Precious metals analysts at Heraeus said that confidence in the possibility of the US Federal Reserve (FED) cutting interest rates has added momentum for gold, but the weakening of the USD and political risks could be a major dominating factor in the coming time.

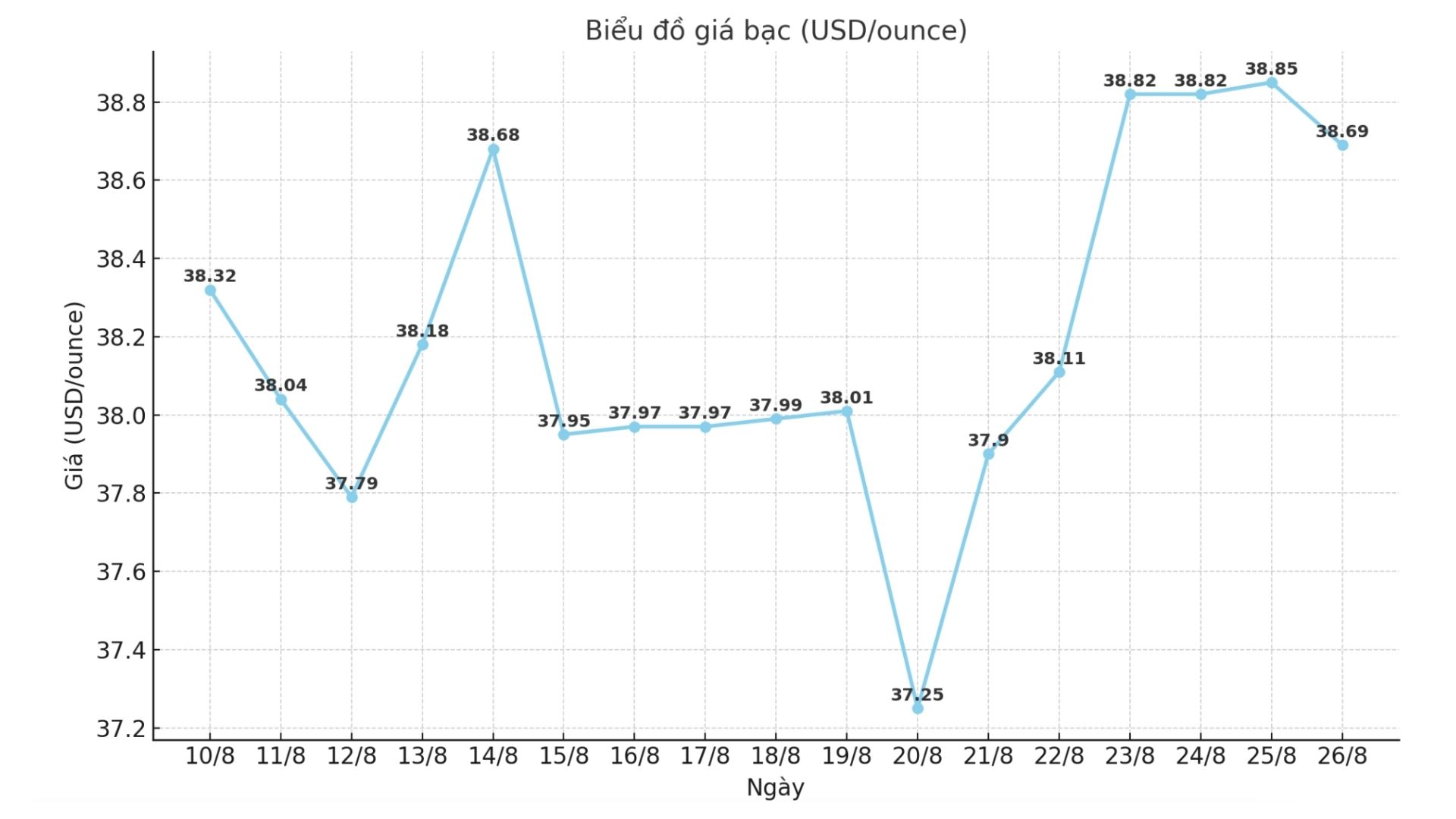

In contrast, silver is losing its upward momentum in some key sectors, despite breaking through to $39/ounce at one point.

In the latest report, precious metals analysts at Heraeus said India's gold imports in July reached about 37.5 tons, equivalent to nearly 4 billion USD.

Imports in the first half of the year were relatively quiet at 170 tons due to high gold prices that have cured demand for jewelry. However, as the wedding season approaches, it seems that manufacturers have increased their reserves, the report said.

Analysts also noted that the minutes of the Fed's most recent meeting showed that the majority of members were more concerned about inflation than the job market, although two voted in favor of cutting interest rates.

As inflation remains clearly above the 2% target, the likelihood of a rate cut at the September meeting is likely to be lower than market expectations, they warned.

The momentum of gold does not only come from safe-haven demand. With the Fed under pressure from US government officials and President Trump to cut interest rates, the risk of intervention in central banks and policy mistakes could become a bigger problem, affecting interest rates, the US dollar (down) and gold (up) experts added.

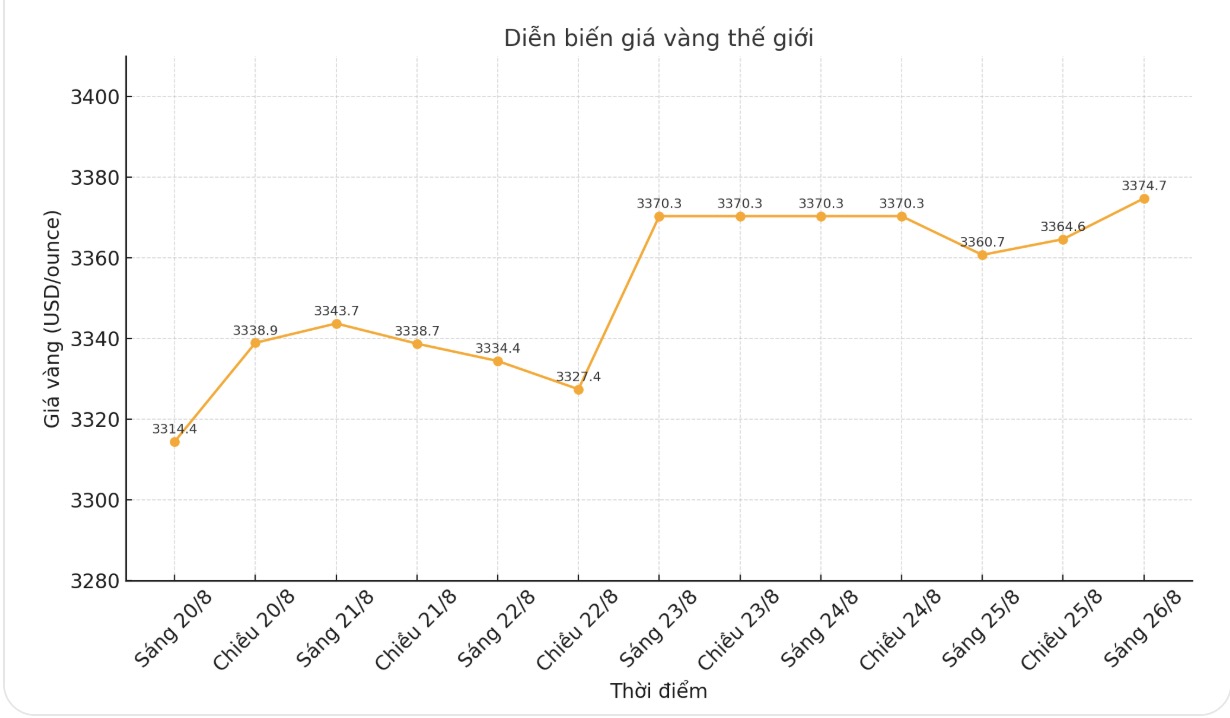

Gold prices have soared to $3,370 an ounce after Fed Chairman Jerome Powell's speech at the Jackson Hole conference and are still holding high range thanks to a gentle tone.

For silver, Heraeus said China's new policy could reduce demand for silver in the solar power industry. Chinas solar power industry faces difficulties in the third quarter as developers delay projects awaiting bidding instructions. The government requires all solar power projects to participate in the electricity market, ending the direct sale of electricity at local coal prices.

Developers are likely to delay investment until the provinces implement the Created Competition Contract (CfD) mechanism. As a result, new installement capacity in the third quarter of 2025 may decrease sharply, to half compared to the same period in 2024".

In the futures market, analysts note that speculators have begun to lose their silver position, taking profits after the recent price increase.

Since prices hit a peak in July, net speculative buying positions have fallen by 16,352 contracts (27%), including 6,390 contracts last week alone, bringing the total non-commercial net buying position down to 44,268 contracts (221 million ounces) - the lowest level in four months. It is likely that speculators are reassessing the risks ahead of the Fed conference and the September interest rate decision, they said.

Gold prices have also risen sharply following Powell's comments, even testing the resistance level of $39/ounce twice in the trading session on Monday.

Updated silver price on the morning of August 26

As of 10:15 on August 26, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at VND1.474 - 1.509 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 38,670 - 39,660 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 39,306 - 40,240 million VND/kg (buy - sell).

At the same time, the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 39.573 - 40.799 million VND/kg (buy - sell).

Gold price update on the morning of August 26

As of 10:55, the price of SJC gold bars was listed by Bao Tin Minh Chau and DOJI Group at 126.1-127.7 million VND/tael (buy in - sell out).

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.1-127.7 million VND/tael (buy in - sell out).

At the same time, DOJI Group listed the price of gold rings at 119.3-122.3 million VND/tael (buy in - sell out). Bao Tin Minh Chau listed the price of gold rings at 119.6-122.6 million VND/tael (buy in - sell out).

Phu Quy Gold and Stone Group listed the price of gold rings at 119.2-122.2 million VND/tael (buy in - sell out).