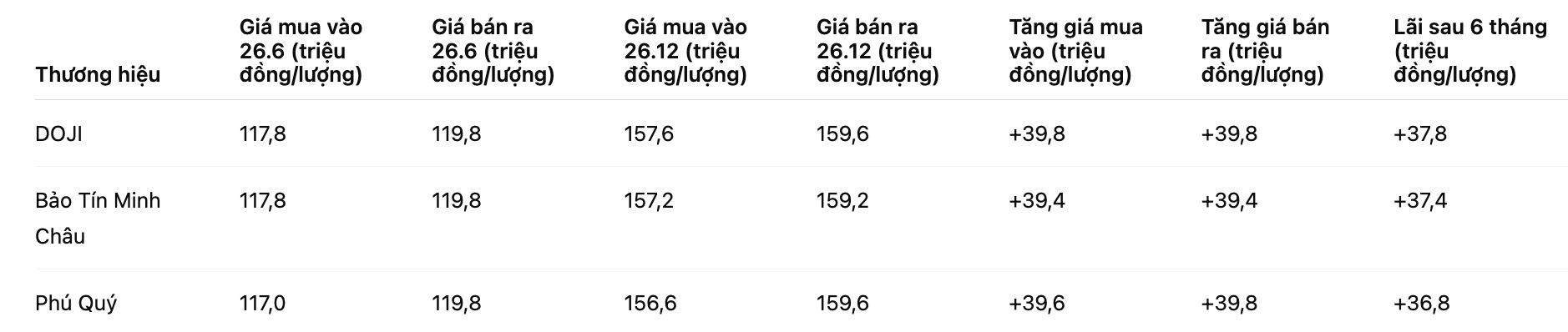

With SJC gold bars, on the morning of June 26, 2025, large enterprises such as SJC, DOJI and Bao Tin Minh Chau all listed prices at 117.8 - 111.8 million VND/tael.

By the morning of December 26th, the buying price at DOJI had jumped to 157.6 million VND/tael, and the selling price was 159.6 million VND/tael.

Compared to 6 months ago, the buying side increased by about 39.8 million VND/tael, and the selling side increased by nearly 39.8 million VND/tael.

If buying gold from the end of June and selling it at the current buying price, DOJI's SJC gold holders will make a profit of about 37.8 million VND/tael after 6 months, although they still have to "carry" the buy-sell difference of 2 million VND/tael.

At Bao Tin Minh Chau, SJC gold bar price on December 26 was listed at 157.2 - 159.2 million VND/tael. Compared to the selling level of 119.8 million VND/tael on June 26, the profit after 6 months is about 37.4 million VND/tael.

For Phu Quy alone, the buying price is currently 156.6 million VND/tael, while the selling price 6 months ago was 119.8 million VND/tael, helping buyers make a profit of about 36.8 million VND/tael, but the buying-selling difference has been widened to 3 million VND/tael.

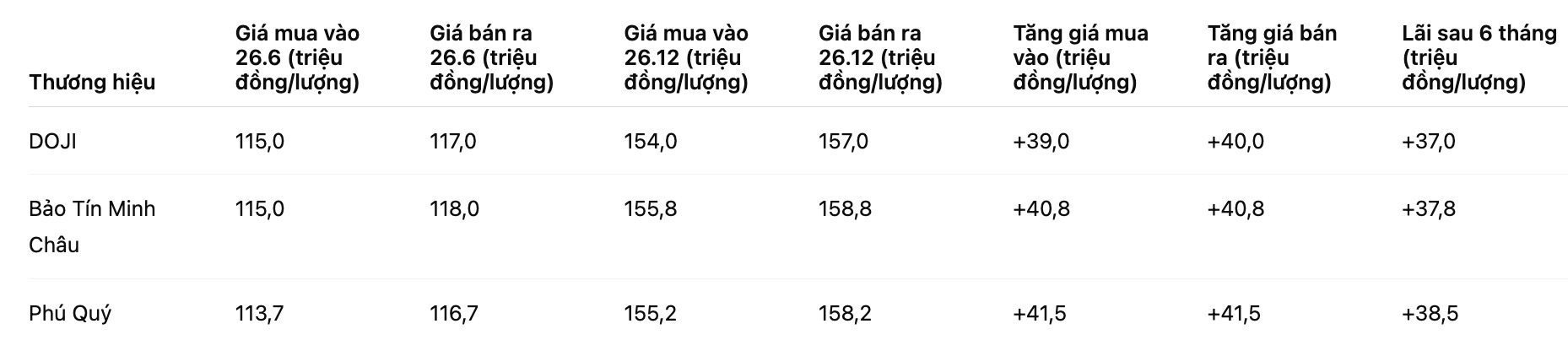

In the 9999 round gold ring segment, the profit margin is also very noteworthy. On June 26, DOJI gold rings were bought at 115 million VND/tael, sold at 117 million VND/tael. By December 26, the buying price had increased to 154 million VND/tael, 39 million VND higher than 6 months ago. Calculated according to the old selling price, DOJI gold ring buyers made a profit of about 37 million VND/tael.

Bao Tin Minh Chau listed gold rings on December 26 at 155.8 - 158.8 million VND/tael, higher by 40.8 million VND on the buying side and 40.8 million VND on the selling side compared to the end of June, helping holders make a profit of about 37.8 million VND/tael.

Notably, Phu Quy gold rings brought the highest profit, about 38.5 million VND/tael, when the buying price is currently 155.2 million VND/tael, while the selling price on June 26 was only 116.7 million VND/tael.

On the morning of June 26, world gold prices were listed around the threshold of 3,334.1 USD/ounce. By December 26, world gold prices had increased sharply, to about 4,506.9 USD/ounce, equivalent to an increase of more than 1,170 USD/ounce in just half a year.

The strong upward momentum of international gold has created an important support, pulling domestic gold prices to continuously escalate and establish a new price level.

Although the profit after 6 months is very large, the gold market today also reveals many risks. The buying-selling gap of both gold bars and gold rings is anchored at a high level, from 2 to 3 million VND/tael, making investors easily fall into a disadvantage if the price reverses in the short term. In addition, world gold prices after a period of hot increase are showing downward adjustments, risking leading to a less positive dien bien of the domestic market.

In this context, experts recommend that people should not follow FOMO psychology, rushing to buy gold when prices are already high. Giving money while the buying-selling gap is large may put investors at risk of losses, especially when world gold prices fluctuate strongly and the downward trend may return at any time.

See more news related to gold prices HERE...