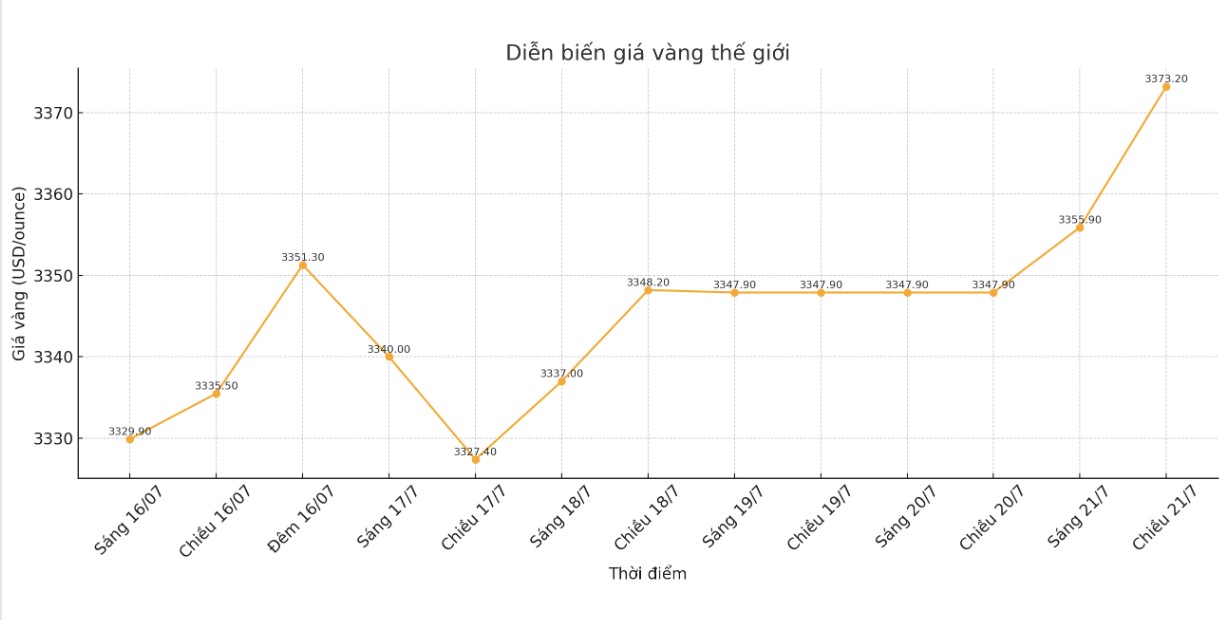

Spot gold increased by 0.5%, to 3,365.49 USD/ounce at 07:51 GMT (ie 14,51 Vietnam time). US gold futures also rose 0.5% to $3,373.20 an ounce.

The slight support for gold prices comes from a weaker US dollar. As the deadline for August 1 is approaching, the market will focus on whether to reach a trade deal or the US will implement the tax, said UBS commodity analyst Giovanni Staunovo.

The USD index fell 0.2% against a basket of major currencies, making gold cheaper for holders of other currencies.

US Secretary of Commerce Howard Lutnick said on Sunday he believes the US can reach a trade deal with the European Union, but August 1 is still a tight deadline for the tariffs to come into effect.

Gold is often considered a safe haven asset in times of economic uncertainty and tends to benefit in a low interest rate environment.

The next policy meeting of the US Federal Reserve (FED) will take place on July 29-30, after the agency decided to keep interest rates unchanged last month.

High expectation inflation and strong economic data are reducing expectations for how many times the Fed will cut interest rates this year. However, the buying strategy when prices fall is still being maintained, helping to limit the downside risk for gold - ANZ experts assessed.

Last week, FED Governor Christopher Waller said he still believes the US central bank should cut interest rates at the next meeting.

Data shows that China's gold imports - the leading consumer country - have decreased for the second consecutive month in June. The country's platinum imports in June also fell 6.1% compared to the previous month.

Spot silver prices increased by 0.6% to 38.39 USD/ounce; platinum increased by 1.8% to 1,447.3 USD/ounce; while palladium increased by 1.5% to 1,259 USD/ounce.

See more news related to gold prices HERE...