Gold prices are still struggling in the sideways zone, trapped below $3,400/ounce. However, according to Banque society Generale (France), the precious metal still maintains its support despite the declining global instability and shifting trading flows.

The bank said short-term risks are emerging as uncertainty levels gradually return to normal. However, experts emphasize that the risk of price reduction is still quite limited.

ETF flows remain stable, while the moderate sale of managed money funds even creates a more solid foundation, as this is the most vulnerable component to dominate prices, the report stated.

Company Generale has maintained an optimistic view on gold this year. In June, the bank said it would not sell until prices exceeded $4,000 an ounce - a level it forecast could reach in the second quarter of 2025.

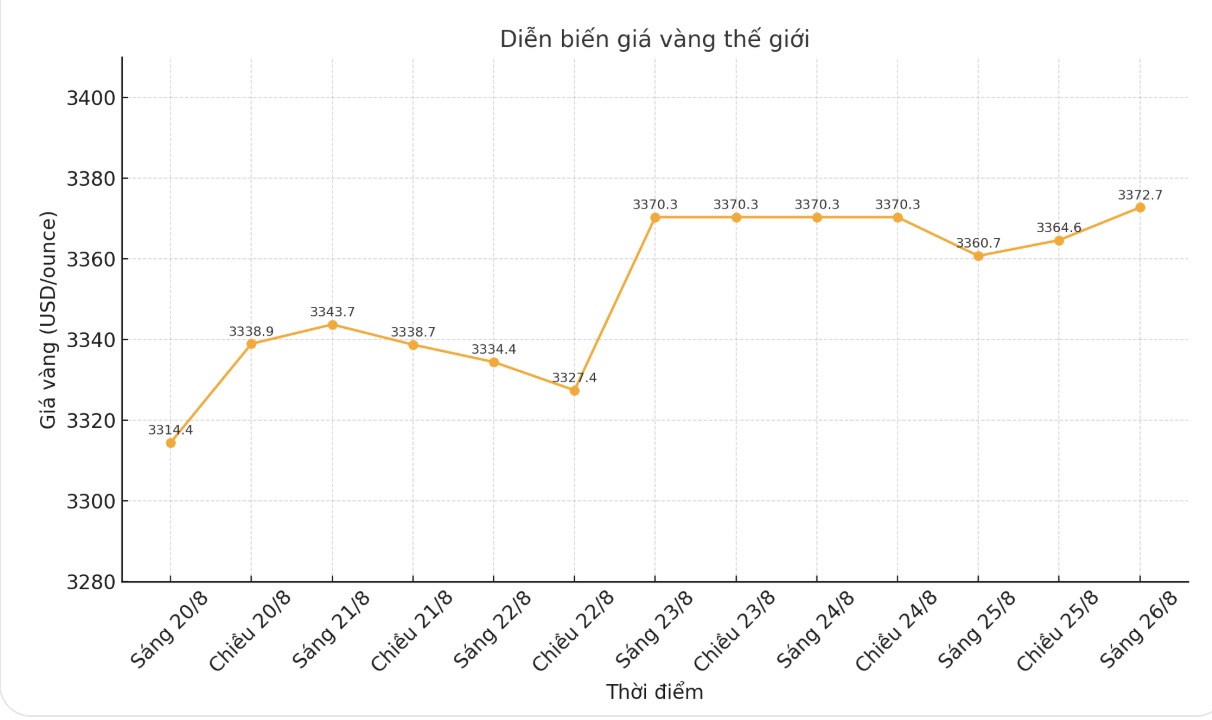

However, profit-taking is still keeping gold prices within a narrow range. The latest spot delivery was recorded at 3,371.9 USD/ounce, almost unchanged for the day.

The increase in gold at the beginning of the year comes from a rare combination of strong ETF inflows, persistent central bank buying and speculative funds increasing their buying position.

The number of speculators holding gold buy positions (106) remained unchanged last week, but the number of contracts decreased by 2%. ETFs lost 5 tons (2,872 tons in the week) but are still close to record levels," SocGen said.

In the coming time, gold will be affected by the normal acceleration of instability or any breakthrough in the Russia-Ukraine conflict. However, experts do not see a peace deal as weakening long-term demand.

The freezing of Russian central bank assets has created a very strong precedent, which will keep central bank demand high, they said.

Although geopolitical tensions have cooled since April, the level of instability is still nearly 3 times higher than the historical average.

We do not have full August data on Chinas uncertainty index, but it is expected to continue to decline as the US weekly index declines. However, the level of instability in China is still double compared to the period before Mr. Trump. In the US, this index is still three times higher than normal. However, ETF capital flows remained strong, the report said.

See more news related to gold prices HERE...