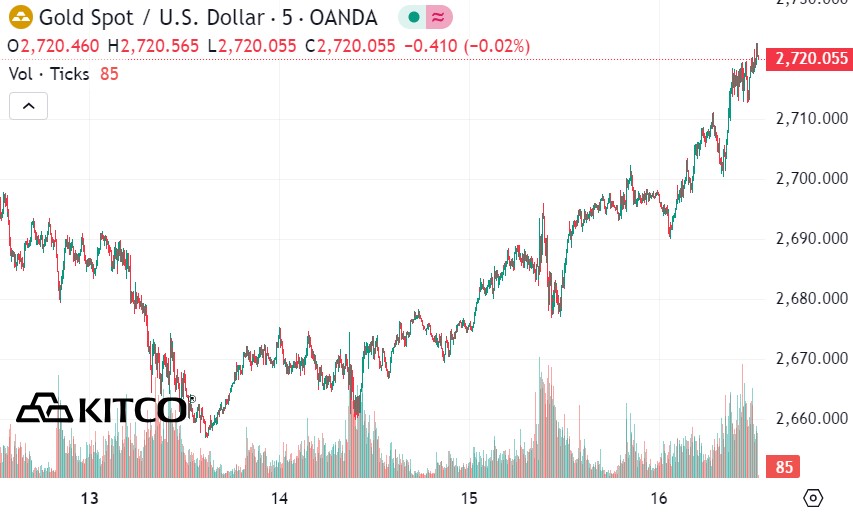

Gold is trading at record highs despite a manufacturing survey from the Philadelphia Federal Reserve Bank that beat expectations and returned to positive territory this month.

The regional central bank said on Thursday its manufacturing business outlook index rose to 44.3 in January, up from a revised -10.9 in December. The reading was much better than economists had expected, who had expected the index to hit -4.0 this month.

“Responses from the January manufacturing business outlook survey pointed to an overall increase in manufacturing activity in the region. The indices for current activity, new orders and shipments all rose sharply. Overall, businesses continued to record an overall increase in prices, and both price indices were above their long-term averages. Firms also continued to report increases in employment,” the report said.

Gold prices rose to a fresh session high just minutes after the manufacturing data was released, along with December retail sales and weekly jobless claims.

“Nearly 51% of businesses reported an increase (up from 19% last month), far exceeding the 7% reporting a decrease (down from 30%). 41% of businesses reported no change in current activity (down from 45%). The new orders and current shipments indexes both rose sharply in January. The new orders index rose 47 points to 42.9, its highest level since November 2021. Meanwhile, the shipments index rose 39 points to 41.0, its highest level since October 2020,” the report said.

Businesses also continued to report increases in employment, with the employment index rising 7 points to 11.9 in January. Nearly 87% of businesses reported no change in employment levels this month. About 13% reported increases, while 1% reported decreases. The average hours worked index turned positive, rising from a revised -3.7 to 20.3, the highest level since March 2022," they noted.

The Philly Fed report also found that price indices exceeded their long-term averages. “Overall, businesses continued to report overall price increases, with both price indices rising to recent highs. The input price index rose 5 points to 31.9 in January, the highest since December 2022. Nearly 36% of businesses reported increases in raw material prices, while 4% reported decreases; 60% reported no change.”

Meanwhile, the current selling price index rose 24 points to 29.7, the highest level since January 2023. Nearly 35% of businesses reported an increase in the price of their goods (up from 9% last month), 5% reported a decrease (little change), and 60% reported no change (down from 85%)" - the report said.

The survey's composite index of future activity also rose, suggesting more widespread growth expectations over the next six months.

Despite the Philly Fed report’s positive economic recovery signals, gold prices have risen in the short term. This is largely due to concerns about price pressures and potential inflation factors. However, if economic growth signals continue for a long time, it could put downward pressure on gold prices due to a shift in investment to riskier assets.

See more news related to gold prices HERE...