The gold market is still waiting for the official announcement from the White House on the possibility of applying a tax on imported gold of 100 ounce and 1kg types of gold bars. However, on social media, US President Donald Trump said that the precious metal will not be subject to import tariffs.

The announcement has helped traders ease concerns after a long period of pressure from a controversial ruling by the US Customs, threatening to impose significant tariffs on imported gold.

The turmoil began when the US Customs issued a ruling that the 1kg and 100-ounce gold bars imported from Switzerland would be subject to a 39% tax. Under current US tariffs, the measure will apply to gold from any country, raising major concerns about the future of global gold trade flows. Initial information reported by the Financial Times has pushed gold futures to a new record as the market reflects the risk of strong increases in import costs.

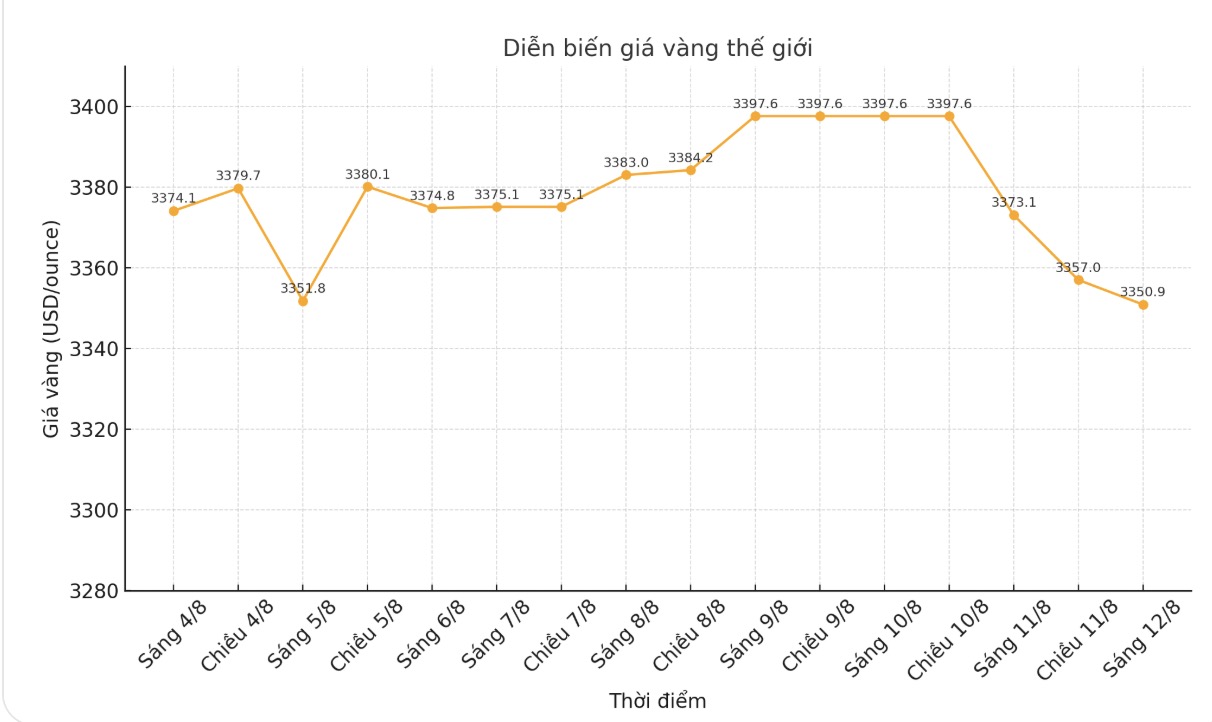

However, the increase did not last long. After Donald Trump posted on Truth Social that gold will not be taxed, gold prices turned to decrease sharply. As of 5:10 p.m. (Eastern US time) on August 11, gold prices fell by 64.5 USD, equivalent to 1.87%, to 3,393.7 USD/ounce, with trading bustling as the market received new policy information.

This "turning around" has caused a strong fluctuation in the gold futures market, creating a doji model (opening and closing prices are almost equal, showing the buyers and sellers struggling), with a range of nearly 55 USD in just 15 minutes.

This development is reminiscent of similar decisions in the past. In April, during an event called Liberation Day by the White House, gold and precious metals were exempted from import taxes, causing spot gold prices to fall by $100 and narrowing the price gap between Comex futures contracts in New York and spot gold in London. This gap has previously widened due to expectations of tariffs, dragging a record amount of gold into the US.

Such policy changes not only impact immediate prices but also affect physical gold storage activities. Gold inventories atcomex approved warehouses in the US have fallen about 14% from the April peak, but there are still more than 70% of inventories compared to the beginning of the year, showing strong demand for physical gold.

If applied, the 39% tax rate will have a big impact on the global precious metals trading network. Switzerland - the world's leading gold refining center, accounting for nearly 70% of global capacity, will be severely affected.

The Swiss Precious Metals Association warned on August 8 that this tax rate will nedically impact global physical gold flows, risking disruption of supply chains and existing trade relationships.

While some investors may take a breath of relief, analysts warn that the gold market may continue to fluctuate this week. As the gold tax information becomes clear, it is expected that the large gap between US gold futures and OTC spot gold prices in London will narrow.

Rhona OConnell, chief market analyst at StoneX, said last weeks fluctuations were just excessive.

Although the difference between spot prices and December contracts once exceeded 100 USD/ounce and was titled by the press as a "record", the reality was not too serious. Since the beginning of 2024, the average difference has been 5.4% and since the beginning of this year is 3.1%. Last Friday, the gap was just 2.8% before falling to 1.7% on Monday morning exactly the same as the previous Thursday, she said.

Looking beyond fluctuations caused by US domestic policy, O'Connell said the physical gold market was almost quiet in most places due to economic uncertainty and seasonal factors.

The price decline in Dubai has boosted demand in India and some retail transactions in some parts of the Middle East, but overall the market is still in a period of stagnation over the seasons, she said.