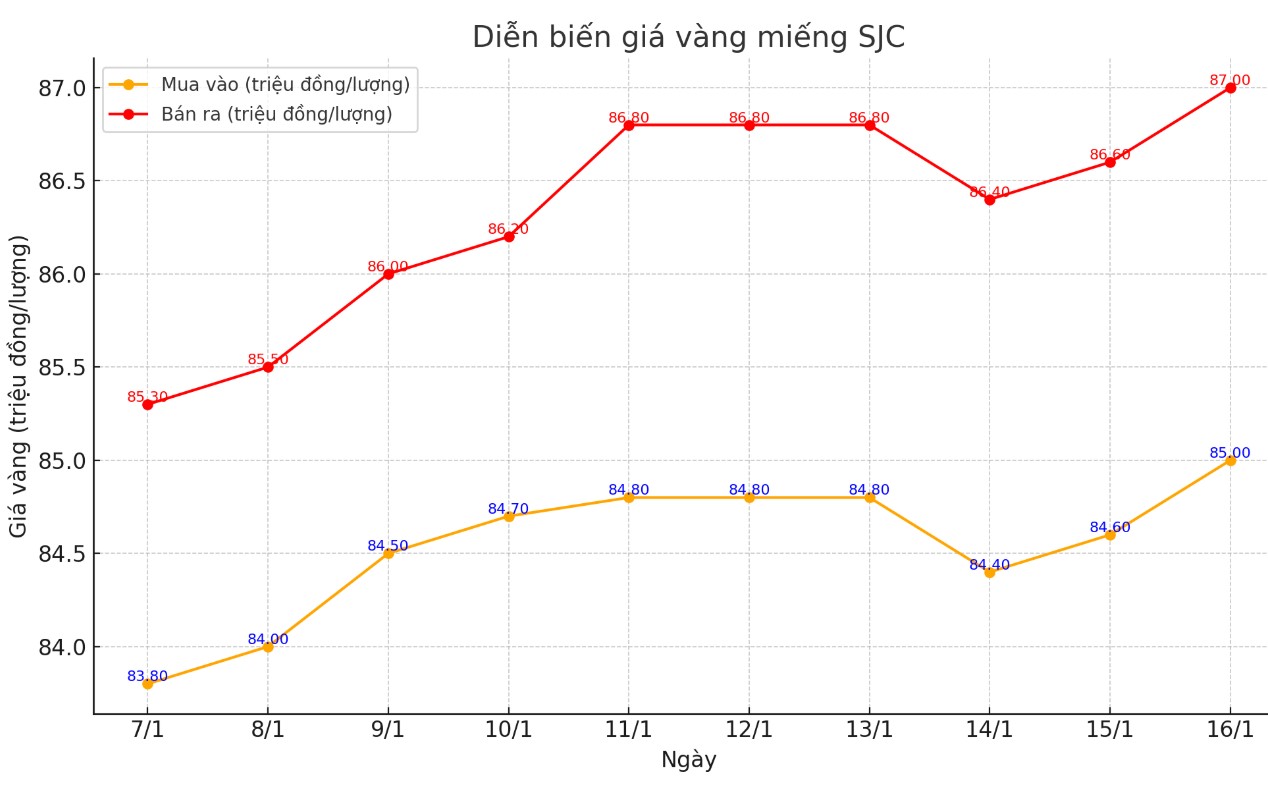

Update SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85-87 million/tael (buy - sell); an increase of VND400,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 85-87 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85-87 million VND/tael (buy - sell); increased 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

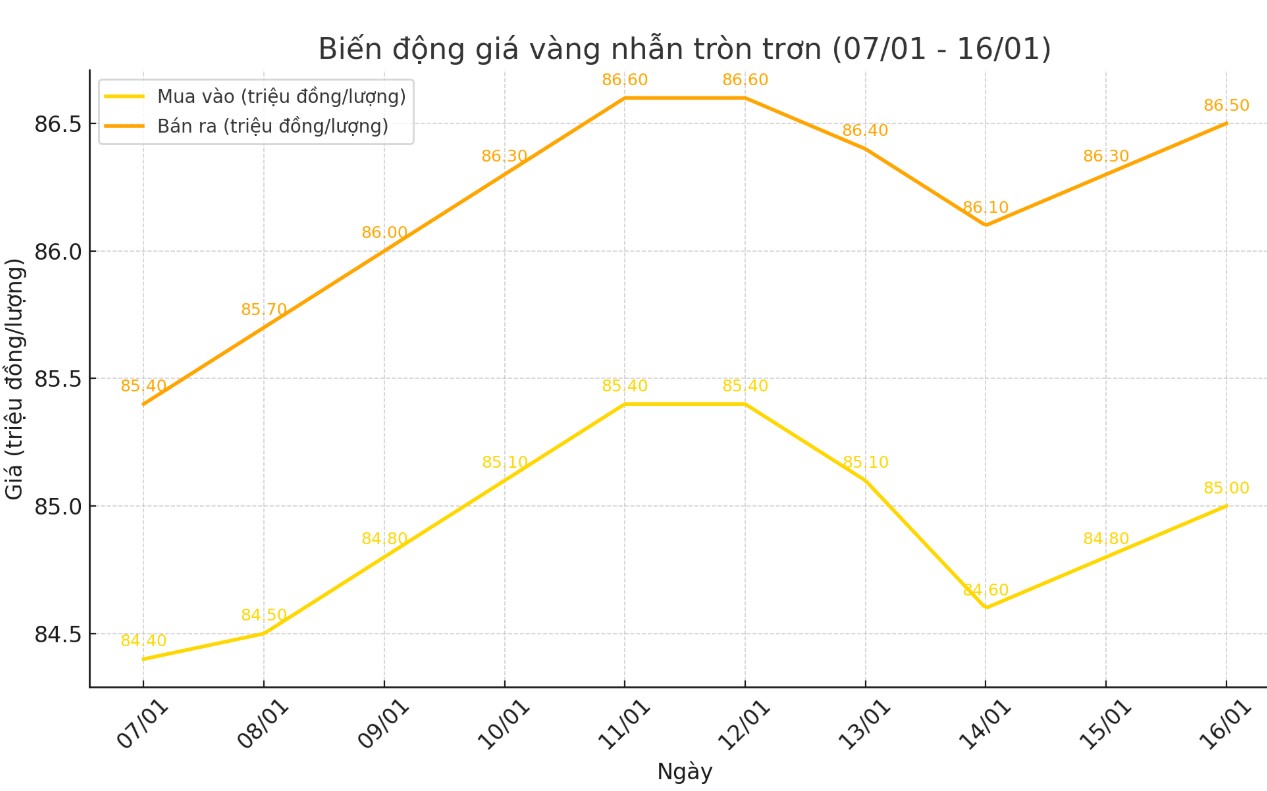

Price of round gold ring 9999

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85-86.5 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.45-86.95 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

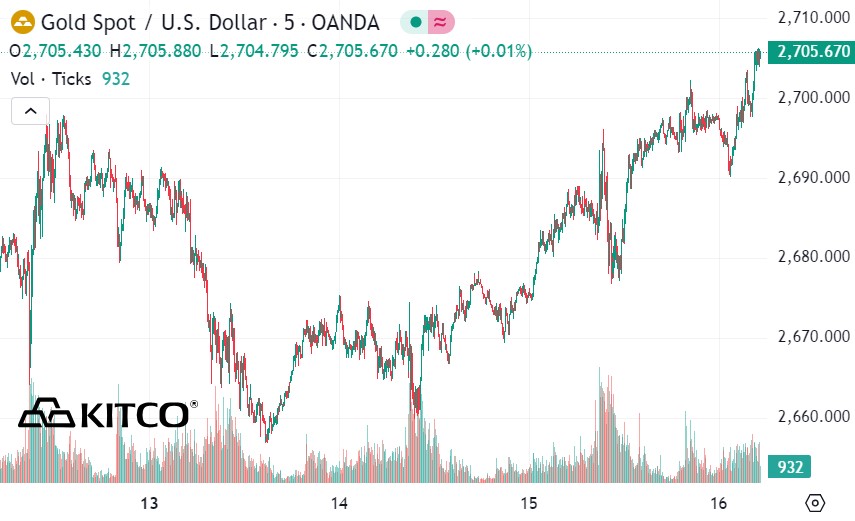

World gold price

As of 5:00 p.m., the world gold price listed on Kitco was at 2,705.6 USD/ounce, up 18.2 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite a slight increase in the USD index. Recorded at 5:05 p.m. on January 16, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.995 points (up 0.07%).

Gold prices rose significantly today after the release of the US Consumer Price Index (CPI) data for December, with futures rising by $29.50 (1.10%), as investors analyzed the latest inflation figures and their impact on the US Federal Reserve's (FED) monetary policy.

Inflation rose 0.4% in December, the Bureau of Labor Statistics reported, beating the 0.3% increase in November and the 0.3% consensus forecast by analysts. The annual rate of inflation was 2.9% before seasonally adjusted. The core CPI, which excludes volatile food and energy prices, rose 3.2% year-over-year, slightly below the 3.3% forecast.

A slight decline in core inflation in the US has raised hopes of a looser monetary policy from the US Federal Reserve (FED) this year. This, along with a moderate rise in the consumer price index, has supported demand for gold, said Jigar Trivedi, senior analyst at Reliance Securities.

Gary Wagner, a commodities broker and market analyst, told Kitco that the gold market will see "one last pullback before continuing its strong rally towards a new record high in 2025."

Gary Wagner highlighted that geopolitical instability, such as tensions in Ukraine and conflicts in the Middle East, are supporting gold prices. He noted that these conflicts show no signs of abating and that “geopolitical tensions remain very much present.”

Meanwhile, the World Economic Forum (WEF) said on Wednesday that armed conflict is the top risk in 2025. “Armed conflict between states is identified as the biggest risk in 2025, reflecting increasing global geopolitical tensions and fragmentation,” the WEF said in its annual report.

In addition to taxes and geopolitical uncertainty, Wagner pointed to other macroeconomic factors that could influence gold prices, such as U.S. fiscal policy and the Fed's monetary policy. He said the Fed is slowing the pace of interest rate cuts and the number of cuts in 2025 remains unclear.

“The Fed’s rate cuts this year will depend on current economic data, so we’ll have to wait and see what the data leads to,” Wagner said. He stressed that inflation, economic growth and budget deficits will influence the Fed’s decisions.

See more news related to gold prices HERE...