Domestic gold prices seem to "ignore" the information about the removal of the monopoly State mechanism for gold bar production. The precious metal held steady its upward momentum last week and showed no signs of stopping.

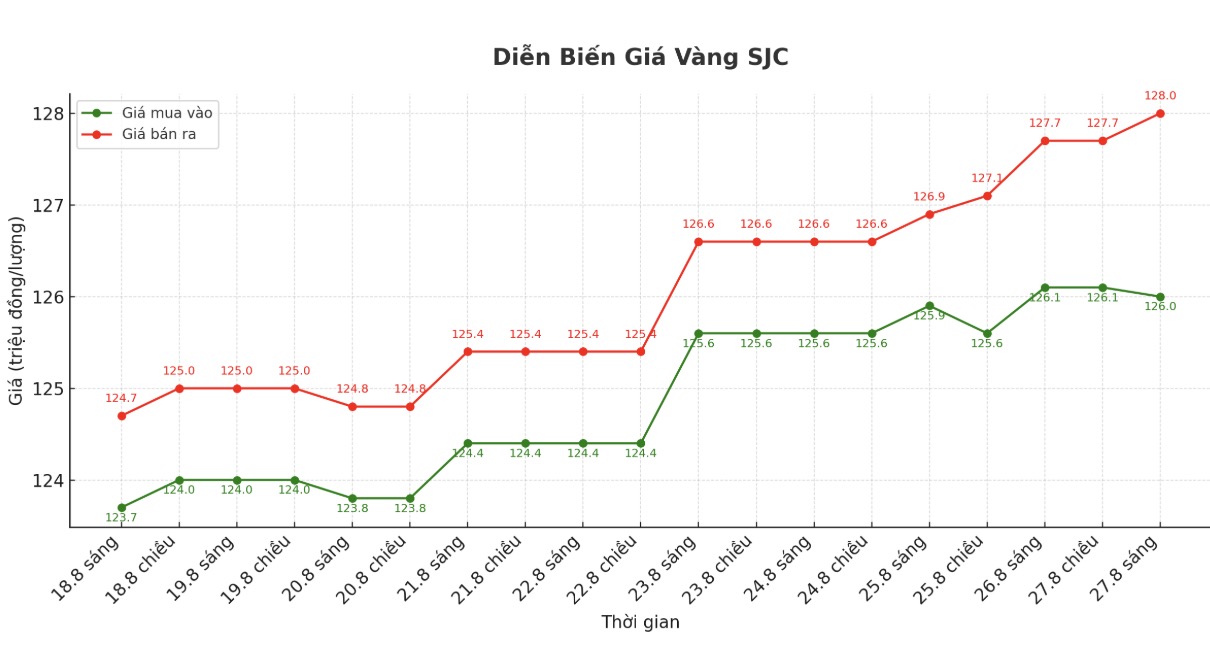

A week ago (8.20), the price of gold bars was listed by some domestic businesses at 123.8-124.8 million VND/tael (buy in - sell out). Meanwhile, the price of gold rings is listed at 117-120.2 million VND/tael (buy in - sell out).

Since then, gold prices have continuously maintained an upward trend. As of 9:00 a.m. this morning (8. 27), the price of SJC gold bars was listed by DOJI Group at 126-128 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 125.8-128 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.4-128 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.6 million VND/tael.

This morning, DOJI Group listed the price of gold rings at 119.6-122.6 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119.8-122.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.5-122.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Thus, there are only two sessions of gold prices moving sideways because businesses are off for the weekend. In the remaining sessions of the past week, domestic gold prices were adjusted up.

The reason for the increase in domestic gold prices is mainly due to the influence of the world market. On August 20, the world gold price was listed around 3,314.4 USD/ounce. By 10:00 on August 27, the price had increased by more than 68 USD, to 3,382.7 USD/ounce.

Currently, the difference between buying and selling domestic gold has been significantly widened, especially in gold rings up to 3 million VND/tael. This increases the risk of losses to investors, because if the price reverses slightly, buyers can suffer losses equivalent to the difference. The larger the range, the more potential disadvantages the market for short-term transactions.

Expanding the scope of regulation for gold bar production activities

On August 26, the Government issued Decree No. 232/2025/ND-CP amending and supplementing a number of articles of Decree No. 24/2012/ND-CP on management of gold trading activities.

The notable content of Decree 232/2025/ND-CP is that it has abolished Clause 3, Article 4 of Decree 24/2012/ND-CP to abolish the State's monopoly mechanism for the production of gold bars, the export of raw gold and the import of raw gold to produce gold bars.

Regarding the scope of regulation, Decree No. 232/2025/ND-CP has added "gold bar production activities" in Clause 1, Article 1 of Decree No. 24/2012/ND-CP.

Accordingly, this Decree stipulates gold trading activities, including: Production and processing of gold jewelry and fine arts; trading activities of buying and selling gold jewelry and fine arts; gold bar production activities; trading activities of buying and selling gold bars; gold export and import activities and other gold trading activities, including gold trading activities on accounts and gold derivatives activities.

Decree No. 232/2025/ND-CP amends and supplements the concept of gold bars: Gold bars are gold products broken into pieces, with characters and numbers indicating the volume and quality, with the symbol of an enterprise and commercial bank licensed by the State Bank of Vietnam (SBV); gold bars are organized by the SBV to be produced in each period.

According to the new regulations, the phrase "credit institution" is changed to "commercial bank" to suit the scope of commercial banking activities in the Law on Credit Institutions and orientations only allows commercial banks (excluding other credit institutions) to carry out gold bar production activities, gold export and import activities.

Decree No. 232/2025/ND-CP also amends and supplements Clause 6, Article 4, accordingly, gold bar production is a conditional business activity and must be licensed by the State Bank.

The amendment and supplementation are consistent with the goal of shifting from a monopoly mechanism for gold bar production to a mechanism for licensing gold bar production activities.