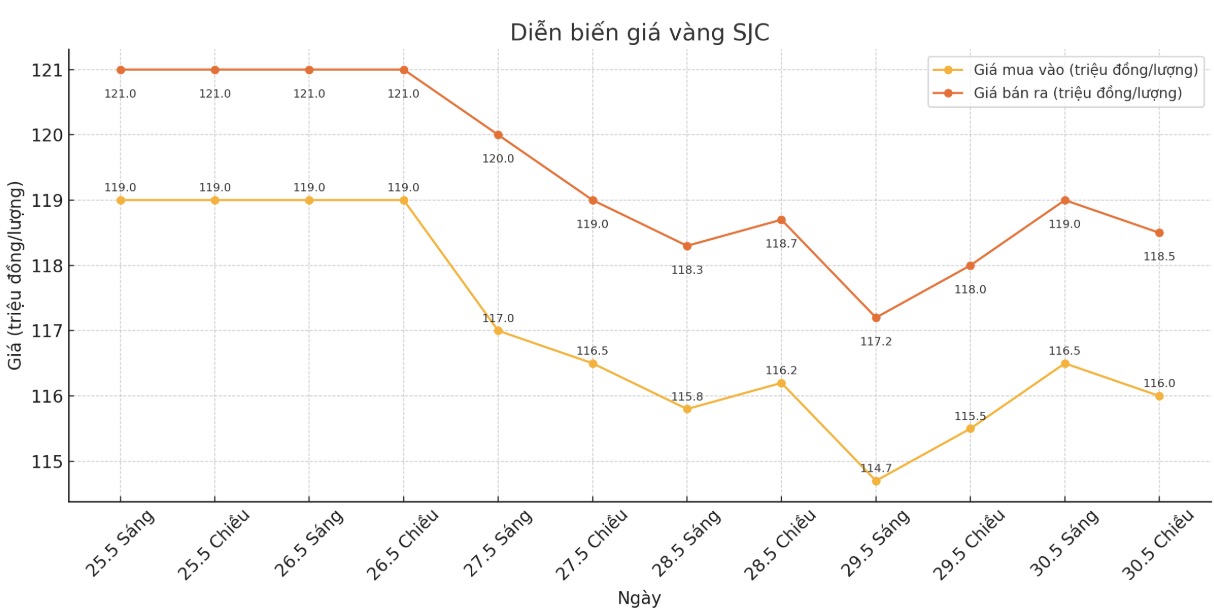

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116-118.5 million/tael (buy in - sell out), an increase of VND500,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116-118.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116-118.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 115.5-118.5 million/tael (buy - sell), an increase of VND 1 million/tael for buying and VND 500,000/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

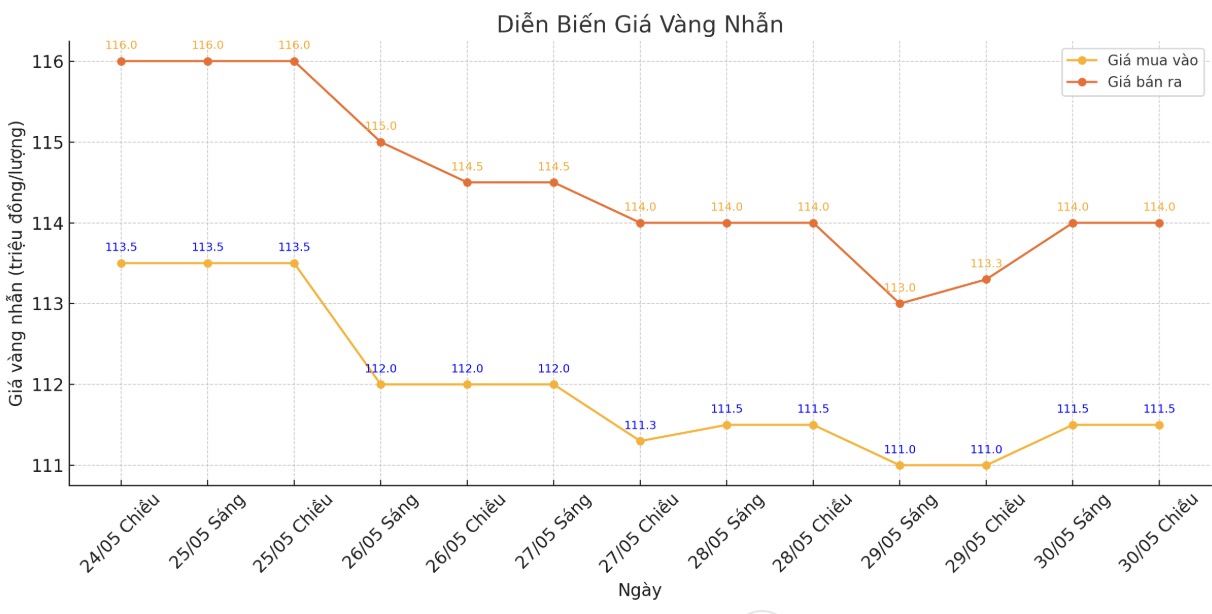

9999 round gold ring price

As of 5:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-114 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.3-114.3 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

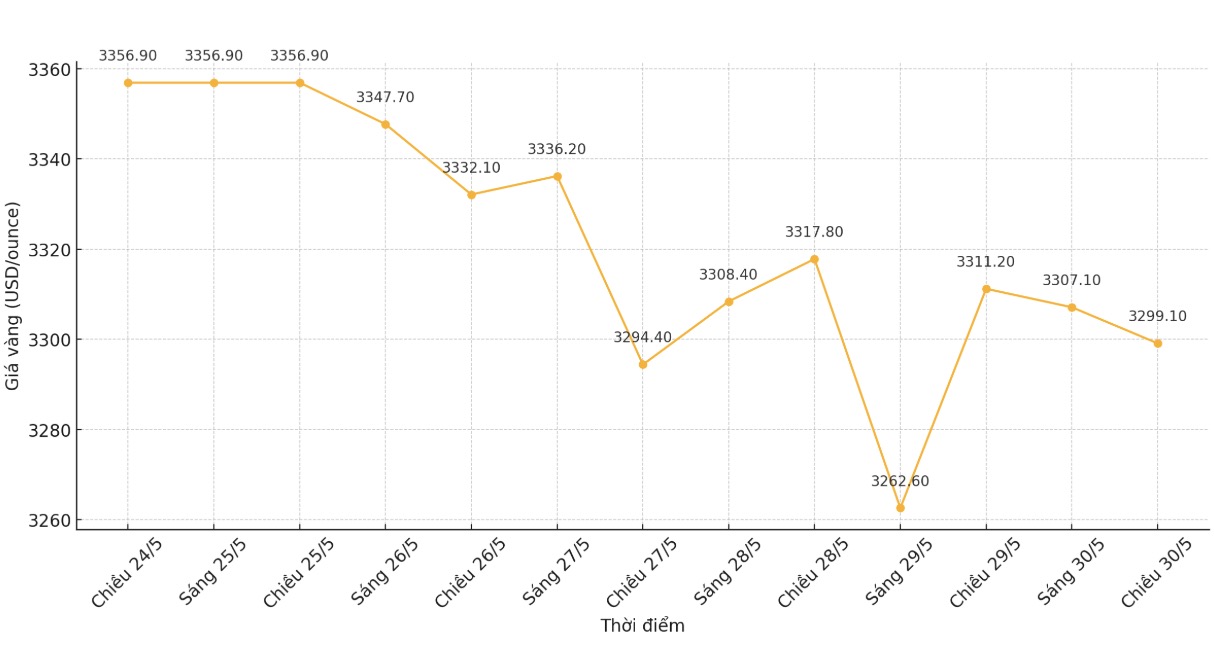

World gold price

At 5:07 p.m., the world gold price listed on Kitco was around 3,299.1 USD/ounce, down 12.1 USD.

Gold price forecast

Despite many fluctuations, many experts and financial institutions predict that gold prices may continue to increase in the coming time. Citigroup has adjusted its short-term price forecast framework for the precious metal to $3,100 to $3,500 an ounce for three months, significantly above the previous forecast of $3,000-3,300 an ounce released on May 12.

The forecast increase was made after Donald Trump's tough statement - US President in office with a warning of imposing a 50% tax on all imported goods from Europe, which could take effect from June 1. Although Trump has since postponed the plan and given the European Union until July to negotiate, the risk of a trade war has overshadowed the market.

Citigroup warned that gold prices could be pressured in late 2025 and in 2026 if the global economy recovers and the US Federal Reserve (FED) cuts interest rates.

Meanwhile, according to Nitesh Shah - Head of European Macroeconomic Commodity Research at WisdomTree, gold is gradually regaining its support and establishing new peaks is just a matter of time. Mr. Shah predicts that gold prices will reach 3,610 USD/ounce in the first quarter of 2026, possibly even up to 4,000 USD/ounce thanks to factors such as trade tensions, unpredictable monetary policy and uncertainties about global economic growth.

Investors are watching the US PCE core inflation index, a Fed's preferred inflation measure, to assess monetary policy prospects and the impact on gold prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...