interest rate cuts and the economy begins to weaken, gold could increase sharply. I cant imagine what scenario would have caused gold to plummet like stocks in the past few days, he said.

Welsh's comments came after Fed Chairman Jerome Powell said there was no rush to cut interest rates. Speaking at the SABEW annual meeting in Virginia, Mr. Powell said the labor market remains stable and the risk of inflation remains high. We will monitor data and context closely before changing policies. It is too early to make the next decision.

Some analysts believe that the FED's neutral stance is disadvantageous for gold, as it supports stronger bond yields and the USD.

However, Naeem Aslam - Investment Director at Zaye Capital Markets - said he is not ready to bet against gold. I still see gold as an asset that can be bought when adjusting. Geopolitical risks and inflation are still present. These factors will continue to support gold.

Next week, inflation data could make gold prices more volatile, as consumers are still adapting to rising prices after new tariffs are imposed.

Economic calendar next week

Wednesday: Minutes of the US FOMC meeting in March

Thursday: US CPI

Friday: US PPI and the University of Michigan Preliminary Consumer Confidence Survey