Last week, New York gold futures widened their gap against the London OTC market due to concerns that these types of gold bars will be subject to import tariffs. However, the gap has narrowed on August 11 as the White House is expected to clarify trade policy, keeping the import tax exemption for gold unchanged.

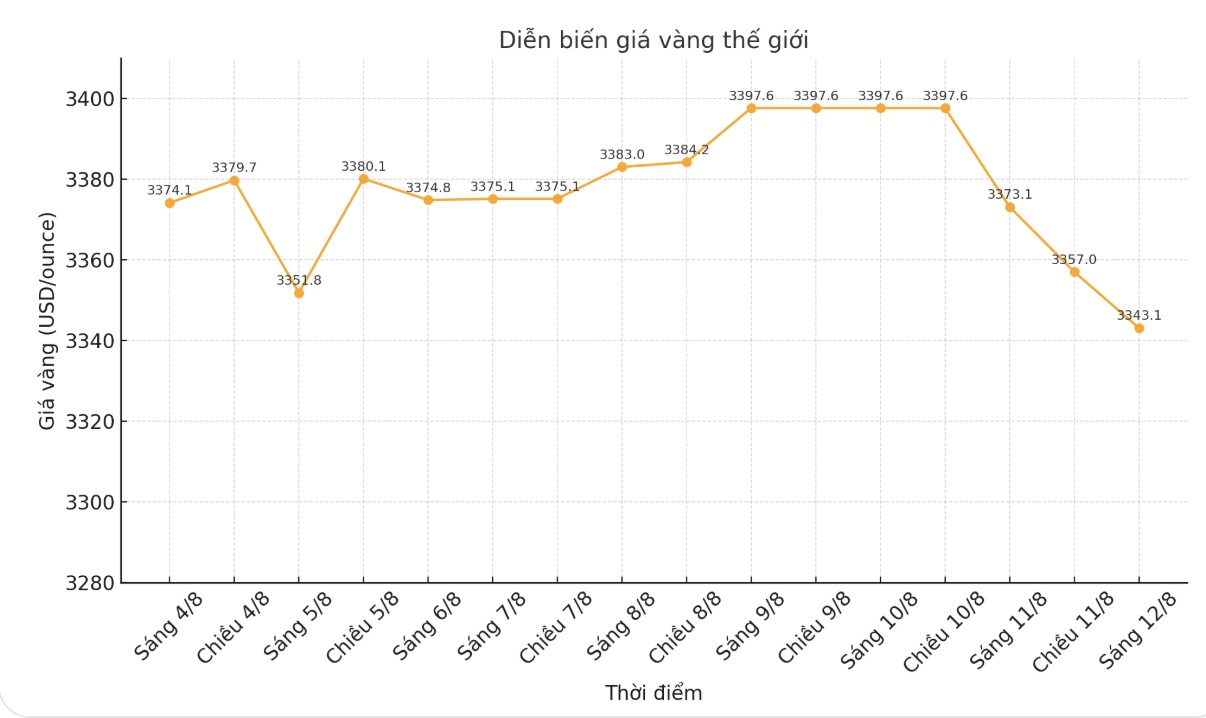

On August 11, December gold futures fell more than 2%, while spot prices fell 1.4%, as investors awaited clarification on the possibility of taxing imported 100-ounce gold bars and 1 kilogram. December gold futures closed at $3,409.7 an ounce, while spot gold was at $3,344. an ounce.

Despite recent fluctuations, Mike McGlone - Senior Commodity Strategist at Bloomberg Intelligence said that looking at the bigger picture, gold still holds important support level above 3,300 USD/ounce and technical developments could signal an upcoming breakthrough.

He said the key to gold's breakout could come from the stock market, as the S&P 500 shows signs of slowing near its historical peak above 6,400 points.

A catalyst for gold to reach $4,000 an ounce could come from a slight correction in US stocks, which will also highlight the risks of gold. Golds foundation has been consolidated around $3,300 an ounce since April and will need a fresh force to push prices below this threshold.

ETFs have shifted to strong inflows after 4 years of net withdrawal. A slight correction in US stocks could be a catalyst for gold to approach $4,000/ounce, he wrote in the latest report.

McGlone noted that the performance of the S&P 500 against the MSCI World Ex-US continues to set records. However, he warned that this development is testing a supportive trend path.

humane intelligence and profit are the main reasons why stocks outperform gold in the long term, but periods when gold outperforms stocks often occur. Gold has caught up with the AI-led stock market's total profit increase since 2017.

This is not a good signal for the economy and may show that risky asset valuation is too high. Or is gold's record just a scam? We are leaning towards the first possibility, and the disruption of the S&P 500 trend line to the world before the end of the year could trigger a domino effect of depreciation, he said.

In addition to closely monitoring the stock market to predict gold's next move, McGlone also stressed that US-led geopolitical instability is still an important trigger.

US President Donald Trump's refutes to US statistics and the independence of the US Federal Reserve could become a driver for the gold market, he said.

See more news related to gold prices HERE...