Investors put their faith in gold

The latest Kitco News survey shows that retail traders remain confident in gold's ability to outperform amid global uncertainty, while industry experts also see potential for silver in the second half of the year.

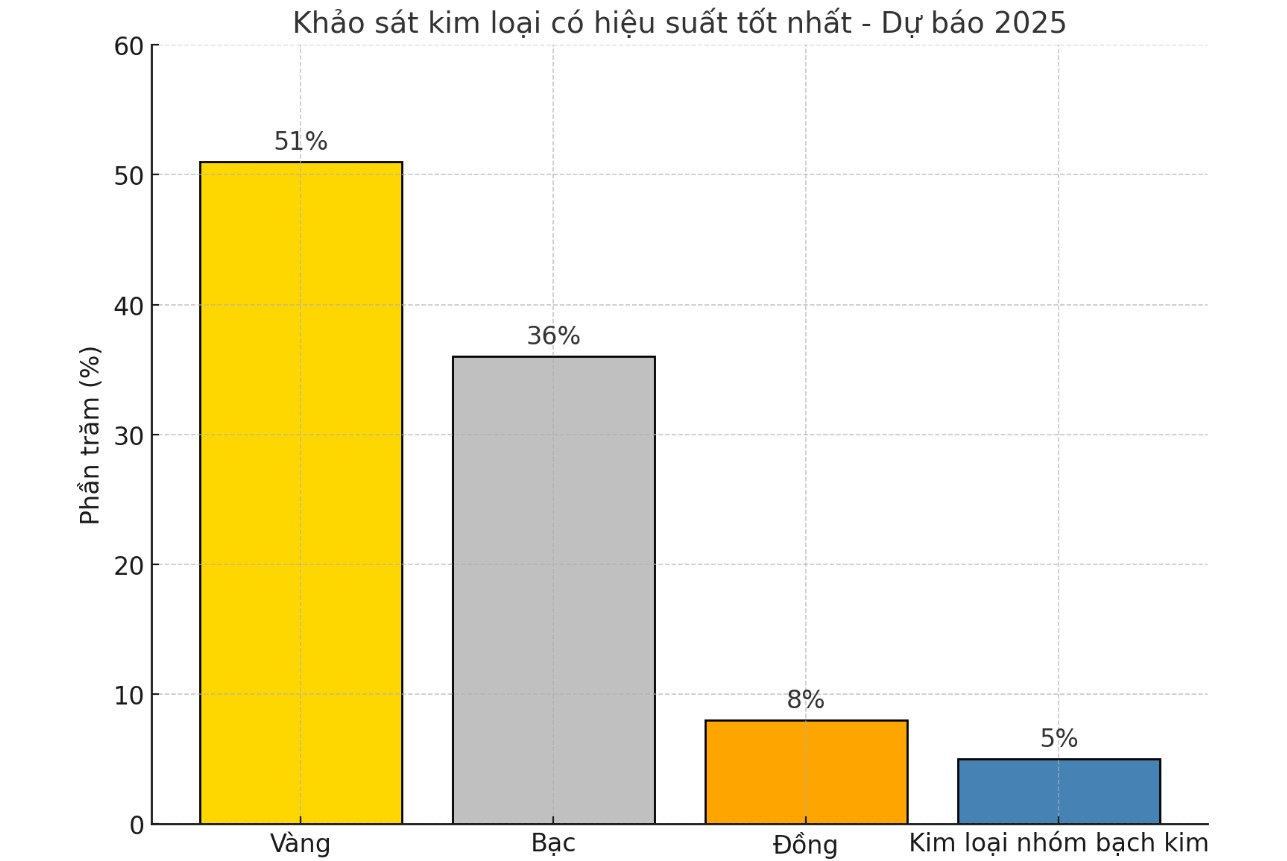

This past week, Kitco News collected opinions from 208 investors for the Kitco News Top Metals 2025 survey. The results showed that more than half of the participants predicted that gold would continue to outperform all other metals in 2025.

106 traders, or 51 percent, believe gold will lead the way this year. Meanwhile, 74 investors, or 36 percent, predict silver will be the best performing metal in 2025. 17, or 8 percent, say copper will be the best performer. The remaining 11, or 5 percent, believe platinum and palladium will outperform other metals this year.

Experts predict positive silver prices

Like investors, most Wall Street experts also have a bias towards gold. However, a large number of major banks and industry experts predict that silver could surpass gold by the end of the year.

Ole Hansen, head of commodity strategy at Saxo Bank, believes that silver could surpass gold in 2025.

“This year’s silver rally is fundamentally no different from previous rallies. Silver still mirrors gold’s moves, but with greater intensity. Often referred to as “power gold,” silver tends to move up and down more aggressively than its stable sibling,” Hansen said.

Silver will only hit a 12-year high in 2024, while gold has been hitting record highs, Hansen said.

“Silver’s dual role – balancing investment and industrial demand – could see it outperform gold next year. At Saxo, we forecast the gold-silver ratio, currently around 87, could fall to around 75, levels seen in early 2024.

If this happens and gold reaches the forecast level of $3,000/ounce (up 13%), silver prices could reach $40/ounce (up more than 25%),” Hansen concluded.

In the same view, analysts at Heraeus Precious Metals also commented that the silver rally in 2024 will continue into 2025, with silver prices expected to outperform gold, while platinum group metals (PGM) prices will be restrained.

Daniel Ghali - senior commodity strategist at TD Securities points out that an unprecedented situation is taking place in the silver market.

“Over the past month, the precious metals market has been severely disrupted as the threat of global tariffs on metals has sent traders rushing to bring silver from London and other markets into the United States to hedge against risk. There has never been a tariff on precious metals, which are treated as currencies, but if that were to happen, traders holding short positions in metals overseas would suffer huge losses.

“To avoid risks, they are shipping physical metals to the US,” Ghali stressed, adding that these are not financial contracts but actual physical metals being shipped en masse to the US.

Ghali warned that this could inadvertently lead to a supply shortage in the world’s largest metal storage facility in London. “This is the biggest story in the commodities market right now. The silver market seems to be sleeping on the risk of a supply shortage.”

“Note that we are entering the fourth consecutive year of large deficits in the silver market. This trend of inventory reduction has already begun and the current situation is only accelerating that process,” Ghali said, adding that this scenario would be very favorable for silver prices.

“I think silver has the potential to go up if we hit a key level. We’ve seen that happen in other commodities over the past few years. Copper had a similar run last year, and palladium was a good example before that.

When asked about his silver price forecast, Ghali was optimistic. “We think silver will end the year at close to $40 an ounce, which is a significant increase from current prices,” he said.