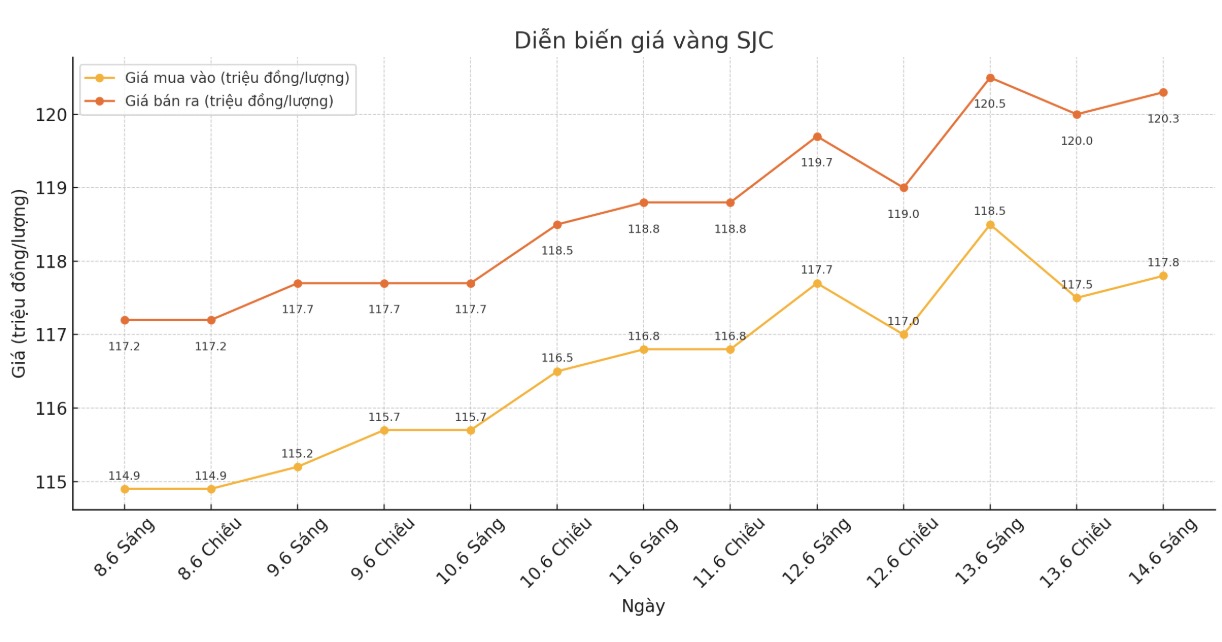

Updated SJC gold price

As of 9:45 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.8-120.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.8-120.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

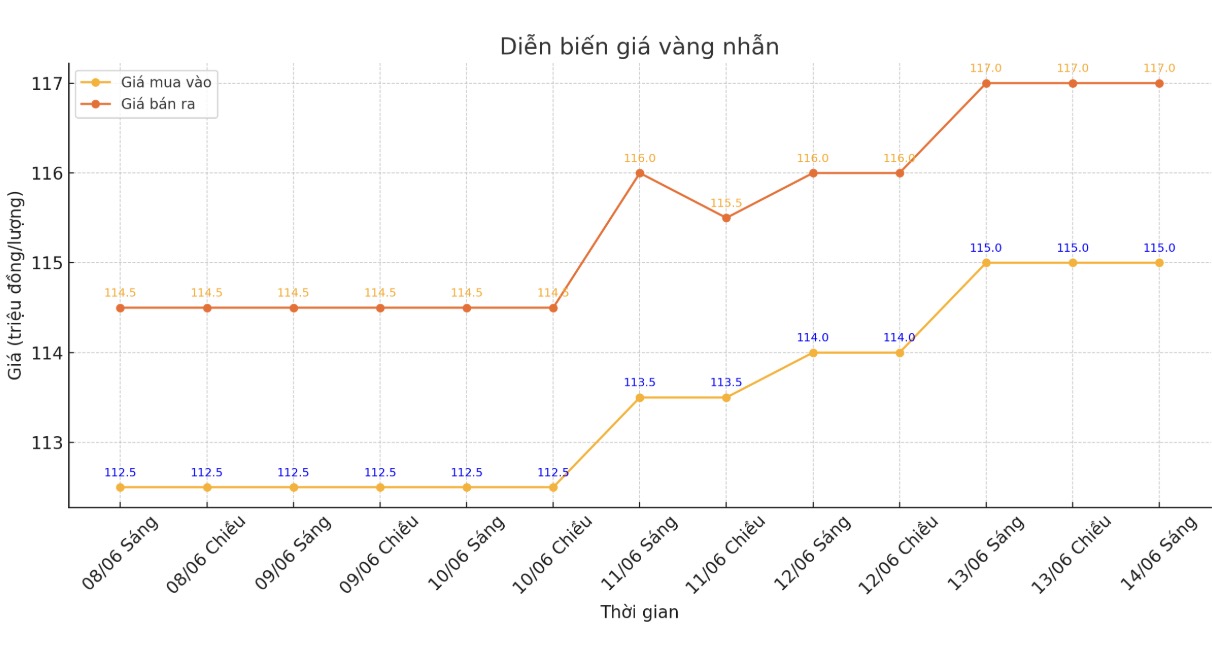

9999 round gold ring price

As of 9:45 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

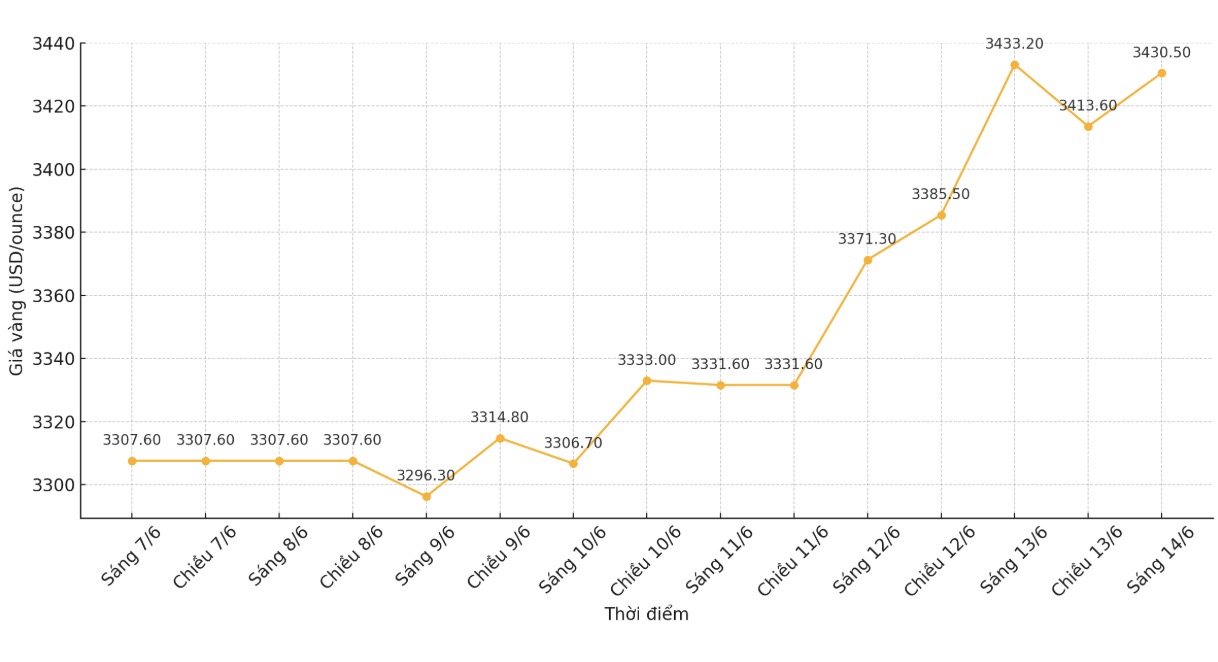

World gold price

At 9:45 a.m., the world gold price was listed around 3,430.5 USD/ounce, down 2.7 USD compared to 1 day ago.

Gold price forecast

Gold prices are anchored around a five-week high thanks to strong safe-haven demand after Israeli attacks on Iran. The risk of avoiding increased risk on Friday amid the most serious military escalation between Israel and Iran in decades.

Israel's airstrikes on Iran overnight have killed several top generals and Iranian nuclear officials, paralyzed Tehran's command structure and plunged the regime into panic. Israel said it was preparing for further military action.

Gold has been supported by a series of military strikes by Israel on Iranian nuclear and missile facilities, raising concerns about a bigger conflict in the Middle East that could seriously disrupt global energy supplies.

Although the world gold price is skyrocketing, experts say that this precious metal will continue to hold an important position in the investment portfolio, making it very difficult to decrease.

Roukaya Ibrahim, commodity strategist at BCA Research, said its portfolio maintained a strong position in precious metals, especially gold, although silver and platinum also grew. Gold continues to be a key asset, benefiting from persistent inflation risks and geopolitical instability, such as trade war and US President Donald Trump's tariff policies.

Ibrahim said gold is benefiting from continued demand and a loss of confidence in the US as a reliable trading partner. She said that in the current environment, there is hardly any scenario that will cause gold prices to fall sharply. However, if the concern about tariffs eases, the US Federal Reserve (FED) may cut interest rates, reducing the opportunity cost of gold.

BCA Research's gold forecast shows a solid foundation at $3,000/ounce, despite concerns that interest rate cuts could boost stocks. However, Ibrahim believes that the interest rate cut will mainly be a reaction to a decline in growth, which will have a negative impact on stocks.

The expert is also optimistic about gold as central banks' gold reserves have increased sharply over the past three years and continue to increase in 2025. Although gold prices have surpassed $3,000/ounce, investment demand and golds role as a diversifier remain strong.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...