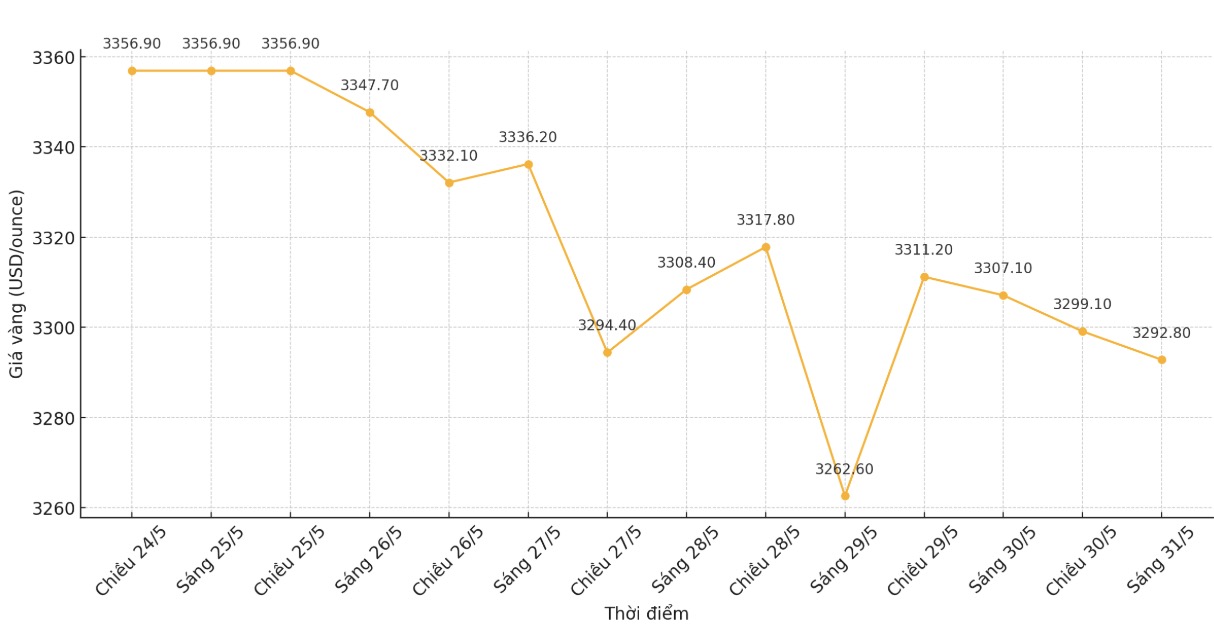

April saw the strongest fluctuations in world gold prices in the past 25 years, but the price movement in May was no less dramatic.

In May, gold prices fluctuated around 325 USD, down 540 USD in April. However, the average monthly fluctuation since 2020 is only about 89 USD.

Investors are unlikely to adapt to the constant changes in US policy. At times, trade tensions ease, people pour money into the stock market; but immediately after that, the threat of escalating again and gold is sought after as a safe haven asset.

In this context, investors are easily falling into a state of confusion, dominating emotions, and an ideal environment for mistakes. As the first half of the year is gradually coming to an end, this is the right time for gold investors to temporarily stop and re-evaluate the overall picture.

Instead of keeping up with every day's fluctuations, investors should focus on long-term foundation factors.

Experts say that US President Donald Trump's use of trade as a weapon and inconsistent policies continue to cause central banks to lose confidence in the USD. Gold remains the only global monetary asset without third-party risks. In the current context, central banks will continue to buy gold, as economic instability and geopolitical chaos are still prominent features of the market.

Tax measures are also putting pressure on the economy. New data updated this week showed the US economy fell 0.2% in the first quarter, slightly better than the initial forecast of a 0.3% decline.

Many economists believe that this weakness is due to an imbalance in trade, with manufacturers hoarding imports before April 15 being called " released day". While this assessment is correct, it ignored the fact that consumption in the US is slowing down. The latest GDP data shows that consumption increased by only 1.2% in the first quarter, lower than the initial estimate of 1.8%.

The downward consumer trend was also clearly shown in the PCE report released on Friday, when personal income in April increased by 0.8%, while spending increased by only 0.2%. The monthly savings rate reached a one-year high of 4.9%.

US inflation continues to cool down, increasing expectations that the US Federal Reserve (FED) will not rush to raise interest rates again, thereby creating a support for gold prices. In the context of consumers tightening spending and the economy facing many uncertainties, gold has further strengthened its role as a safe-haven asset.

Consumers are bracing for a possible economic storm, and that is the time when gold makes a clear gains.